- EURUSD closes below 200-day SMA

- Bearish momentum building on D1 chart

- Data heavy week could rock currency pair

- Key levels of interest at 1.0850, 1.0770 and 1.0700

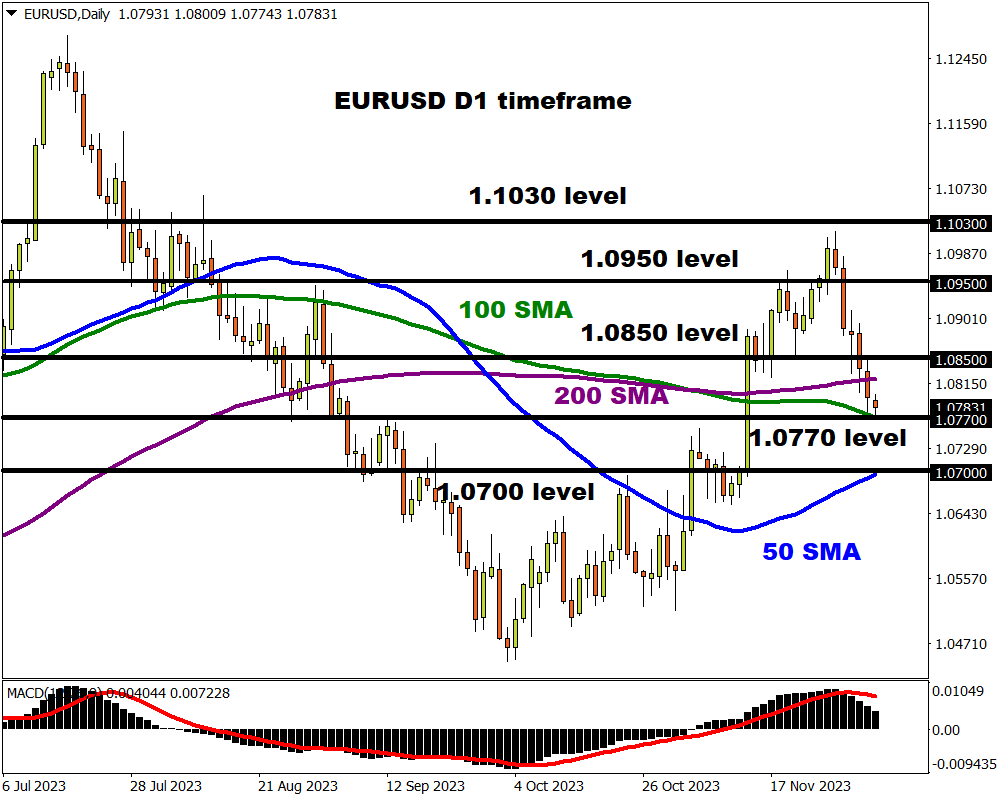

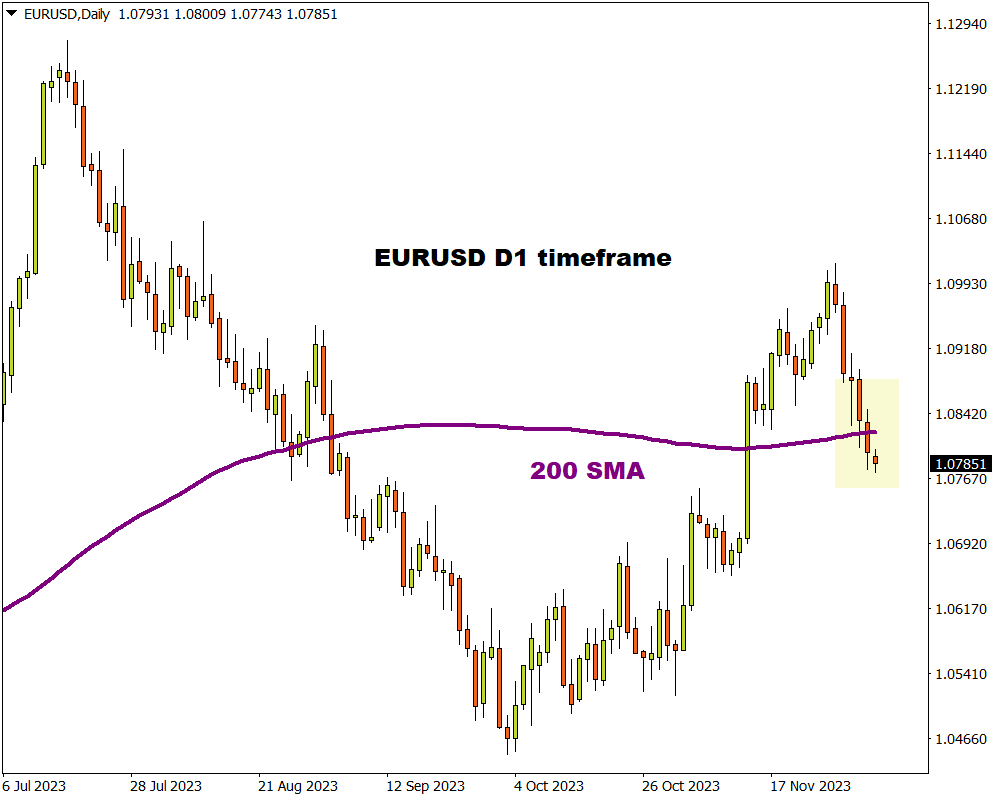

The EURUSD entered standby mode on Wednesday after closing below the 200-day Simple Moving Average (SMA) for the first time in three months.

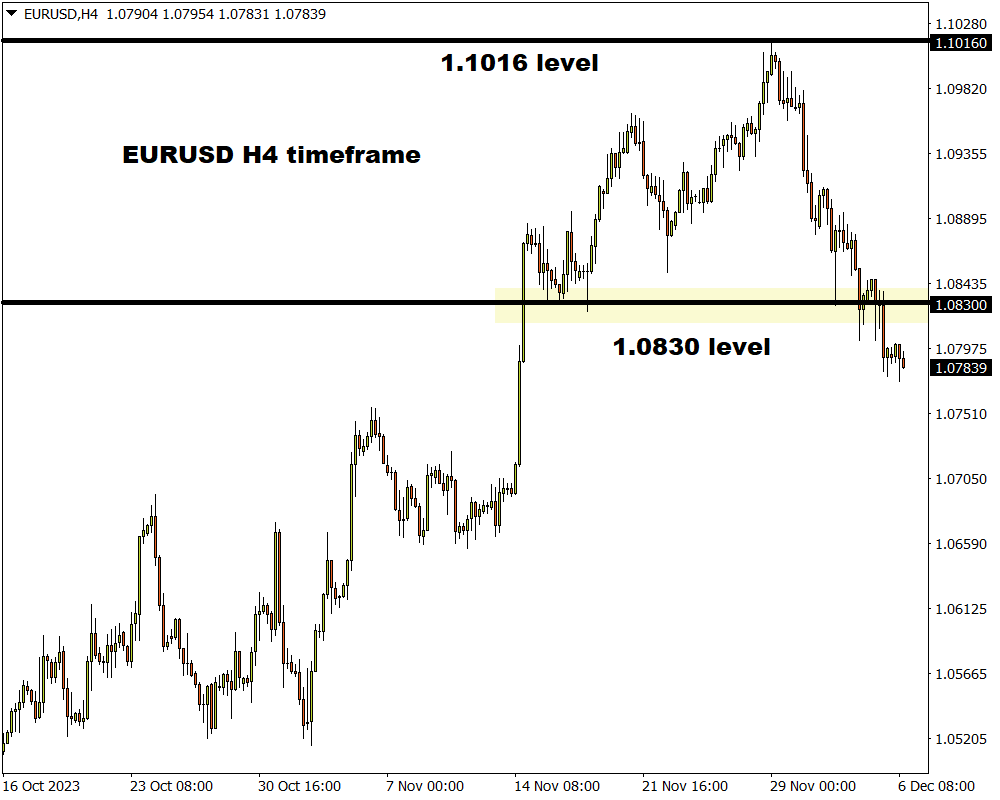

Euro bears seem to be making a return after dragging prices from a multi-month high at 1.1016 with the recent breakdown below the 1.0830 level supporting the bearish case.

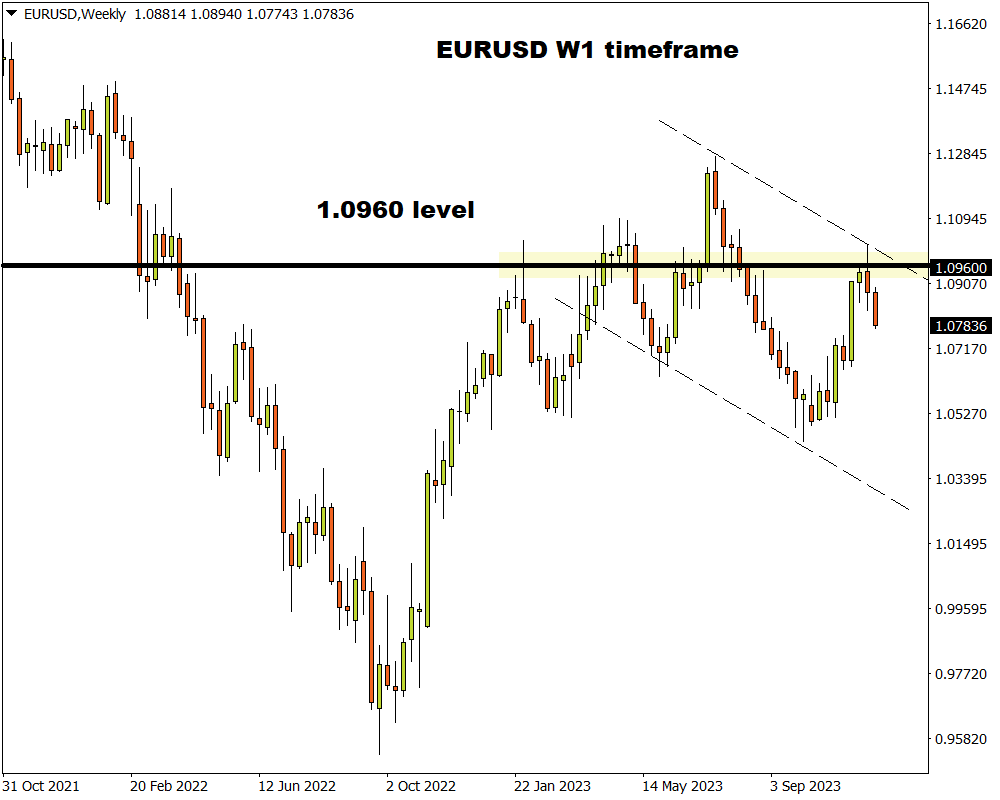

Zooming out on the weekly charts, the negative momentum could pick up after bulls failed to conquer the 1.0960 level which has acted as significant resistance in the past.

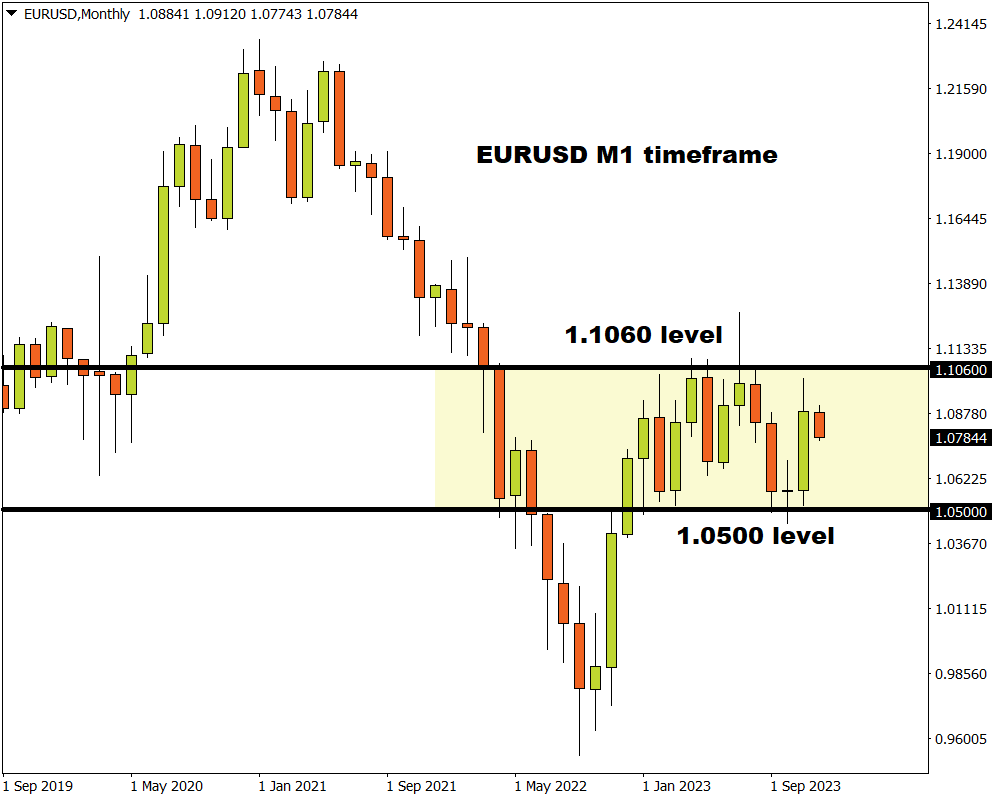

On the monthly charts, it’s still the same old story for the EURUSD with major support at 1.0500 and resistance at 1.1060.

The real action is back on the daily charts, especially after the daily close below 1.0830. Although prices are no longer trading within the bullish channel, some support can be seen around the 100-day SMA.

A potential breakout opportunity could be on the horizon with the right fundamental spark. Given how this is a data-heavy week for both Europe and the United States, this could translate to increased volatility on the EURUSD – especially on Friday when the NFP is released.

-

Should prices secure a strong daily close below 1.0770, this could open a path towards the 50-day SMA at 1.0700 and 1.0550.

-

A move back above the 200-day that pushes prices beyond 1.0850 could spark a move toward 1.0950 and 1.1030, respectively.