- Watch out for ECB meeting, key US data and big tech earnings

- EURUSD primed for breakout after bouncing within range

- Trend bearish with technical forces signalling more downside

- However, keep a close eye on fundamental forces

- Key levels of interest at 1.0630 and 1.0450

Get ready for another event-heavy week for global markets as the focus falls on central bank decisions, top-tier economic data, and corporate earnings from the largest companies in the world.

Watch out for the European Central Bank (ECB) meeting, key US data, and quarterly results from big tech titans.

But before we discuss what asset to keep an eye on, here is a quick list of major events and data releases for the upcoming week:

Monday, October 23

- EUR: Eurozone consumer confidence

Tuesday, October 24

- EUR: Eurozone & Germany S&P Global PMI

- GBP: UK S&P Global/ CIPS PMI, jobless claims, unemployment

- USD: US S&P Global Manufacturing PMI

- OIL: International Energy Agency world energy outlook

- N100_m: Microsoft, Alphabet earnings

Wednesday, October 25

- AUD: Australia CPI

- CAD: BoC rate decision

- EUR: Germany IFO business climate

- USD: US new home sales

- NQ100_m: Meta earnings

Thursday, October 26

- EUR: ECB rate decision

- USD: US Q3 GDP, durable goods, initial jobless claims

- NQ100_m: Amazon, Intel earnings

Friday, October 27

- CNH: China industrial profits

- JPY: Japan Tokyo CPI

- USD: US September PCE report, University of Michigan consumer sentiment

- SPX500_m: Exxon Mobil earnings

The robust list of key economic data, corporate earnings barrage, Fed rate expectations, and ongoing geopolitical tensions spells heightened volatility for financial markets. However, our attention gravitates towards the EURUSD thanks to the ECB rate decision and top-tier US data.

Before we identify what factors could spark a major move on the EURUSD, it is worth pointing out that the currency pair has been trapped remain a range since late September. Nevertheless, the path of least resistance points south with technical indicators in favour of bears.

Here are 3 reasons why the EURUSD is primed for a major breakout next week:

-

ECB meeting

No hikes are expected when the ECB meets on Thursday 26th October. However, the central bank may reinforce the message that rates will remain higher for longer to tame inflation.

Over the past few months, the inflation rate in Europe has been cooling – falling to 4.3% in September which was the lowest level since October 2021. However, recent data points to further signs of eurozone economic weakness with ECB President Christine Lagarde recently stating that the risks to the outlook remain tilted to the downside.

As of writing, traders are only pricing in a 12% probability of a rate hike by the end of 2023 with the odds of a rate cut by April 2024 currently around 40%.

- The euro could receive a boost if the ECB strikes a hawkish note and hammers down the “higher for longer” mantra.

- A cautious-sounding ECB that hints at a potential rate cut down the road could send the euro lower.

-

Key US economic data

Investors will be served up top-tier US economic reports in the week ahead which may influence the EURUSD.

But all eyes will be on the latest US GDP and September PCE report which are likely to shape Fed rate expectations.

Real GDP in the third quarter of 2023 is forecast to have jumped to 4.3% annualized, practically doubling from the 2.1% in the previous quarter while personal consumption was seen accelerating 3.7% vs the prior 0.8%.

The Fed’s preferred inflation gauge, the Core Personal Consumption Expenditure will also be combed through by investors for vital clues on the Fed’s next move. Markets expect the latest PCE report to show headline prices cooled 0.3% month-over-month after rising 0.4% in August while the core PCE deflator is forecast to rise 0.2%, up from 0.1% in the prior month. The core personal consumption expenditures price index for projected to cool 3.7% year-over-year in September, down from the 3.9% seen in August.

As of writing, traders are currently pricing in a 38% probability of a 25-basis point Fed hike by the end of 2023.

- Should overall US economic data beat forecasts and US inflation remain sticky, this may boost the dollar and pull the EURUSD lower as a result.

- If US economic data disappoints and there are signs of cooling inflationary pressures, the dollar could take a hit – boosting the EURUSD as a result.

-

Technical forces

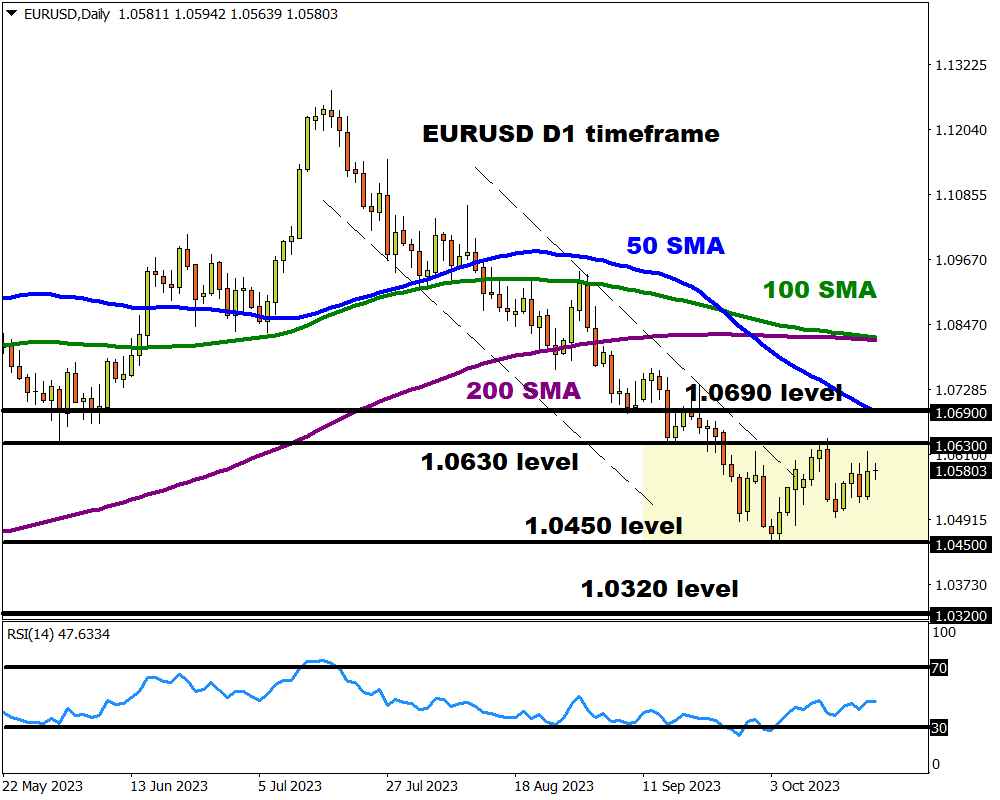

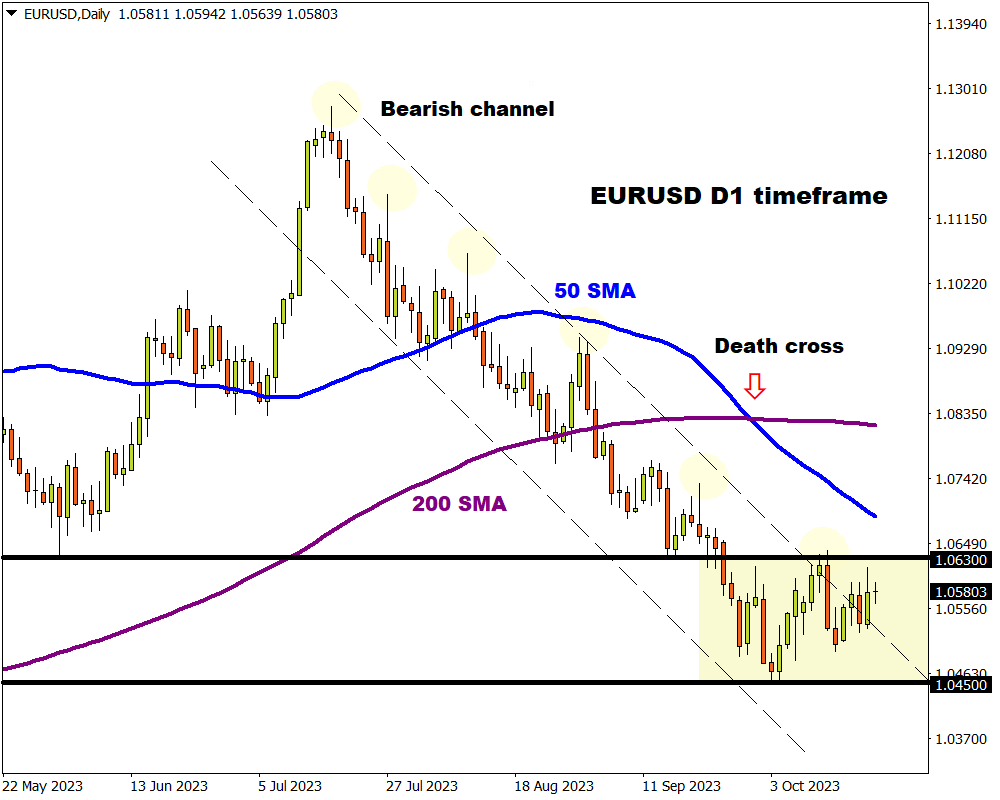

The EURUSD remains trapped within a range on the daily charts with support at 1.0450 and resistance at 1.0630 but bears remain in a position of power.

Prices are trading below the 50, 100, and 200 SMA while a “death cross” technical pattern was formed at the start of October.

- Sustained weakness below 1.0630 could encourage a move back towards 1.0450 before bears attempt to drag prices lower towards 1.0320.

- Should prices push back above 1.0450, this may trigger an incline towards the 50-day SMA at 1.0690.