- Gold gaps higher on geopolitical tension

- Market caution may keep metal buoyed

- Watch out for US CPI report on Thursday

- Failure to close gap may see prices test 21-EMA

- Keep eye on $1885 level

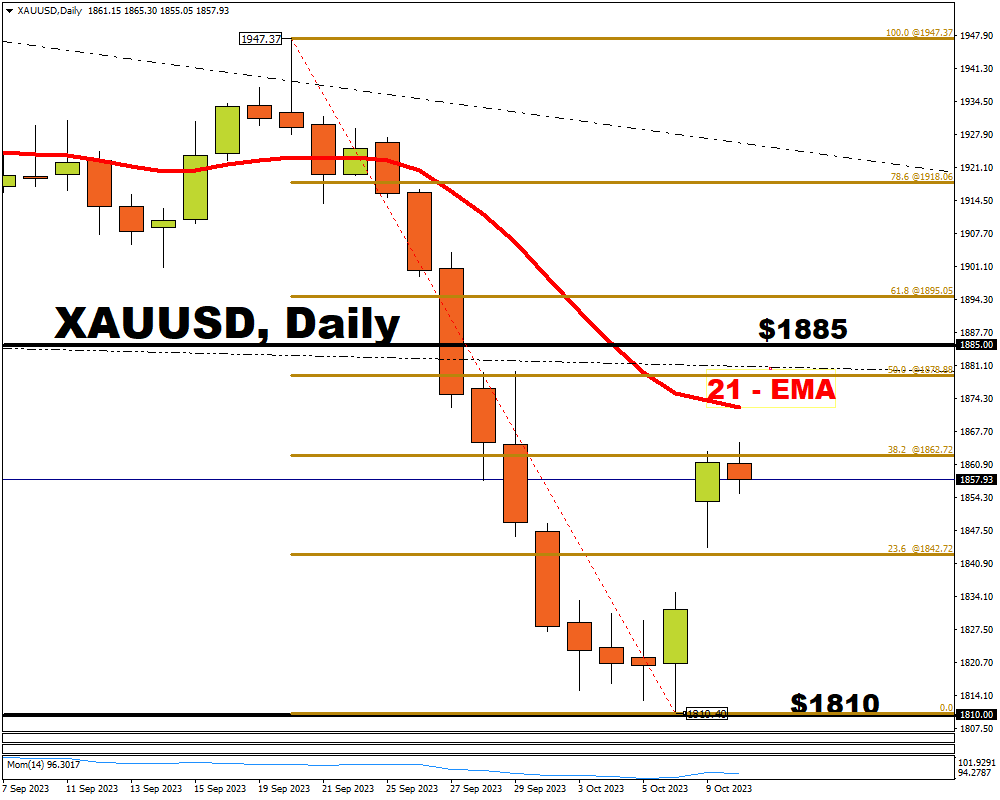

Friday’s post-NFP price action saw gold bounce off levels not seen since March 2023 at $1810, to post its first bullish candlestick since September 19th.

Escalating tensions in the Middle East over the weekend triggered risk aversion, sending investors rushing toward safe-haven assets with gold prices gapping over $20 at market open.

The failure to close the gap following yesterday, October 9th’s price action could present an opportunity for both bulls and bears.

At the time of writing, XAUUSD D1 is below its open for the day at $1861.15 and looks to be in a decline to close the gap at $1831.50.

Geopolitical tensions may continue supporting gold prices and this has been evident over the past 48 hours since the escalations in the Middle East began. However, the US CPI report on Thursday 12th could heavily influence gold’s near-term outlook than the ongoing crisis would.

A higher CPI is likely to bolster Fed hike expectations and the USD, weakening gold as a result. A weaker CPI may cool Fed hike bets and weaken the dollar, providing room for gold prices to push higher.

-

A failure to close the gap today may see the shiny metal rally into its 21-day EMA at $1873.00 with $1885 as the next near-term resistance.

-

Applying the Fibonacci retracement tool on the daily timeframe, from September 20th’s high at $1947.37 to October 6th’s low at $1810.40 we see the 38.2 retracement level at $1862.82 acting as the current resistance zone.

Bulls and bears alike could use markets close above or below this level as a pointer to the next direction for XAUUSD.