- Gold boosted by fundamental forces

- Technical indicators signal further upside

- Time for bulls to step into a higher gear?

- All eyes on key psychological $2000 level

Gold glittered on Wednesday after jumping over 1% in the previous session.

The precious metal drew strength from a weaker dollar and falling Treasury yields following the softer-than-expected US inflation data on Tuesday.

This data has knocked the probability of another hike to almost zero with traders pricing in a 50-basis point rate cut by July 2024, according to Fed Funds futures.

Given gold’s zero-yielding nature, further gains could be on the cards as expectations rise over the Fed cutting interest rates in 2024.

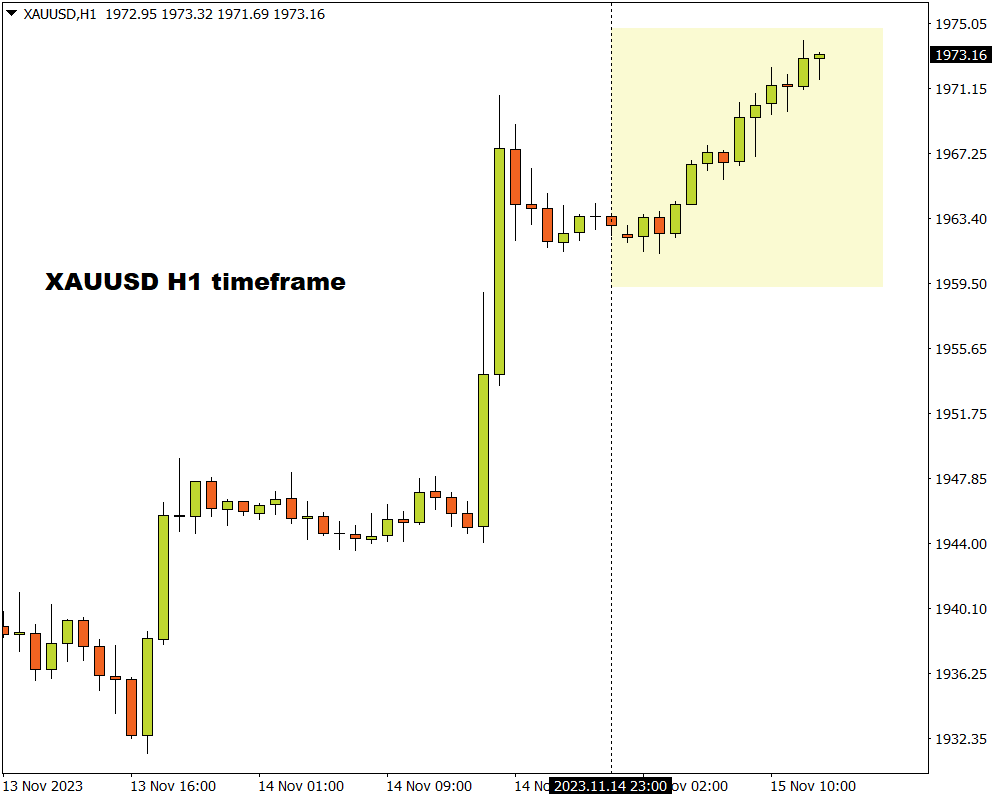

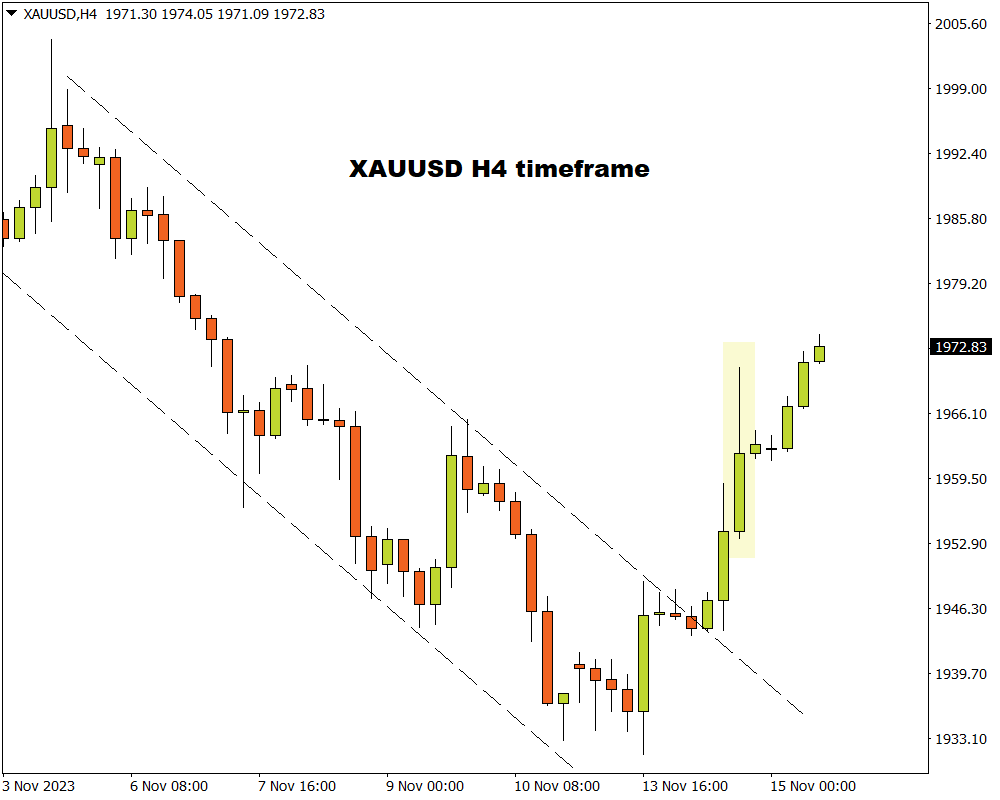

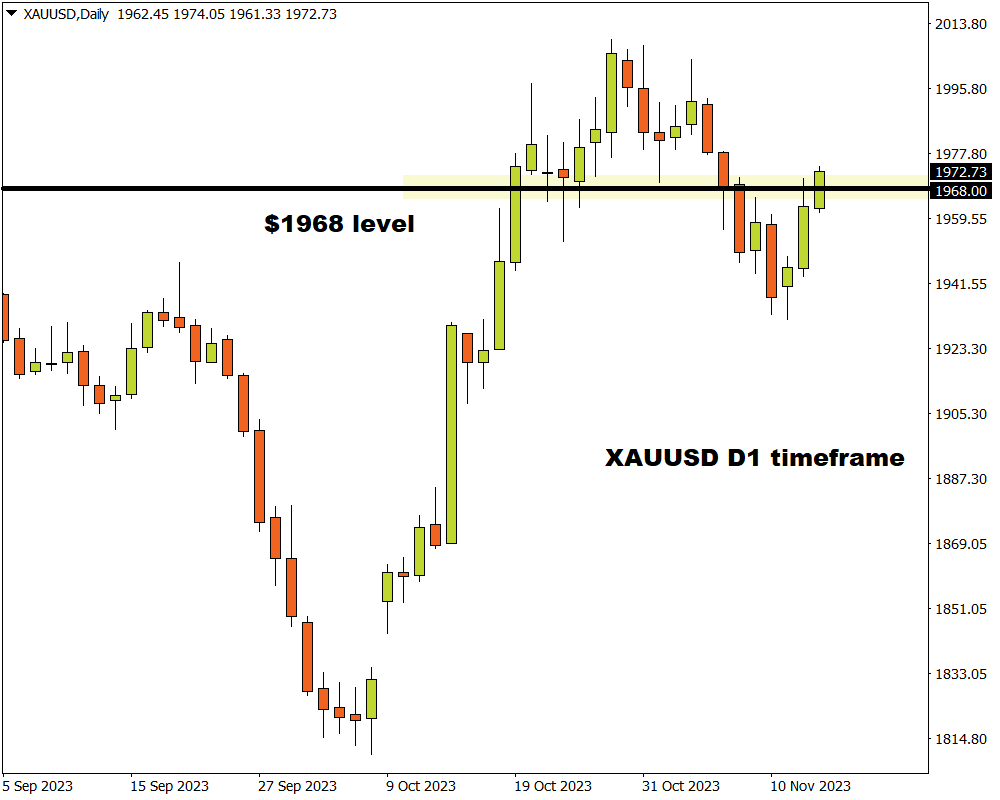

Focusing on the technical picture, gold could push higher if a daily close above $1968 is achieved.

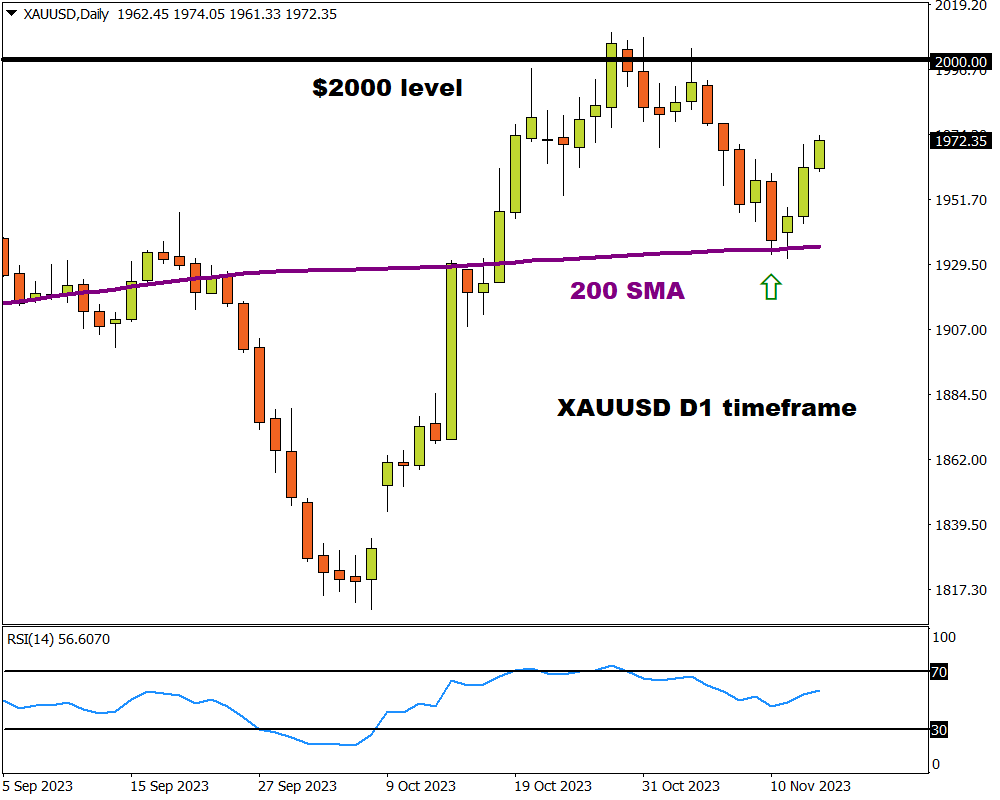

After rebounding from the 200-day SMA earlier this week, bulls have been armed with the technical and fundamental ammunition to attack the psychological $2000 level once again.

In addition, the Relative Strength Index (RSI) has yet to hit overbought conditions – signaling room for further upside.

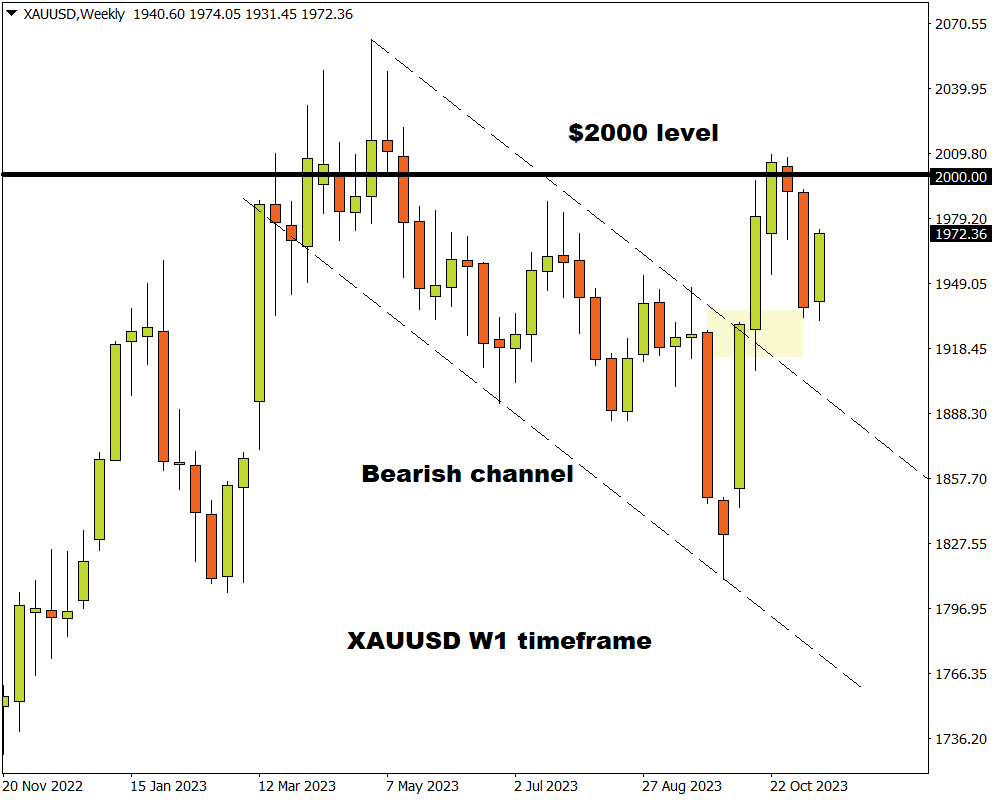

On the weekly charts, the trend flipped back in favor of bulls in October after prices breached the bearish channel. However, a solid close above the $2000 resistance is needed for bulls to step into a higher gear.

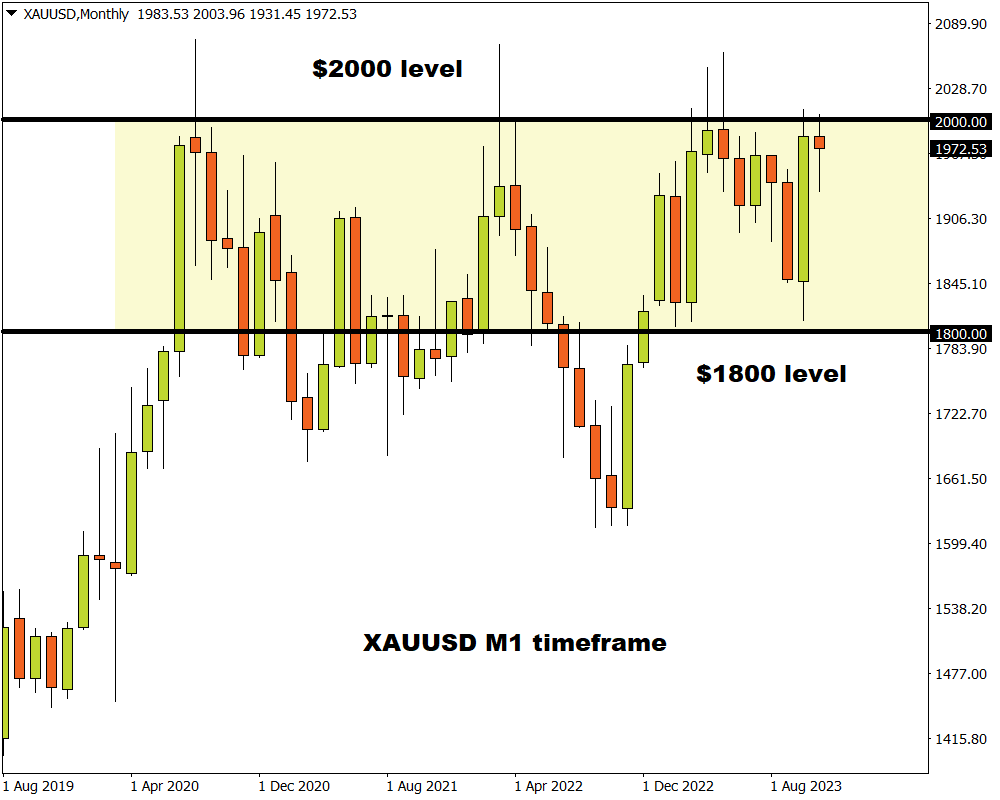

Taking a brief look at the monthly timeframe, prices remain in a very wide range with key resistance at $2000 and support at $1800. It is worth noting that gold has never secured a monthly close above the psychological $2000 level. Given the solid monthly candle in October and strong fundamental drivers supporting bulls, a significant move could be on the horizon.

Redirecting our attention back to the daily timeframe, bulls look to be in a position of power with all eyes on $2000.

-

A strong daily close above $1968 may open the doors back towards $2000, $2010, and $2018, respectively.

-

Should prices remain capped below $1968, this could trigger a decline back towards $1968 $1945, and $1934 – where the 200-day resides.