- Yen set for largest weekly gains since mid-July

- BoJ decision and US PCE may move USDJPY

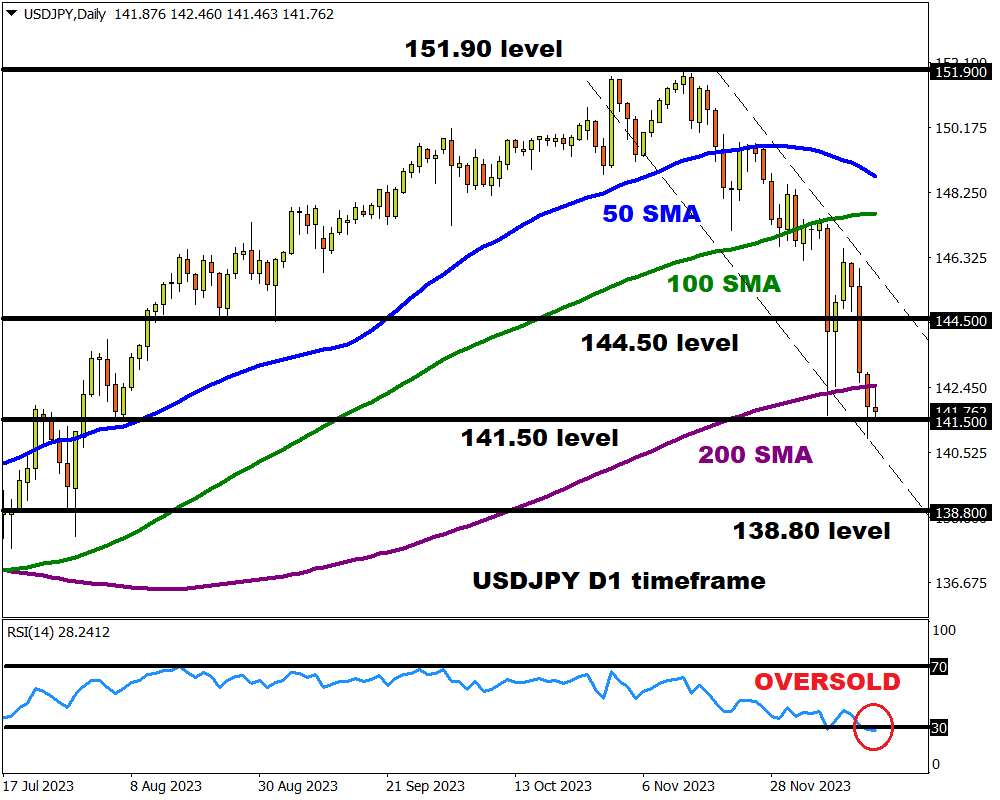

- Currency pair bearish on daily charts but RSI oversold

- Daily close below 200-day SMA could fuel downside

- Key levels of interest at 144.50, 141.50 and 138.80

Our focus falls on the Japanese Yen which has been the performing G10 currency against the US dollar over the past five weeks!

The final trading week before Christmas could be lively for markets thanks to key economic reports from across the globe:

Monday, 18th December

- EUR: Germany IFO business climate

- NQ100_m: Annual reconstitution (before market open)

- GBP: BOE Deputy Governor Ben Broadbent speech

Tuesday, 19th December

- JPY: BoJ rate decision

- AUD: RBA meeting minutes

- CAD: Canada CPI

- EUR: Eurozone CPI

- USD: Atlanta Fed President Raphael Bostic speech

Wednesday, 20th December

- CNY: China loan prime rates

- JPY: Japan trade

- EUR: Eurozone new car registrations, consumer confidence

- GBP: UK CPI

Thursday, 21st December

- CAD: Canada retail sales

- USD: US initial jobless claims, GDP, Conf. Board leading index

- SPX500_m: Nike earnings

Friday, 22nd December

- JPY: Japan CPI, BoJ meeting minutes

- GBP: UK GDP

- USD: US November PCE report, University of Michigan consumer sentiment index

The yen has been on a tear in recent weeks amid growing speculation around a hawkish policy pivot by the BoJ from negative interest rates.

This comes at a time when expectations are mounting over the Fed and other central banks embarking on rate cuts in the face of cooling inflation. Such an environment continues to empower the yen which is set for its largest weekly gain since mid-July.

With all the above said, the yen could be gearing up for another big move over the holiday season.

Here are 3 factors to watch out for:

-

BoJ rate decision

The Bank of Japan is widely expected to keep its yield-curve control and short-term interest rates unchanged at -0.1%.

However, recent hawkish comments by BoJ officials have fuelled speculation around the central bank signalling an exit from negative rates. Despite inflation rising to 3.3% in October, economic growth contracted 2.9% on an annualized basis in Q3, worse than the preliminary data of 2.1%. These mixed signals may encourage investors to focus on the policy statement to gauge what to expect from the BoJ in 2024.

Interestingly, traders are currently pricing in a 70% probability of the BoJ scrapping its negative rates by March 2024.

Looking beyond the rate decision, it is worth keeping an eye on Japan’s latest inflation figures on Friday which may influence speculation around the BoJ’s next move.

- The yen could receive a boost from any hawkish hints and signalling an end of negative rates in 2024.

- Should the central bank push against market expectations of a pivot, the yen is likely to weaken.

-

US November PCE report

Much attention will be directed toward the Fed’s preferred inflation gauge – the Core Personal Consumption Expenditure which could influence rate cut bets.

After the Fed flagged the end of its tightening cycle markets now expect the central bank to cut rates by as much as 150 basis points in 2024, according to Fed Funds futures.

The PCE core deflator is expected to rise 0.2% month-over-month, unchanged from October while rising 3.4% year-over-year in November, down from the 3.5% seen in the previous month.

- Ultimately, more signs of cooling price pressures may reinforce bets around the Fed cutting rates next year. Given how this may hit the dollar, it could drag the USDJPY lower.

- If the PCE report prints above market forecasts, this may impact Fed cut bets and support the dollar – pushing the USDJPY higher as a result.

-

Technical forces

After closing below the 200-day SMA, the USDJPY could be poised for further downside.

The trend is firmly bearish on the daily charts as there have been consistently lower lows and lower highs. However, the Relative Strength Index (RSI) has dipped below 30, suggesting that prices are heavily oversold. This could trigger a technical throwback if 141.50 proves to be a tough nut to crack.

- A solid breakdown and daily close below 141.50 could trigger a decline toward levels not seen since late July at 138.80.

- Should prices push back above the 200-day SMA, this may trigger a rebound towards the 144.50 region.