- Big week for NQ100_m thanks to key risk events

- Watch out for big tech earnings and Powell speech

- NQ100_m trapped in choppy range on D1 chart

- Breakout on horizon with right fundamental spark

- Key levels of interest at 14900 and 15300

Watch this space because the next few days promise to be eventful for the NQ100_m.

Big tech earnings, key US economic data, and speeches from various Federal Reserve officials including Jerome Powell may inject the index with extreme levels of volatility.

Last week, the combination of geopolitical risk and Fed rate expectations placed the NQ100_m on a rollercoaster ride. However, prices are back within a choppy range with support at 14900 and resistance at 15300.

A major breakout could be on the horizon and here are 3 reasons why:

1) Big tech earnings

On Wednesday 18th October, all eyes will be on tech giants such as Tesla and Netflix who will publish their quarterly earnings report after US markets close. These results could impact the NQ100_m, especially when factoring how Tesla is within the top 10 companies in terms of weighing.

-

It is worth noting that at the start of October, Tesla announced a decline in vehicle production and deliveries in Q3 due to factory upgrades. Investors will be paying close attention to how development impacted revenues and profits.

-

Netflix will also be in focus with investors keeping a close eye on how the company’s crackdown on password sharing impacted its third-quarter results.

Ultimately, a positive set of earnings may support the NQ100_m which tracks the underlying Nasdaq 100. Should earnings disappoint, this could weigh on the index – dragging prices below the 14900 support as a result.

2) US data + Powell combo

Before the earnings from tech giants, the NQ100_m may be influenced by key US economic data such as retail sales among many others.

It is worth keeping in mind that the NQ100_m is filled with tech stocks that dislike the prospects of higher US interest rates. So essentially, the index could find itself under pressure if positive US economic data boosts expectations around US rates staying higher for longer.

This week is also jampacked with speeches from various Fed officials but the spotlight shines on Jerome Powell on Thursday 19th October.

-

If Powell strikes a hawkish tone, this could boost Fed hike bets –pressuring the NQ100_m as a result.

-

Should Powell adopt a cautious stance and sound less hawkish than expected, the NQ100_m could be given some room to push higher.

3) Technical forces: Breakout

The NQ100_m is back within a choppy range on the daily charts and could need a fresh fundamental spark to break out.

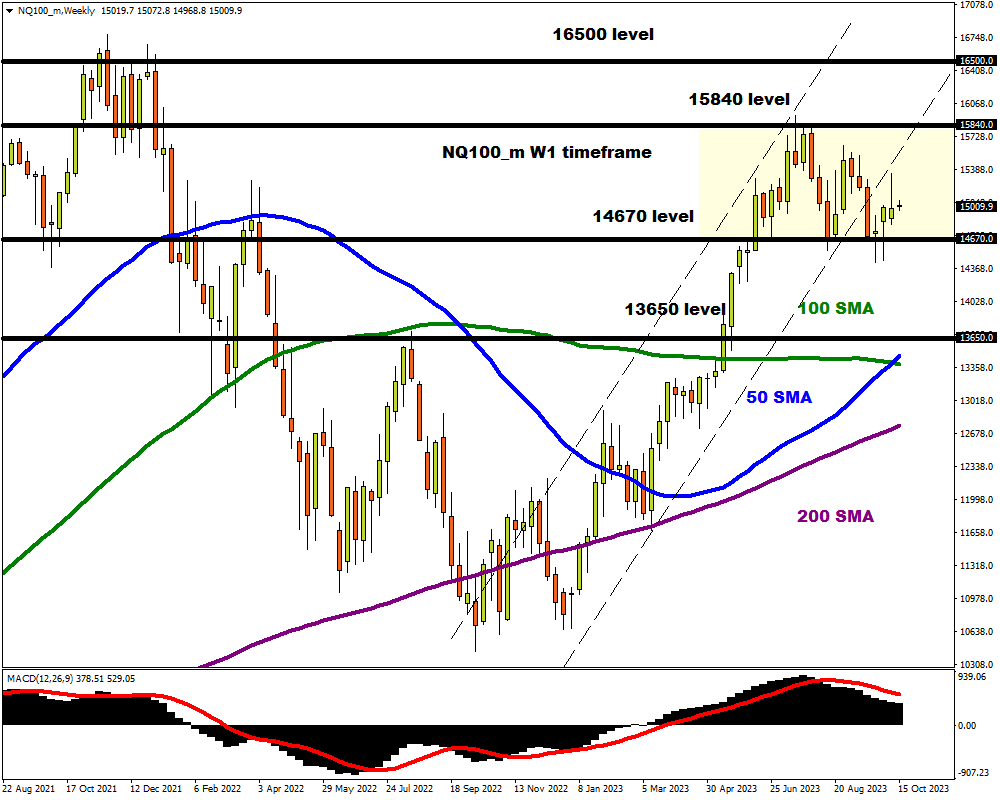

Prices are trading below the 50, 100-day SMA while the MACD trades below zero. A strong breakdown and daily close below 14900 could encourage a decline towards 14550 and 14250, respectively. Should prices push back above 15300, this may inspire an incline back towards 15630.

Zooming out on the weekly charts, the index remains in a very wide range with support at 14670 and resistance at 15840. While the weekly trends are currently bullish, a strong close back under 14670 could invite bears onto the scene – opening the doors towards 13650.