- EURUSD climbs roughly 500 pips from October low

- Data from both sides of the Atlantic could rock currency pair

- Euro bulls in position of power but RSI signals overbought

- Prices are testing resistance level at 1.0950

- Another big move around the corner for EURUSD?

The world’s most traded FX pair has climbed roughly 500 pips from its October low!

Over the past few weeks, EURUSD bulls have been putting in the work with prices back above the 200-day Simple Moving Average.

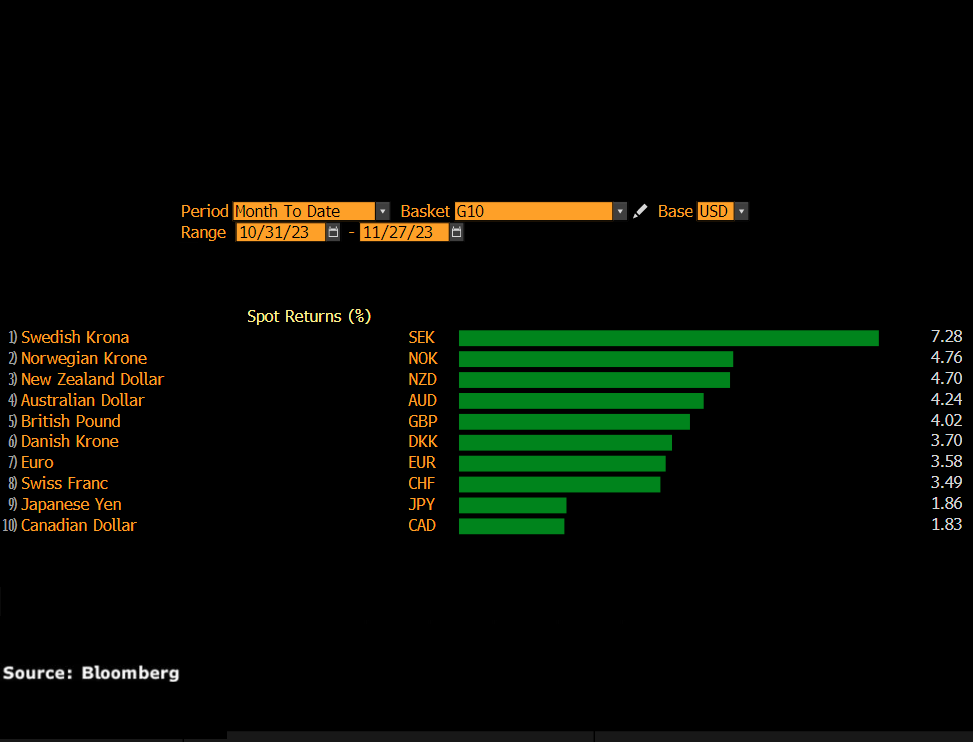

Fundamentally, a weaker dollar has powered the EURUSD’s upside. Dollar weakness was a major theme this month, especially after the softer-than-expected US inflation data solidified bets over the Fed being done with rate hikes.

Given how the currency pair is testing a significant resistance level ahead of a data-packed week from both sides of the Atlantic, another big move could be around the corner.

Here are three main factors to look out for this week:

-

Key EU data

It’s a data-heavy week for the euro with the latest inflation figures and PMI's among other reports in focus.

Wednesday sees the Eurozone economic and consumer confidence report coupled with CPI figures from Germany which could offer fresh clues about what actions the ECB may take beyond 2023. Germany’s month-on-month inflation figures are expected to post a negative 0.1% print in November while the year-on-year is forecast to hit 3.5% - lower than the 3.8% in the previous month. On Thursday, attention will be on the Eurozone CPI and Germany unemployment figures which will be topped off with the Eurozone/Germany S&P Global Manufacturing PMI’s on Friday.

Traders are currently pricing in a 61% probability of an ECB 25 basis point rate cut by April 2024.

- The EURUSD could weaken on further evidence of cooling price pressures and disappointing economic data from the eurozone/Germany.

- A surprise uptick in inflation and better-than-expected economic data could support the euro, pushing the EURUSD higher as a result.

-

Dollar volatility

The cocktail of US economic data coupled with speeches from a host of Fed officials including Jerome Powell could trigger dollar volatility this week.

Data such as third-quarter US GDP (second estimate), consumer confidence, the latest PCE report and PMI’s among others may offer fresh clues about the Fed’s 2024 policy outlook. On Friday, Powell will be under the spotlight with his comments heavily scrutinized by investors for more clarity on the Fed’s thinking beyond 2023.

- The dollar is likely to strengthen if economic data beats forecasts and Powell downplays expectations around US rate cuts next year. A stronger dollar may drag the EURUSD’s lower.

- Should US economic data disappoint and Powell along with other Fed officials strike a dovish tone, the EURUSD may venture higher amid a weaker dollar.

-

Technical forces

The EURUSD remains in a healthy uptrend on the daily charts as there have been consistently higher highs and higher lows. Although euro bulls are in a position of power above the 200-day SMA, the Relative Strength Index (RSI) has touched 70 - indicating that prices may be overbought. A strong breakout or technical rebound could be on the horizon, with 1.0950 acting as a key level of interest.

- Should prices secure a strong breakout and daily close above 1.0950, this could open the doors towards 1.1030 and 1.1080 – a level not seen since late July.

- Should the EURUSD remain capped below 1.0950, this could trigger a decline back towards 1.0850 and the 200-day SMA at 1.0813.