- Brent sheds 3.8% in previous session

- Global commodity hit by supply concerns & demand fears

- Oil under pressure despite recent rebound

- Bears in driving seat but RSI signals oversold

- Key levels interest at $78, $74 and $72.50

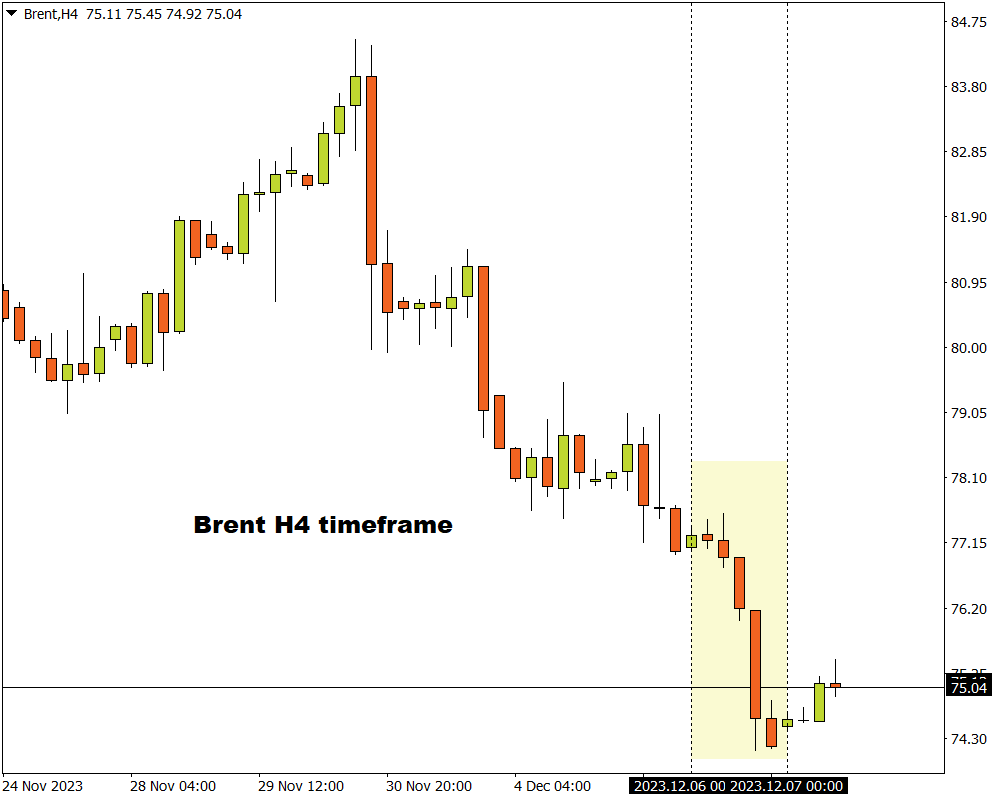

Oil prices staged a small rebound on Thursday after diving 3.8% in the previous session to its lowest level since June 2023.

The global commodity was pounded by concerns over excess supply after official US data showed another build in crude inventories. Bears also drew strength from the uncertain demand outlook amid fears over economic slowdowns in the United States and China. In addition, a sense of disappointment with OPEC+ latest measures to rebalance oil markets complemented the downside momentum.

December has been rough and rocky for Brent which has shed over 8% month-to-date. With the fundamentals and technical moving in favour of bears, this could open the doors to further losses.

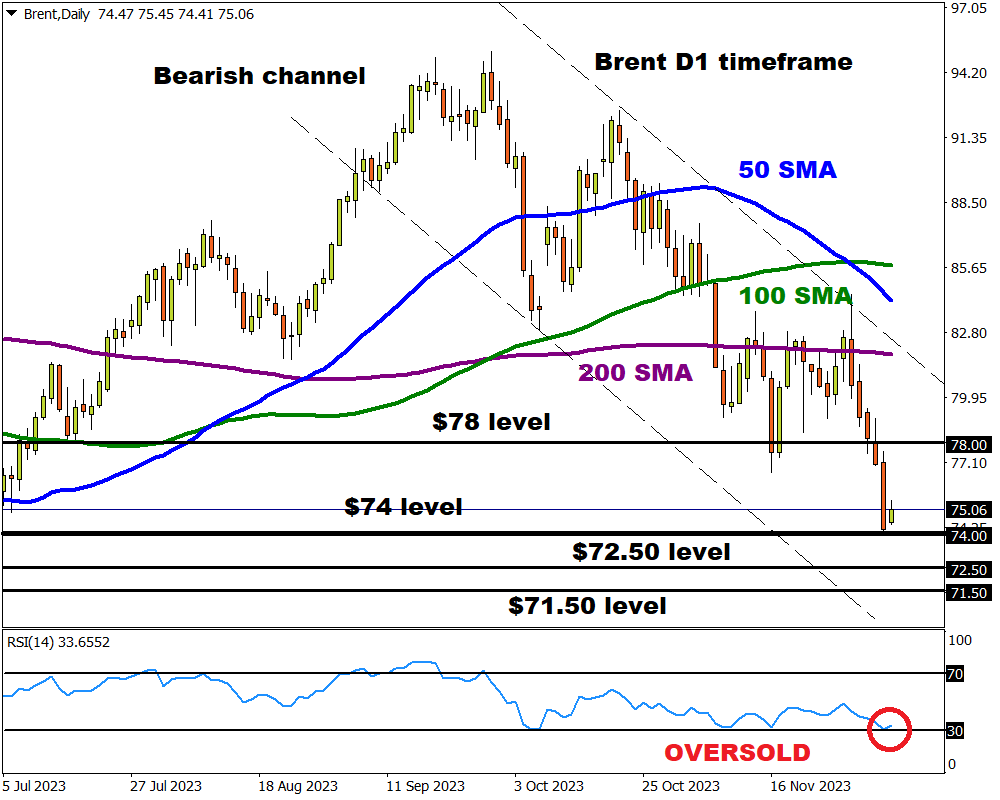

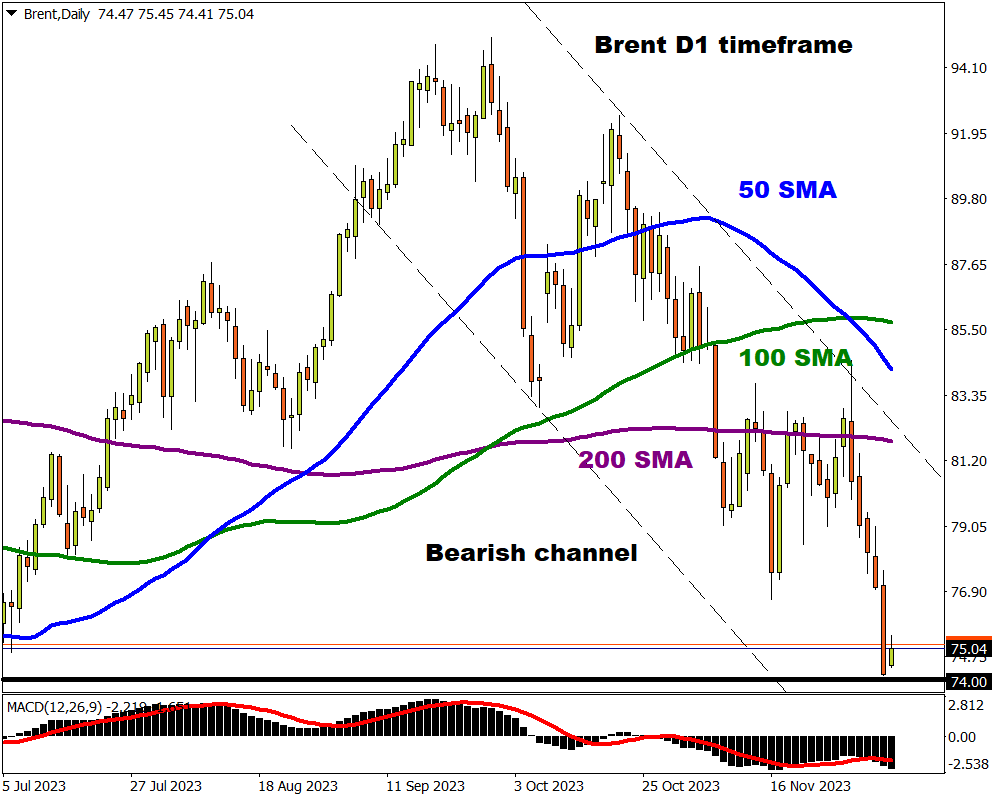

Focusing on the technical picture, Brent was already respecting a negative channel on the daily charts – creating lower lows and lower highs. Prices are trading below the 50, 100, and 200-day SMA while the MACD trades below zero.

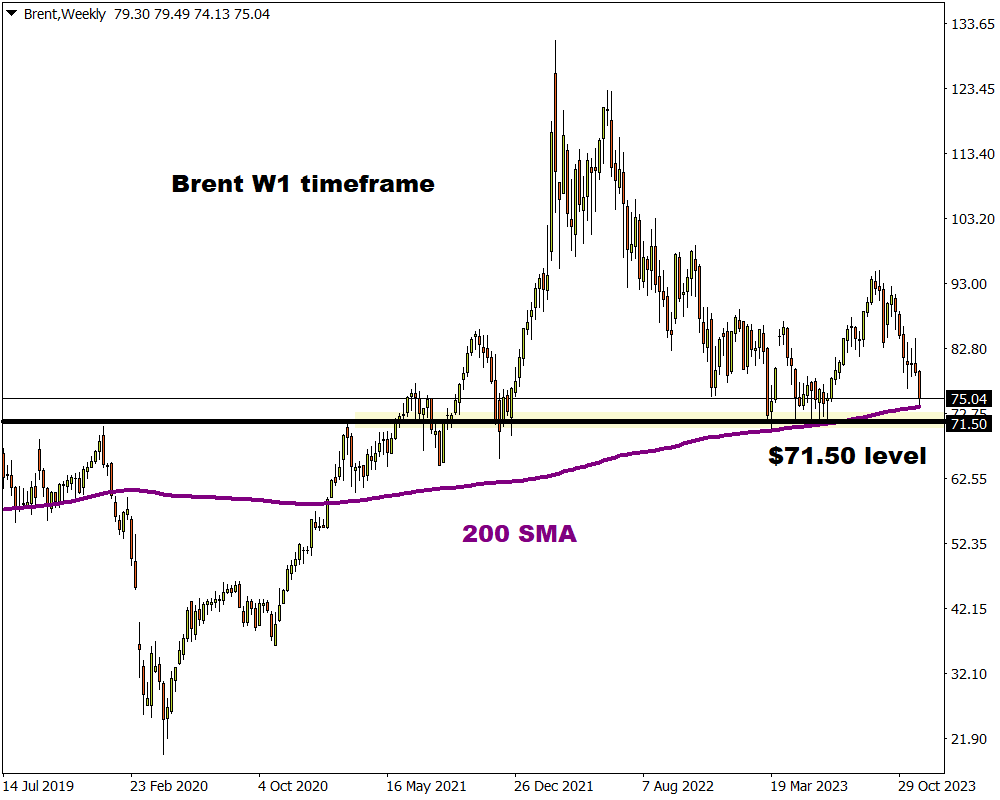

Zooming out to the weekly charts, prices are approaching the 200-week SMA which could prove a tough nut to crack. The last time Brent secured a weekly close below this point was back in January 2021. Should bears have what it takes to clear this key point, the next major support can be found at $71.50.

Redirecting our attention back to the daily timeframe, bears remain in power with the first obstacle to clear at $74.00. It is worth keeping in mind that the Relative Strength Index (RSI) is flirting near 30, indicating that crude may be oversold. While this could trigger a technical rebound down the road, it may result in a dead cat bounce given the fundamental forces at play.

Note: A dead cat bounce is a temporary recovery in a downtrend, followed by further declines.

-

A solid breakdown and daily close below $74 may send prices towards $72.50 and $71.50.

-

Should $74 prove to be reliable support, this may trigger a rebound back towards $78.