This year has seen its share of surprises and shockers, to say the least.

Investors and traders had to battle with a US and European banking crisis in March, the outbreak of the Israel-Hamas war in October, all while contending with the uncertainties over the Fed’s next policy moves.

Yet, many assets and instruments were able to move beyond the negative headlines to punch their way up to record highs!

As the curtains come down on 2023, we highlight 3 major assets that had a year to remember:

1) XAUUSD

On December 4th, briefly spiked to $2147.14 which was a new record high for spot gold!

This surpassed gold’s previous all-time peak of $2074.87, registered on August 7th, 2020, when the Fed kept its benchmark rates near-zero amid the economic turmoil from the Covid-19 pandemic.

Also, on December 27th, the precious metal secured its highest-ever daily closing price of $2077.16.

What drove XAUUSD to a new record high?

Markets are getting excited about the prospects of Fed rate cuts in 2024.

Note that the prospects of lower US interest rates (and a weaker US dollar/lower US Treasury yields) are a boon for gold.

After all, gold does not pay interest to investors who hold on to the precious metal.

In other words, lower interest rates make gold more attractive as a place to invest in.

At the time of writing, gold is set to close out 2023 with an annual gain of over 13%.

As long as the Fed can trigger the forecasted rate cuts, that should boost gold's chances of reaching even higher heights in 2024!

2) NVIDIA

The stocks for this US chipmaker secured a daily close above the psychologically-important $500 line for the first time in its history on November 20th.

However, after posting an intraday record high of $505.46, it was unable to maintain such lofty heights.

The stock faltered and eventually found support around its 50-day simple moving average (SMA), before relaunching another attempt to retake the $500 level as we tip over into the new year.

To be clear, it's been a great year overall for US stocks.

There were also record highs for the likes of:

-

NQ100_m (which tracks the Nasdaq 100 index)

-

WSt30_m (which tracks the Dow Jones Industrial Average index)

- Apple

However, Nvidia takes the cake and is being singled out among its US peers, in light of its stunning year-to-date gains of nearly 240%!

What drove NVIDIA to a new record high?

The artificial intelligence craze has made Nvidia the best-performing member on both the S&P 500 and Nasdaq 100 indices.

Nvidia stands out from the crowd in having already produced very real profits from the AI-mania, as opposed to mere hype.

Nvidia’s graphics processing units (GPU) are a crucial component for companies that are looking to build their own AI products and services.

And of course, the prospects of US interest rates moving lower in the new year is also adding to the overall cheer for broader US stock markets as well.

As for the 2024 outlook, Wall Street is forecasting a further 31.7% climb for Nvidia over the next 12 months.

Outside of the US, European stock indices also had a stellar year!

There were record highs for the likes of:

-

FCHI40_m (which tracks France's benchmark CAC 40 index)

-

SPN35_m (which tracks Spain's benchmark IBEX 35 index)

- STOX50_m (which tracks Europe's blue-chip EURO STOXX 50 index)

But for this article, we zoom in the benchmark stock index for the Eurozone's largest economy ...

3) GER40_m

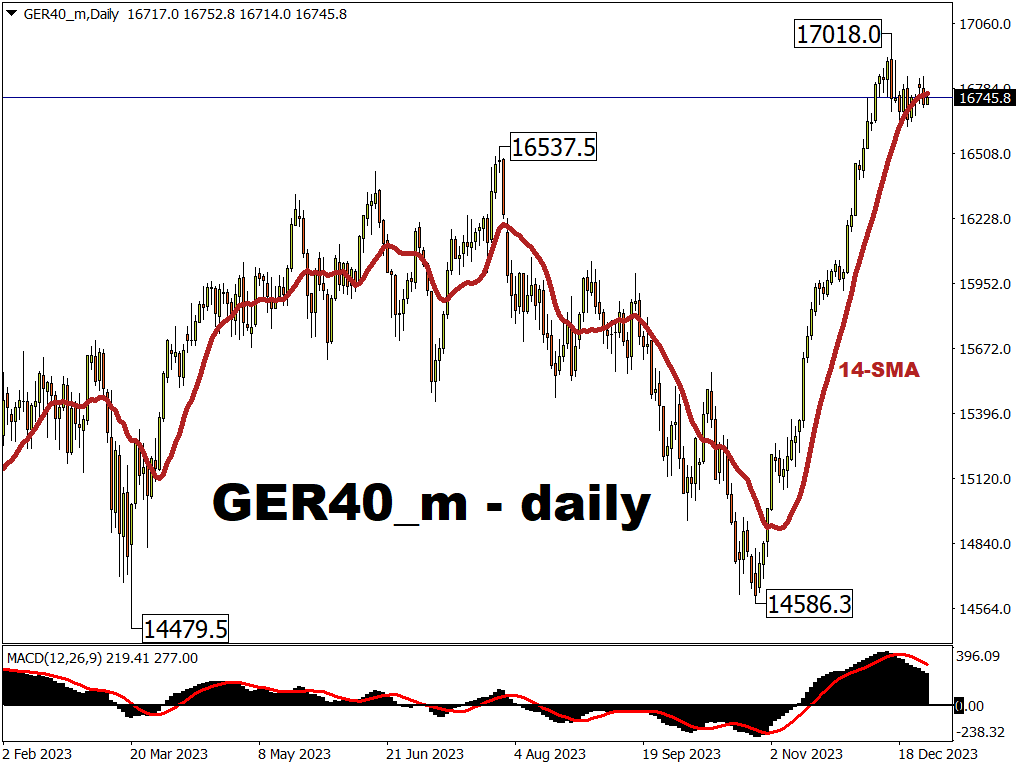

On December 14th, Germany's benchmark stock index hit an all-time high of 17,018.0.

That was 2.9% higher than its previous record high of 16,537.5 set at end-July 2023.

However, it has eased slightly lower since, now settling around its 14-day simple moving average (SMA) for support.

Still, the GER40_m index is set to claim a 20% gain for all of 2023!

What drove GER40_m to a new record high?

Here are two main factors:

- Hopes for ECB rate cuts

At the time of writing, markets are betting on a 70% chance that the ECB could cut its rates as soon as March 2024.

Stocks tend to rejoice at the thought of lower interest rates, which makes it cheaper to borrow money to fuel the company’s growth, while shoring up economic growth.

- Cheaper valuations

The DAX’s price-to-earnings (PE) ratio still stands at a mere 12.49, despite the recent record high for Germany’s benchmark stock index.

That 12.49 number is lower compared to the S&P 500’s PE ratio of 21.97 and the Nasdaq 100’s PE ratio of 30.33.

The lower the PE ratio, the “cheaper” the asset.

And that has made German stocks more appealing for investors who realize they can access a greater share of the earnings for every euro invested into stocks that make up the DAX index.

As for the 2024 outlook, it could be a choppy year for the European stock indices amid forecasts for a recession.

Still, if the Ger40_m can battle past such fears, new record highs may well be ahead.

Analysts are predicting up that Germany's benchmark stock index could be as much as 13% higher by this time next year!

So there you have it!

So many assets found fresh all-time peaks in 2023, rewarding investors and traders that anticipated higher prices along the way.

Could there be new record highs for other assets in the new year?

Find out via our 2024 outlook, which is set to be published in the first week of the new year!