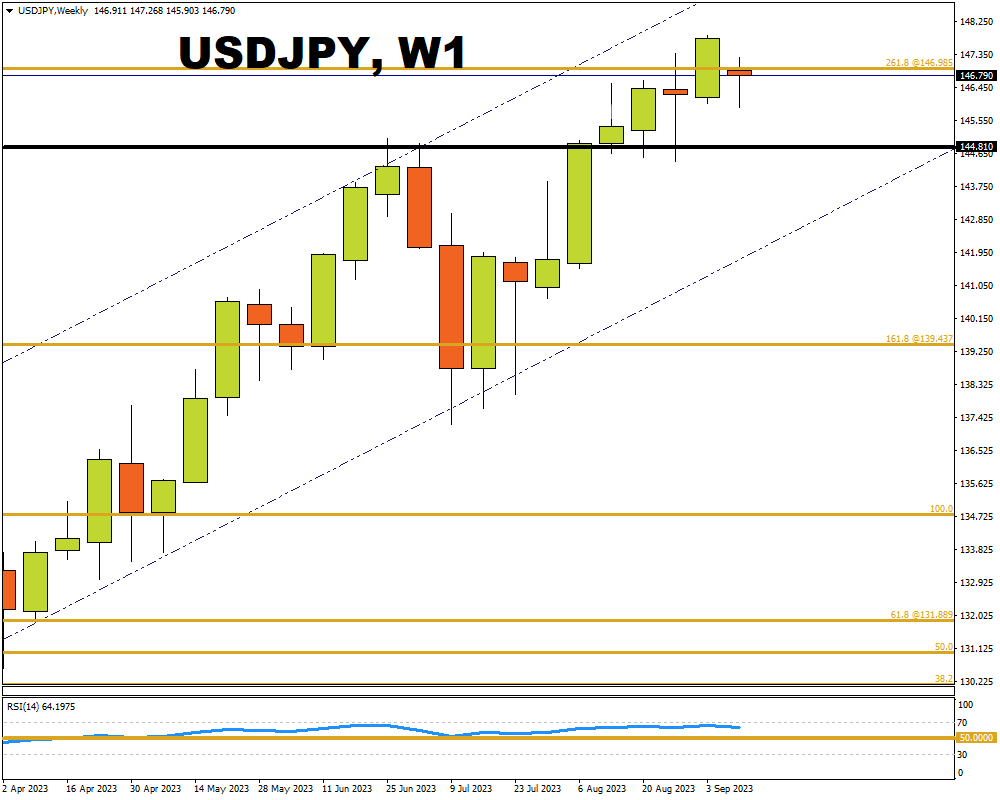

- USDJPY busy forming second flag since August, amidst year-to-date uptrend

- JPY surged Monday after BoJ Governor Ueda offered hawkish policy clues

- Yen bulls unable to build on Monday's intraday low of 145.904.

- USDJPY may look to close Monday's gap down

- Tomorrow's US CPI to decide USDJPY's immediate fate

USDJPY gapped down on Monday, September 11th’s market open.

The Yen surged at the onset of the trading week after Bank of Japan governor Kazuo Ueda hinted at the possibility of a first rate hike in Japan since 2007!

The stronger Yen resulted in an intraday low of 145.904 for USDJPY.

This FX pair closed Monday at a zone which could serve as a demand zone-base for a possible second flag, in its ascent from the lows of 141.53 printed on August 7th, 2023.

This close is also below the significant 261.8 Fibonacci level when drawn from 134.772, January 6th high to the lows of 16th January 2023 at 127.224 on the weekly chart.

Attentions turn to the USD side of USDJPY, with the pivotal US consumer price index due to be released tomorrow (Wednesday, September 13th).

Both bears and bulls will be looking for price action around key levels for pointers to the next impulse direction for the USDJPY.

Bulls will be looking to close Monday’s open gap as they climb to the flag’s resistance around 147.769

They will however have to contend with the psychologically important Fibonacci level at 261.8 at 146.985.

A bullish flag breakout could see a test of the 148.850 region which had resisted USDJPY bulls back in late-October/early-November 2022.

Further north, lies the potential resistance zone of the upward sloping channel drawn from January 5th, 2023.

USDJPY bears on the other hand will be looking for a strong close below the current bullish flag’s support, and also below the psychologically-important 146.00 line.

Such price action may indicate a reversion to its 50-EMA which is below and more than 2600 points away from the current price at the time of writing.

Ultimately, much of USDJPY’s immediate fate should rest on tomorrow’s US inflation data release.

-

A higher-than-expected CPI (consumer price index) that ramps up bets of one further Fed rate hike by end-2023 should bolster the US dollar and potentially send USDJPY higher.

- However, a lower-than-expected CPI that solidifies hopes that the Fed is truly done with its rate hikes should soften the US dollar and potentially drag USDJPY lower.