-

US government shutdown may further slow economic momentum

-

Fed could be prevented from one last rate hike

-

Market reaction from 2018 shutdown may repeat itself

-

US dollar may weaken, but not much

-

Gold, US stock indexes could recover

The US government is set to be shut down temporarily, starting this Sunday, October 1st.

The Democrats and Republicans in the world’s largest economy are at loggerheads, yet again, over how to deploy fiscal funds.

A blast from the past ...

Since 1981, the US government has suspended operations (though not entirely) 14 different times.

The last time we saw a US government shutdown was for a 35-day stretch between December 2018 till January 2019 – the longest shutdown in US history.

And during that last shutdown:

-

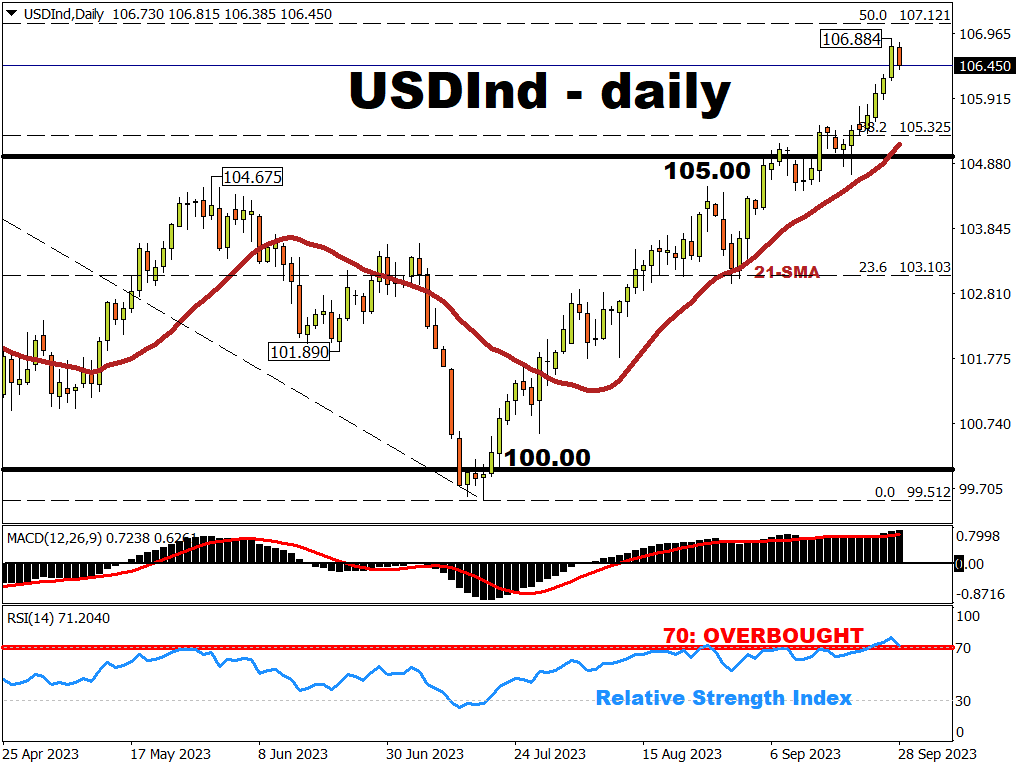

The US dollar (as measured by USDInd) fell by 1.2%

-

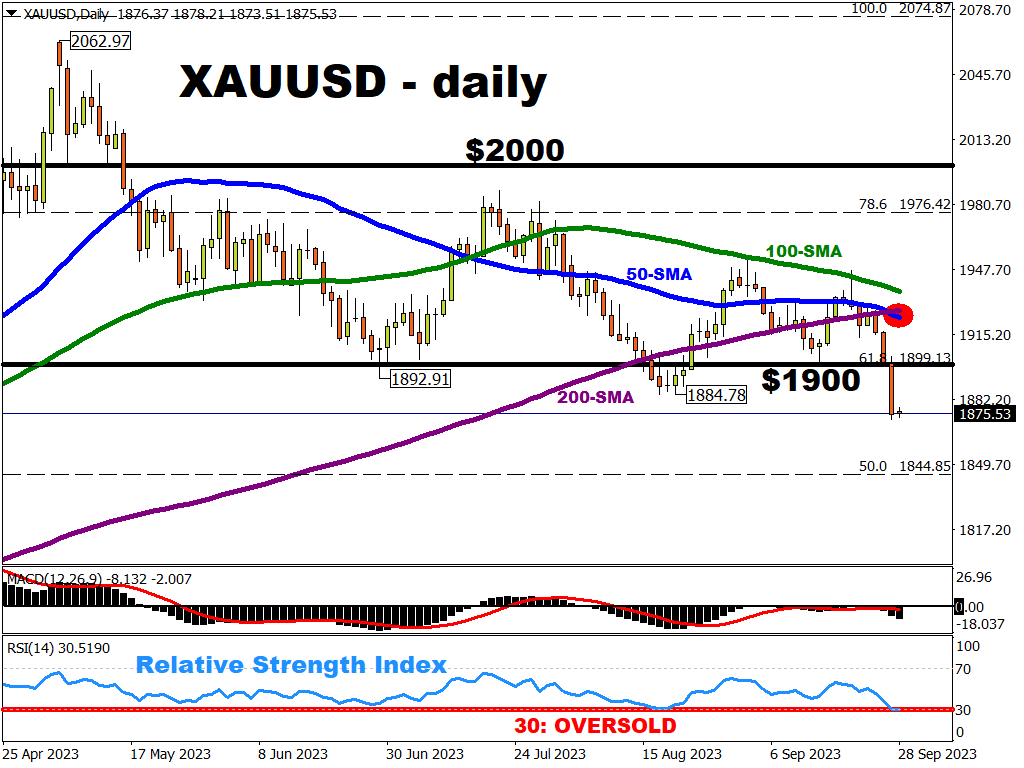

Gold climbed by 3.8%

- SPX500_m soared by 10.3%

Perhaps the more notable takeaway from that prior episode is this:

The previous US government shutdown also coincided with the Fed’s last interest rate hike for that cycle.

-

December 2015: Fed raises US interest rates for the first time since the global financial crisis

-

December 2018: US government shuts down for 35 days; Fed's last rate hike of that cycle that began in Dec 2015

- July 2019: Fed turns tail and begins CUTTING rates, eventually sending it all the way back down to near-zero at the onset of the global pandemic in 2020.

Would Fed adopt same playbook at imminent US government shutdown?

Probably not, given that core US inflation, at 4.1% in August, remains more than double the Fed's 2% inflation target.

Sticky inflation suggests that one more Fed rate hike could be in the pipeline, or at least US rates staying higher for longer.

Still, markets remain obsessed with trying to figure out:

-

Whether the Fed can trigger one last 25-basis point hike by year-end?

Currently, markets predict a 53% chance of it happening.

- How long will the Fed keep interest rates at this peak?

And we know that these rate hikes are intended to slow down inflation by destroying demand in the economy.

Even prior to the threat of this imminent government shutdown, economists and market watchers had already been bracing for a US economic slowdown, possibly even a recession.

Goldman Sachs predicted that the shutdown may result in a 0.2 percentage point drag on US GDP per week.

How would a government shutdown slow the US economy?

A US government shutdown means that:

-

many public employees, including staff at national parks to museums, will see their paycheques halted.

-

private companies that get paid from government contracts, stand to lose almost US$ 2 billion a day from this shutdown.

- The highly-anticipated releases of the US nonfarm payrolls report (due Friday, October 6th) and the US consumer price index (due October 12th), as well as other major economic data, may be delayed.

All the above suggests that, the longer the US government stays shut, the more it deprives the world's largest economy of crucial fiscal spending.

Hence, an extended US government shutdown could yet raise the prospects of a US recession.

And that could prevent one more Fed hike, or even hasten a rate cut.

And such an outlook would have a major impact across global financial markets.

POTENTIAL SCENARIOS

If the US government is shut down, as expected, beginning October 1st, with signs of staying offline for an extended period, we’d expect a similar market reaction from 2018:

-

The USD Index may find it tougher to climb higher, and even moderate lower as the shutdown goes on.

However, the US dollar may not fall by much, perhaps only to around the 105.0 region, as long as US yields remain notably higher than its major peers, such as Europe, the UK, and Japan.

-

Spot gold may return above $1900

An easing US dollar would make it an easier task ahead for gold bulls (those hoping prices will move higher) as markets wind down bets for one final Fed rate hike.

After all, gold tends to have an inverse relationship with US interest rates/yields/dollar (gold tends to go up when US rates/yields/dollar does down, and vice versa).

Demand for traditional safe havens, which include gold, may also help the precious metal recover.

-

US stock indexes (SPX500_m, NQ100_m, WSt30_m) may find some relief

The declines of late for US stock markets have been largely attributed to the fact that the Federal Reserve intends to keep its benchmark rates higher for longer.

However, an extended US government shutdown could alter that narrative, i.e. prevent one last Fed rate hike, or potentially even bring forward the Fed’s rate CUT.

Hopes for a sooner-than-expected Fed rate cut should help US stock indexes pare back recent declines.