- Crude oil tumbles into bear market on demand fears

- Keep eye on incoming EIA report and US data

- Oil slump throws OPEC+ into spotlight

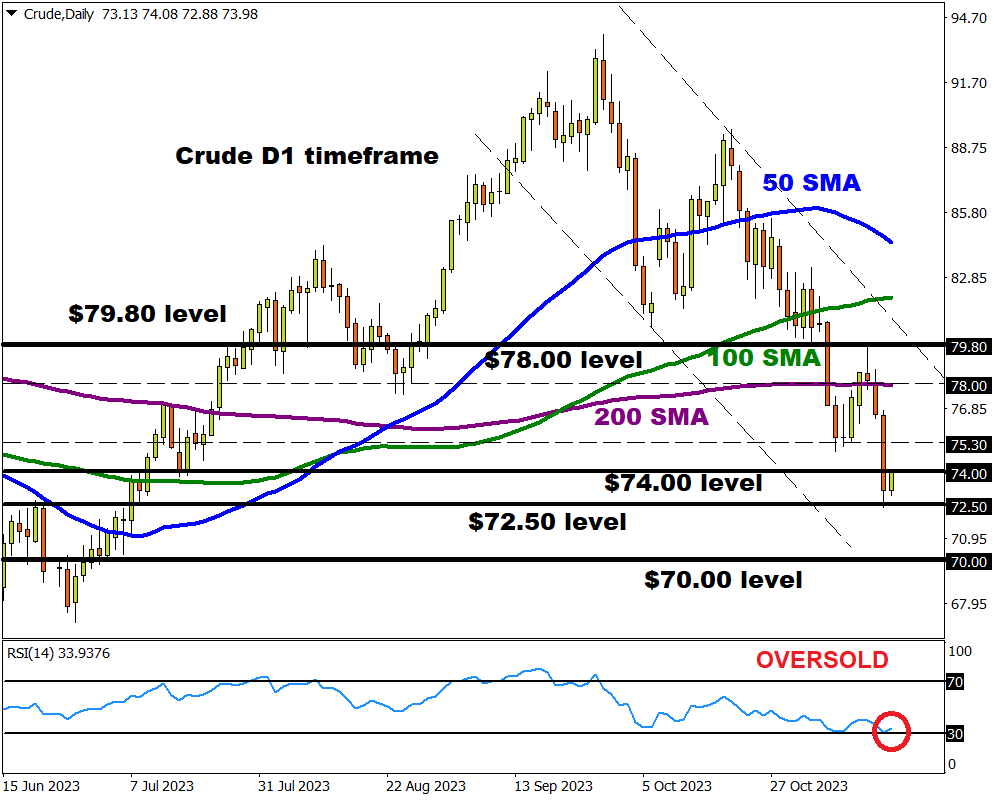

- Bears in power but RSI oversold

- Key levels of interest at $75.30, $72.50 and $70

Despite the holiday-shortened week ahead in the United States, financial markets could see some action thanks to top-tier economic releases across the globe.

Monday, 20th November

- CNH: China loan prime rates

- GBP: Speech by Bank of England Governor Andrew Bailey

- USD: Conference Board leading index

Tuesday, 21st November

- CAD: Canada CPI

- EUR: Eurozone new car registrations

- NZD: New Zealand trade

- USD: US FOMC minutes, existing home sales

- NQ100_m: Nvidia earnings

Wednesday, 22nd November

- EUR: Eurozone consumer confidence

- GBP: UK government’s Autumn Statement

- USD: US initial jobless claims, University of Michigan consumer sentiment

Thursday, 23rd November

- EUR: Eurozone/Germany S&P Global PMIs

- GBP: UK S&P Global /CIPS Manufacturing PMI

- US Markets closed – Thanksgiving holiday

Friday, 24th November

- CAD: Canada retail sales

- EUR: Germany IFO business climate, GDP

- JPY: Japan CPI

- USD: S&P Global manufacturing PMI

- US markets close early - 1:00 pm ET

Sunday, 26th November

- OIL: OPEC+ meeting

Our focus falls on US crude oil which has collapsed into a bear market.

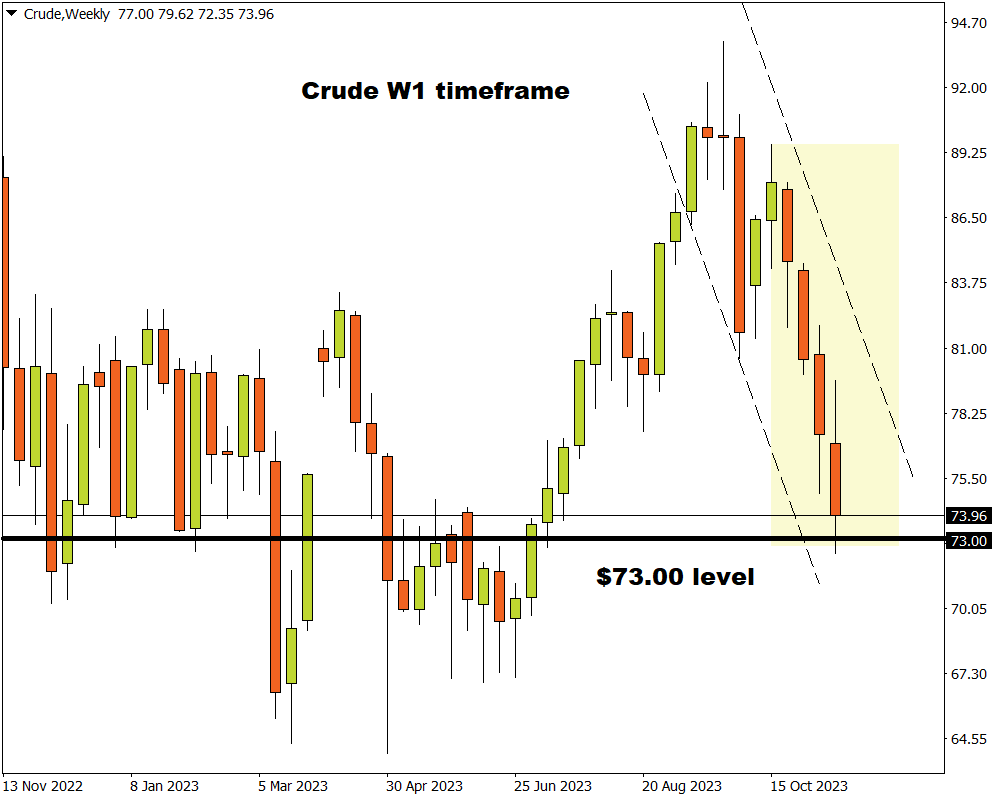

The global commodity is under intense pressure, heading for its fourth straight week of declines.

Note: A bear market happens when an instrument drops by 20% or more from its most recent high.

The pain started mid-week as swelling US inventories fuelled demand-side fears with disappointing economic data from the largest economy in the world exciting oil bears further.

Before the hefty 4.7% selloff this week, oil prices were already being pressured by weak data from China and easing fears over the Israel-Hamas conflict disrupting supply from the region.

With the path of least resistance for oil pointing south, further losses could be on the cards.

Here are 4 key factors that may influence oil in the week ahead:

-

US Energy Information Agency (EIA) report

It is worth noting that markets received 2 weeks of data from the EIA due to a planned system upgrade.

Crude oil inventories expanded for a fourth week, rising by 3.6 million barrels in the week ended November 10. This was followed by a huge 13.9 million-barrel build in the previous period.

The next EIA report published on Wednesday 22nd November may shape oil’s short to medium-term outlook.

- Another build in US crude inventories may further darken the demand outlook, dragging the global commodity lower as a result.

- A decline in US inventories could soothe fears around waning oil demand, potentially limiting downside pressures on crude.

-

FOMC minutes + US data

Much has changed since the Federal Reserve policy meeting on the 1st of November with the soft US inflation report extinguishing any remaining bets around the Fed hiking rates.

Nevertheless, the Fed minutes could offer additional insight into what Fed officials thought about the US economic outlook. On the data front, there will be some key economic releases including the US initial jobless claims, university of Michigan consumer sentiment, and manufacturing PMI which could trigger dollar volatility.

- Should the minutes strike a cautious note and overall US economic data disappoint, this could feed fears around waning demand – dragging oil prices lower.

- While a positive set of US economic data may quell fears around the demand outlook and supporting oil – a stronger dollar could limit upside gains.

-

Anticipation ahead of OPEC+ meeting

Note: the full impacts of what is decided during the OPEC+ meeting will not be reflected until Monday 27th November. However, the growing anticipation could influence oil prices in the week ahead.

Crude oil prices are trading at their lowest levels since July ahead of the OPEC+ meeting on Sunday 26th November.

The latest selloff in oil prices has added more focus to the upcoming meeting, opening the doors for greater supply cuts as the cartel continues its quest to rebalance markets. It is worth keeping in mind that OPEC+ has been cutting production since late 2022 with a broader deal to limit supply throughout 2024.

Markets already expect the extension of production cuts by Saudi Arabia and Russia into the early parts of 2024. So, the cartel may need to offer something new to revive oil bulls.

- Crude oil prices could be thrown a lifeline if the cartel moves ahead with deeper supply cuts.

-

Technical forces

Prices are under intense pressure on the daily charts with crude respecting a bearish channel. There have been consistently lower lows and lower highs while the MACD trades to the downside. However, the Relative Strength Index (RSI) is flirting near 30, indicating that crude may be oversold. While this has the potential to trigger a technical rebound, the scales of power remain in favour of bears.

- A solid daily close below $74 could send prices back towards $72.50 and $70, respectively.

- Should prices push back above $75.30, this could open the doors towards the 200-day SMA at $78 and $79.80.