- Crude oil tumbles towards key $79 support

- Prices still remain above moving averages

- ADX indicator signals weak bearish move

- Bears could attack 50 EMA if $79 support breached

- A rebound from $79 could re-open doors to $83

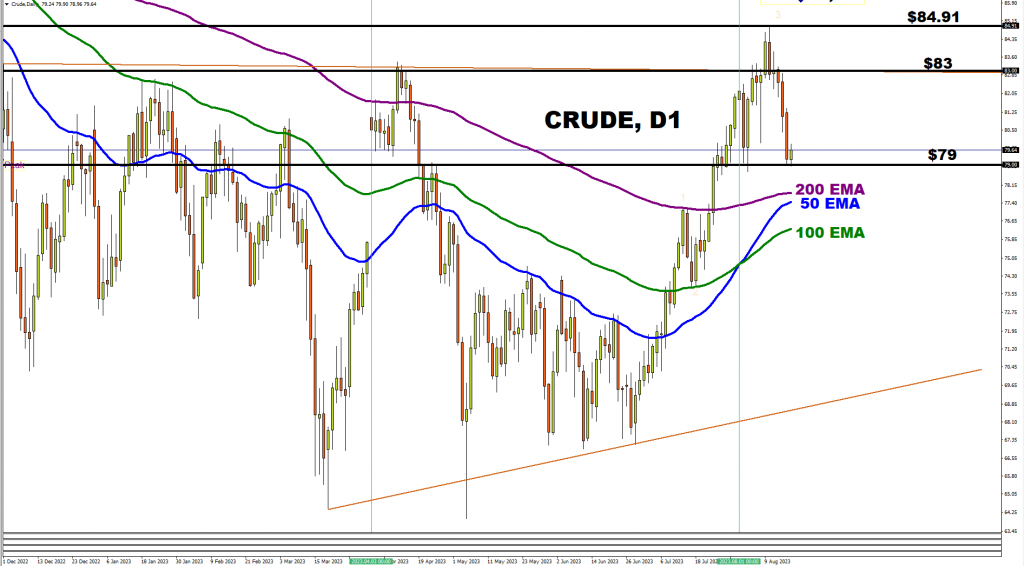

Crude oil prices broke through the $83 resistance level which held for 184 trading days to close at $84.25 on 9th August 2023, and since then have declined back towards the $79 support level at the time of writing.

This decline is in no little way thanks to negative economic data out of China, the world's largest exporter of goods, and with key levels in sight it may continue further.

Sitting above the important $79 price, a level not broken since the 25th of July, bears will be looking for a close below for Crude prices to extend their decline albeit with the moving averages in sight.

Crude is above its moving averages signaling a bullish trend, but with prices’ reversion to the mean, we see the moving averages contract, signaling a drop in momentum but much more, a pending impulse move in waiting.

A break below the psychologically important price level of $79 could see prices test the 50-day EMA, a potentially strong support area given, the cluster of moving averages.

With a failure to break the $79 price level bulls may be emboldened to return and push price back to test the $83 resistance handle while seeking highs above $84.91, reached at the false break.

A move to the upside could see the emergence of a golden cross- this is when 50-day EMA crosses over the 200-day EMA to the upside-, signaling a strong uptrend.

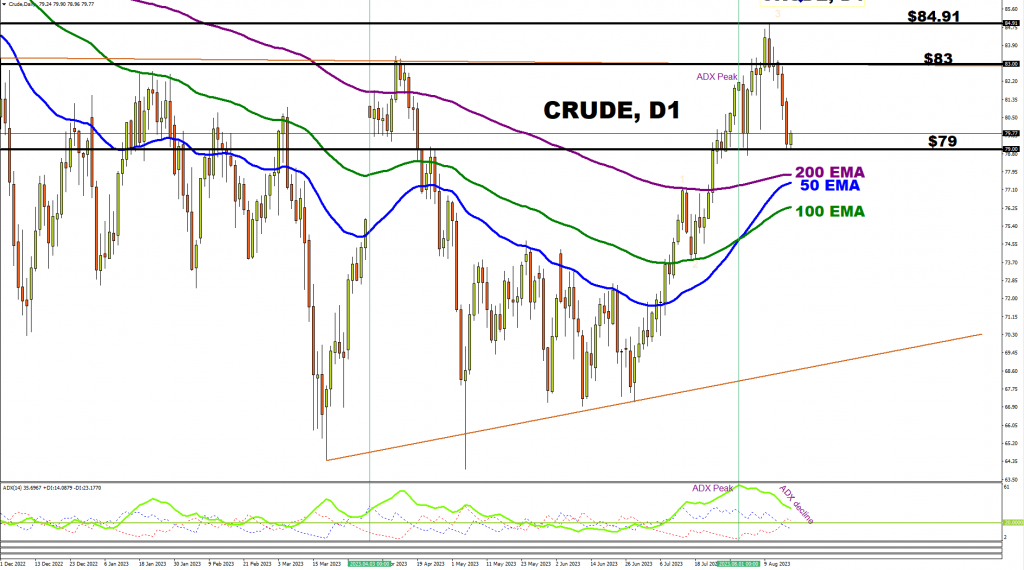

Further clarity may be gotten from the ADX – an indicator that shows us trend strength.

At the time of writing, we see the ADX continue its decline toward the 20-point threshold.

This decline started after the ADX peaked on the 1st of August as Crude prices approached the psychologically important $83 price level, signaling a weak bullish run nearing its possible end. This ADX decline has continued, following Crude price declines from the $84.91 highs of 10th August 2023, signaling a tame bearish move for the past 5 trading days.

Both bulls and bears will be looking for an upward sloping ADX with the DI+ and DI- respectively, locked in step, for a confirmation of their bias.