- Fed/BoE combo could trigger GBPUSD volatility

- Watch out for UK CPI report mid-week

- Fed widely expected to leave rates unchanged

- BoE expected to hike rates by 25 basis points

- GBPUSD could see big moves, keep eye on 1.2430 level

A super central bank combo featuring the Federal Reserve and Bank of England may trigger extreme levels of volatility in the GBPUSD this week.

The past few months have been rocky for Sterling which is down roughly 2.4% in the second half of 2023 thus far.

Pound bears seem to be drawing strength from stagflation fears amid rising unemployment, sticky inflation, and stagnant economic growth.

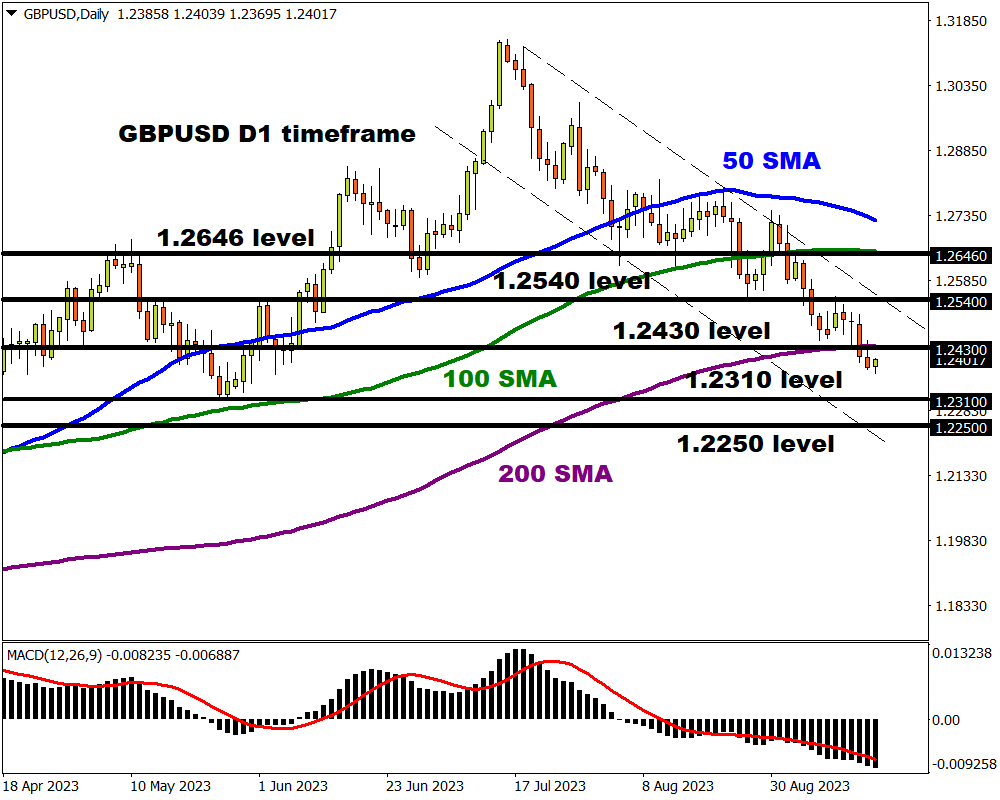

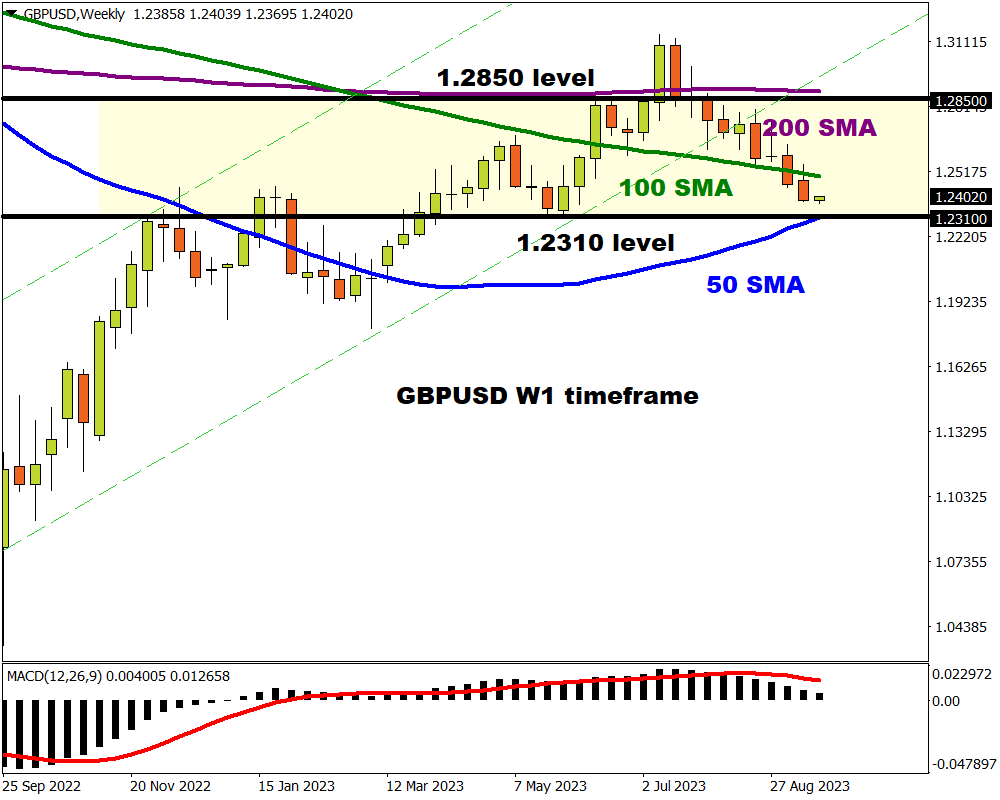

Buying sentiment towards the currency has also been hit by disappointing economic data, further supporting Governor Andrew Bailey’s comments about the BoE nearing the end of its hiking cycle. Taking a glance at the technicals, the GBPUSD is approaching weekly support at 1.2310 – where the 50-week SMA resides.

The GBPUSD could see big moves this week and here and 3 reasons why…

BoE rate decision

The Bank of England (BoE) monetary policy decision will be on Thursday 21st September.

24 hours before the BoE decision, the latest UK inflation figures will be published with markets forecasting CPI to rise 7.0%, up from the July print of 6.8%. Core inflation is projected to cool 6.8% year-on-year, down from 6.9% in the previous month. This report could influence expectations around what the BoE does beyond September.

Markets widely expect the BoE to raise interest rates by 25 basis points. This would be the 15th straight hike, taking the key rate to 5.5% - its highest level since 2007. The key question is whether this will be the final rate hike as policymakers weigh sticky inflation against growth concerns.

Traders are currently pricing in a 79% probability of a 25 basis point hike on Thursday, with the probability of another 25 basis point hike by December currently standing at 45%.

- If the BoE raises rates and signals the possibility of another 25 basis point hike before the end of 2023, this could propel the GBPUSD higher.

- A dovish sounding BoE that hikes interest rates but hints that this could be the final move for the remainder of 2023 may drag the GBPUSD lower.

Fed rate decision

Markets widely expect the Federal Reserve to leave interest rates unchanged at 5.5% at the September 19-20 meeting.

Investors will direct their attention towards the economic projections, dot plots and press conference by Jerome Powell which could offer clues on future rate hikes.

- The GBPUSD may find itself under renewed pressure if the Fed signals one more interest rate increase in 2023.

- Should the central bank hint that it could be done with hikes for the rest of 2023, this may weaken the dollar – pushing the GBPUSD higher as a result.

Bearish technical forces

The GBPUSD remains under pressure on the daily timeframe as there have been consistently lower lows and lower highs.

Prices are trading below the 50, 100, and 200-day SMA while the MACD trades below zero. Bears are certainly in a position of power with the recent daily close below the 200-day SMA opening the doors to further downside.

- Sustained weakness below 1.2430 could encourage a decline towards 1.2310 and 1.2250, respectively.

- Should prices push back above the 200-day SMA at 1.2430, this could spark a rebound back toward the 1.2540 level and 1.2646 where the 100-day SMA resides.