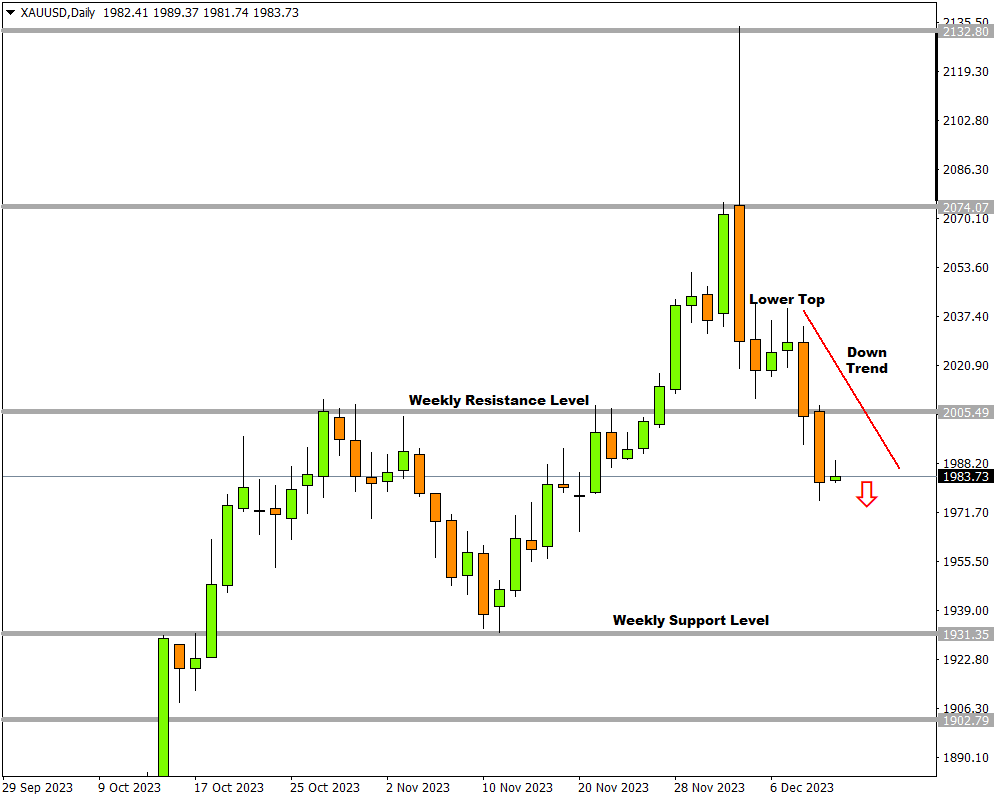

- Gold bearish on daily timeframe

- 4 potential targets identified on H4 chart.

- Bearish scenario invalidated above 2039.91

- Watch out for US CPI report this afternoon

After the spectacular bearish move on Monday 4th December, gold is back in bearish territory.

This is reflected in the daily timeframe where prices are busy with an impulse in the current downtrend. Bears seem to be aiming for the next weekly support level around 1931.35 with the negative momentum increasing after the solid daily close below the psychological $2000 level. Nevertheless, looking at the 4-hour timeframe might give more insight into what to expect from the precious metal over the next few sessions.

Before we take a deeper dive into the technicals, it is worth keeping in mind that fundamental forces could impact the precious metals’ outlook this week.

The incoming US CPI report released this afternoon could impact expectations around what actions the Fed will take in 2024, ultimately influencing gold.

A softer-than-expected inflation figure may support gold, while a higher-than-expected figure has the potential to drag the precious metal lower.

Shifting our focus back to technicals...

The 4-hour chart validates the daily scenario with a downtrend in progress. The bearish impetus is further confirmed by the price being below the 50 Exponential Moving Average. Both the Momentum Oscillator and the Moving Average Convergence Divergence (MACD) are also beneath their respective base lines.

Attaching a modified Fibonacci tool to the trigger level below the last lower bottom at 1975.75 and dragging it above the 50 Exponential Moving Average at 2039.91, four possible targets can be determined:

-

The first potential target is at 1950.09 (Target 1).

-

The second price target is likely at 1937.25 (Target 2).

-

The third price target is possible at 1911.59 (Target 3) if the price has enough momentum to break through the weekly support level.

-

The fourth and last price target is feasible at 1879.51 (Target 4) if the bears can continue their rule for long enough.

If the price at 2039.91 is broken, this scenario is no longer valid.