- GBPUSD set to be driven by technical and fundamental forces

- Keep eye on UK CPI report, US data dump and Fed speeches

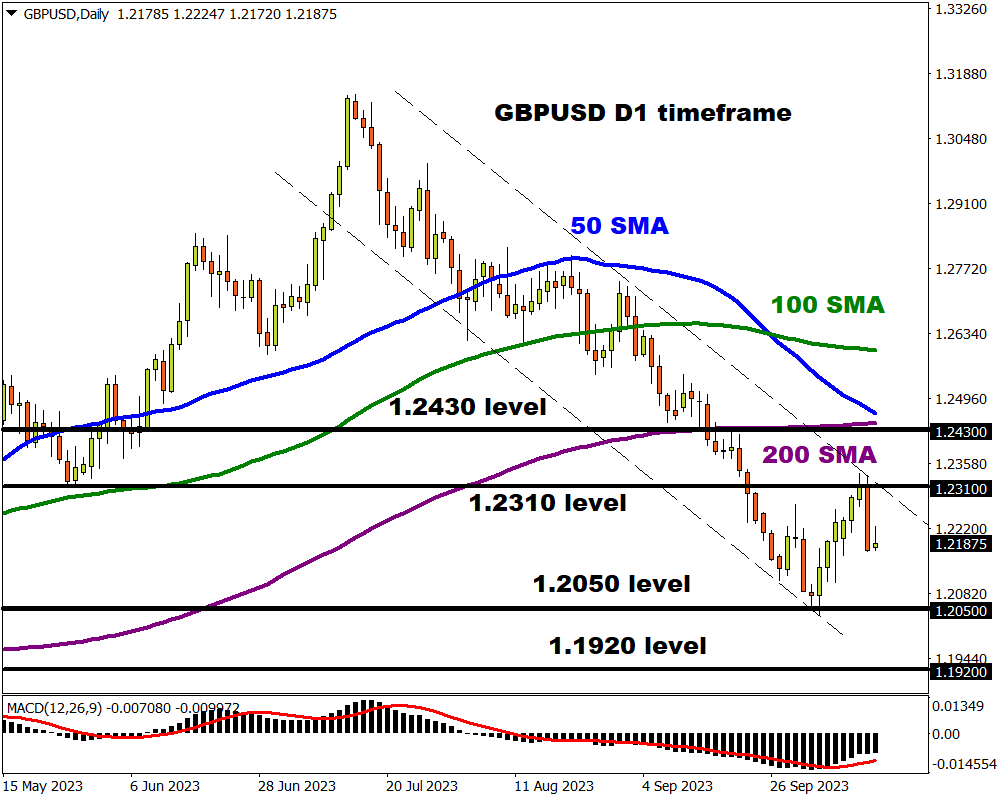

- Looming “death cross” formation points to further declines

- GBPUSD remains bearish despite recent bounce

- Key levels of interest found at 1.2310 and 1.2050

The combination of geopolitical risk and Fed rate expectations injected markets with explosive levels of volatility this week. We could see more action later today due to earnings announcements by Wall Street banks.

And even before things settle down, volatility is likely to intensify in the week ahead thanks to top-tier economic reports and speeches from policymakers among other key risk events:

Monday, October 16

- CNH: China medium-term lending facility rate

- JPY: Japan industrial production

- GBP: BOE chief economist Huw Pill speech

- USD: US Empire Manufacturing index, Philadelphia Fed President Patrick Harker speech

Tuesday, October 17

- CAD: Canada housing starts, CPI

- EUR: Germany ZEW survey expectations

- GBP: UK jobless claims, unemployment

- USD: US retail sales, industrial production, New York Fed President John Williams, Richmond Fed President Tom Barkin speech

- SPX500_m: Goldman Sachs, Bank of America earnings

Wednesday, October 18

- CNH: China GDP, retail sales, industrial production

- EUR: Eurozone CPI

- GBP: UK September CPI

- USD: US housing starts, Philadelphia Fed President Patrick Harker, New York Fed President John Williams speech

- NQ100_m: Netflix, Tesla earnings

Thursday, October 19

- CNH: China property prices

- AUD: Australia unemployment

- JPY: Japan trade

- USD: US initial jobless claims, existing home sales,

- USD: Fed speak - Federal Reserve Chair Jerome Powell, Chicago Fed President Austan Goolsbee, Atlantia Fed President Raphael Bostic, Philadelphia Fed President Patrick Harker, Dallas Fed President Lorie Logan

Friday, October 20

- CAD: Canada retail sales

- CNH: China loan prime rates

- NZD: New Zealand trade

- JPY: Japan CPI

- USD: Philadelphia Fed President Patrick Harker speech

Our focus falls on the GBPUSD which is forming a “death cross” pattern on the daily timeframe.

A death cross happens when an asset's 50-day simple moving average (SMA) moves below its 200-day SMA. This technical pattern is widely viewed as a signal that prices may continue to fall further in the medium to longer term.

After initially kicking off the week on a positive note amid a weaker dollar, the GBPUSD tumbled aggressively on Thursday thanks to the stronger-than-expected US inflation figures. With the dollar drawing strength from renewed Fed hike bets, the GBPUSD could resume its downtrend.

Here are 3 reasons why GBPUSD could be gearing up for a major move:

-

UK September Consumer Price Index (CPI)

The latest UK inflation data published on Wednesday, 18th October is likely to influence expectations around the BoE’s next move. Before this key report, the UK will release its latest batch of labour market data on Tuesday, October 17th. Any further signs of the UK jobs market's cooling may support the argument around the BoE keeping rates on hold for the rest of 2023.

Markets are forecasting:

- CPI year-on-year (September 2023 vs. September 2022) to cool 6.5% from 6.7% in the prior month.

- Core CPI year-on-year to cool 6.5% from 6.7% seen in August.

- CPI month-on-month (September 2023 vs August 2023) to rise 0.5% from 0.3% in the prior month.

As of writing, traders are pricing in a 45% probability of a 25 basis point BoE hike by the end of 2023.

- Signs of still stubborn inflation may boost bets around the BoE hiking rates one more time before the end of 2023, pushing the GBPUSD towards 1.2310.

- Should September’s CPI report show signs of cooling inflationary pressures, this could fuel hopes around the BoE keeping rates on hold – dragging the GBPUSD lower as a result.

-

US data dump + Fed speeches

Dollar volatility could be the name of the game next week due to key US economic data and speeches by a host of Fed officials. After receiving a boost from stronger-than-expected US inflation data, dollar bulls could switch into higher gear if the incoming economic releases support the case for another Fed hike in 2023.

The US Empire manufacturing will be in focus on Monday, with key US retail sales and industrial production figures published on Tuesday and US initial jobless claims on Thursday. These reports will be complemented by speeches from various Fed officials including Fed chair Jerome Powell.

- If US economic data misses expectations and Fed officials reiterate their dovish remarks, this could hit the dollar as bets rise over the Fed pausing hikes for the rest of 2023.

- A strong set of economic releases may fuel speculation around the Fed raising rates one more time this year. This may boost the dollar, pulling the GBPUSD lower as a result.

-

Bearish technical force: Death cross pending

The GBPUSD remains under pressure on the daily charts with the looming “death cross” formation signalling a steeper decline down the road. Although the currency pair experienced a technical bounce from seven-month lows, prices are still trading below the 50, 100, and 200-day SMA while the MACD trades to the downside.

- Sustained weakness below 1.2310 may keep bears control with the downside momentum opening a path towards 1.2050. A breakdown below this point could trigger a selloff towards 1.1920.

- Should prices push back above 1.2310, could see prices test 1.2430 – where the 200-day SMA resides.