- Gold lingers nears psychological $2000 level

- Big week ahead for precious metal thanks to key risk-events

- Keep eye on geopolitical developments, US data and Fed speeches

- Bulls back in control on D1 charts but RSI approaching overbought region

- Major breakout/down could be on horizon.

After throwing jabs at the psychological $2000 level, are gold bulls setting up for a knockout blow or ready to throw in the towel?

It’s back to business as usual from next week as US markets resume normal trading on Cyber Monday. Given the long list of high-risk events, the final week of November promises to be eventful.

Monday, 27th November

- Cyber Monday

- CNH: China industrial profits

- EUR: ECB President Christine Lagarde speech

- USD: US new home sales

Tuesday, 28th November

- AUD: Australia retail sales

- GBP: Bank of England policy maker Jonathan Haskel speech

- USD: US Conf Board consumer confidence, Fed Governor Chris Waller, Chicago Fed President Austan Goolsbee speech

- NQ100_m: Intuit earnings

Wednesday, 29th November

- AUD: Australia CPI

- NZD: New Zealand Rate Decision

- EUR: Eurozone economic confidence, consumer confidence, Germany CPI

- GBP: Bank of England Governor Andrew Bailey speech

- USD: US Q3 GDP, Fed releases Beige Book, Cleveland Fed President Loretta Mester speech

Thursday, 30th November

- CNH: China non-manufacturing PMI, manufacturing PMI

- EUR: Eurozone CPI, Germany unemployment

- CAD: Canada GDP

- USD: US October PCE report

- OIL: OPEC+ meeting

Friday, 1st December

- CNH: China Caixin Manufacturing PMI

- AUD: Australia Judo Bank Manufacturing PMI

- EUR: Eurozone/Germany S&P Global Manufacturing PMI

- GBP: UK S&P Global / CIPS Manufacturing PMI

- USD: US ISM Manufacturing, Fed Chair Jerome Powell, Chicago Fed President Austan Goolsbee speech

Gold bulls and bears have been taking swipes at each other throughout this month, trapping the precious metal in a range as a result.

A major breakout/down may be on the horizon and here are 4 reasons why:

-

Israel-Hamas temporary truce deal

After over six weeks of conflict, Israel and Hamas have agreed on a temporary four-day truce that would take effect from this morning. (Friday 24th November).

This development could be an important step that sparks hopes for a long-term peace deal between both sides. It is worth keeping in mind that mounting geopolitical tensions have rocked global financial markets this quarter, clouding sentiment and leaving investors jittery.

- Should the temporary ceasefire between both sides open the doors for further talks and lead to easing tensions – gold is likely to weaken as market sentiment brightens.

- Gold could shine if geopolitical tensions continue to rise beyond the temporary ceasefire.

-

Top-tier US economic data

The exceptional list of US economic data due next week may provide fresh insight into the health of the US economy.

Much focus will be on the second estimate for third-quarter growth, Fed’s Beige Book, and the PCE report among others which could influence gold prices. The Fed’s preferred inflation gauge, the Core Personal Consumption Expenditure is likely to be closely scrutinized by investors. Any further evidence of cooling price pressures is likely to reinforce bets around the Fed cutting interest rates in 2024.

Traders are currently pricing in a 63% probability of a 25-basis point rate cut by May 2024, according to Fed Funds Futures.

- Should overall US economic data disappoint, and inflation print lower than expected, gold prices are likely to rise as Fed cut bets jump.

- Stronger than expected US data coupled with sticky inflation figures may drag gold prices lower as investors re-evaluate rate cut expectations.

-

Speeches from Powell and Co.

A host of Fed officials including Jerome Powell will be under the spotlight next week.

As far as markets are concerned, the Federal Reserve is done with hiking rates with the next move being a cut. Market players are likely to scrutinize these speeches for more clues on the Fed’s policy outlook beyond 2023.

Note: Fed Chair Jerome Powell is scheduled to speak on Friday 1st December.

- Gold prices could appreciate if Fed officials including Powell strike a dovish tone, signalling rate cuts down the road.

- If Powell and Co. downplay expectations around rate cuts, this may see the dollar rebound – dragging gold lower as a result.

-

Technical forces

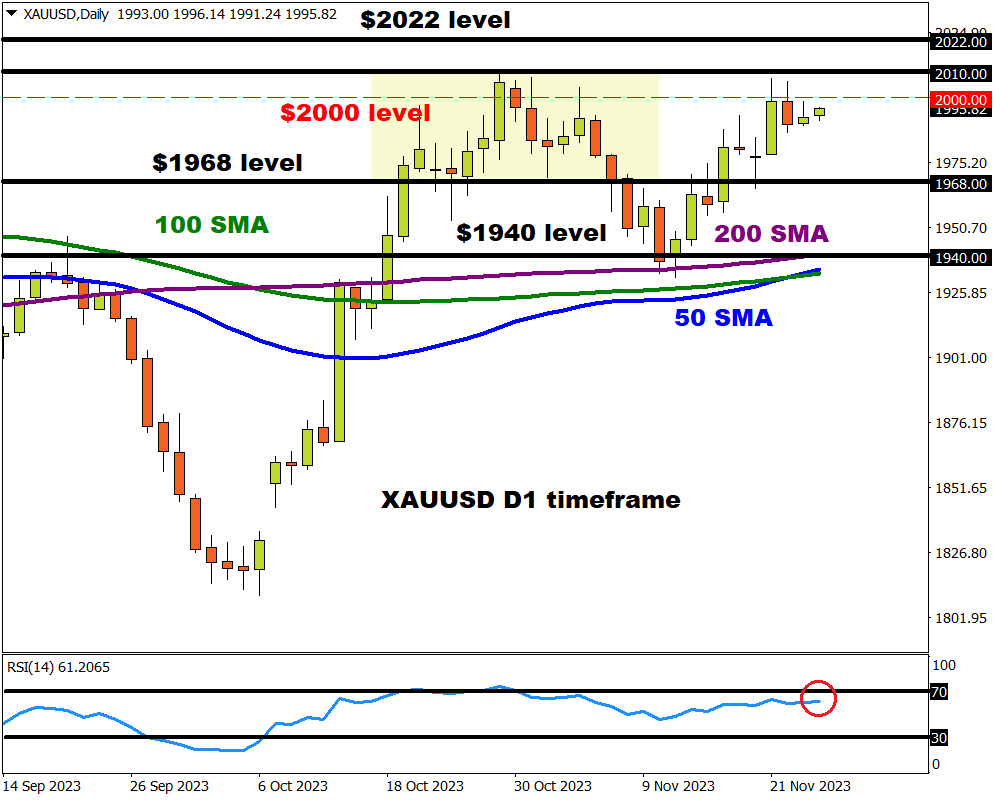

Gold bulls seem to be back in control on the daily charts with prices flirting around the psychological $2000 level.

A breakout could be on the horizon, but this may require a potent fundamental catalyst. While prices are trading above the 50, 100, and 200-day SMA, the Relative Strength Index (RSI) is slowly approaching 70, indicating that gold may heading towards overbought territory.

- A solid daily close above the psychological $2000 level may open a path toward $2010 and $2022.

- Should prices remain capped below $2000, this could see a decline towards $1968 and the 200-day SMA at $1940.