- Gold in a correction wave of W1 uptrend

- Possible bullish momentum building on D1/H4 timeframe

- 4 potential bullish targets if 2042.09 breached

- Bullish scenario invalidated below 2020.31

- Incoming US CPI report could trigger volatility

Gold prices were steady on Thursday ahead of a key US inflation report that may influence market expectations around when the Federal Reserve will cut interest rates this year.

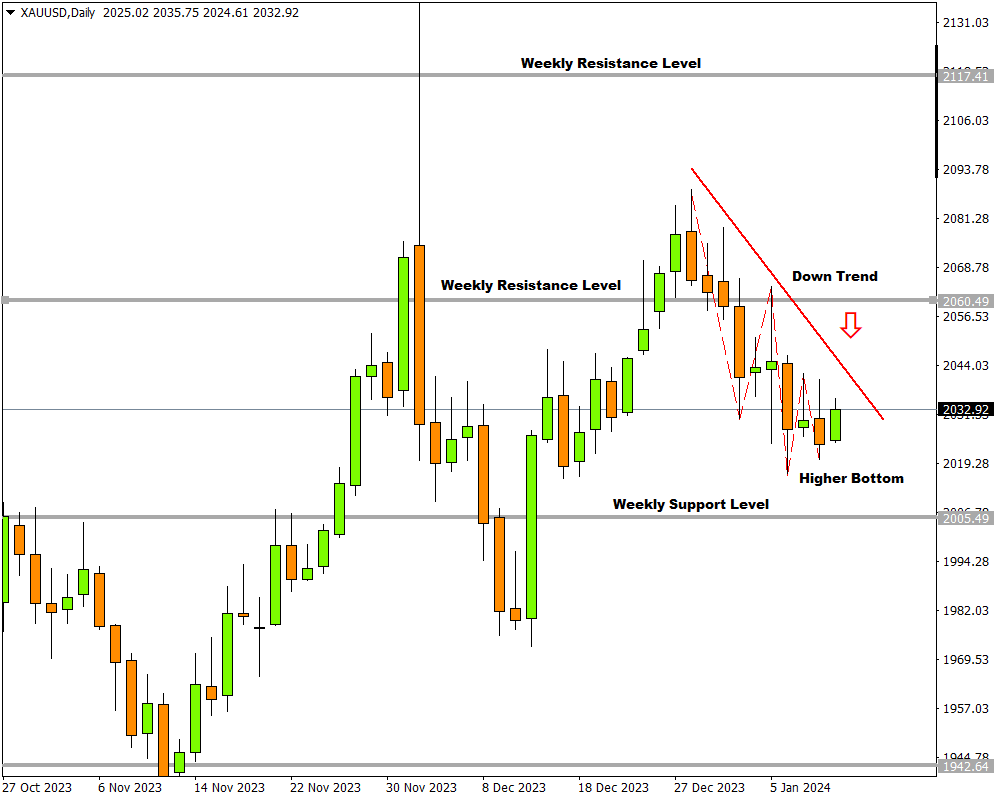

The precious metal is busy with a correction wave in an uptrend on the weekly timeframe which could act as a possible area of trendline support. Looking at the daily charts, a downtrend is advancing but the price is getting closer to a weekly support level and a higher bottom might already be in progress.

A significant move could be around the corner with the incoming US CPI report acting as a fundamental catalyst. More evidence of cooling price pressures may boost bets around the Fed cutting interest rates, supporting gold prices as a result. However, a hot reading could dampen hopes around the Fed taking action early this year – potentially dealing a blow to zero-yielding gold.

Redirecting our attention back to the technical…

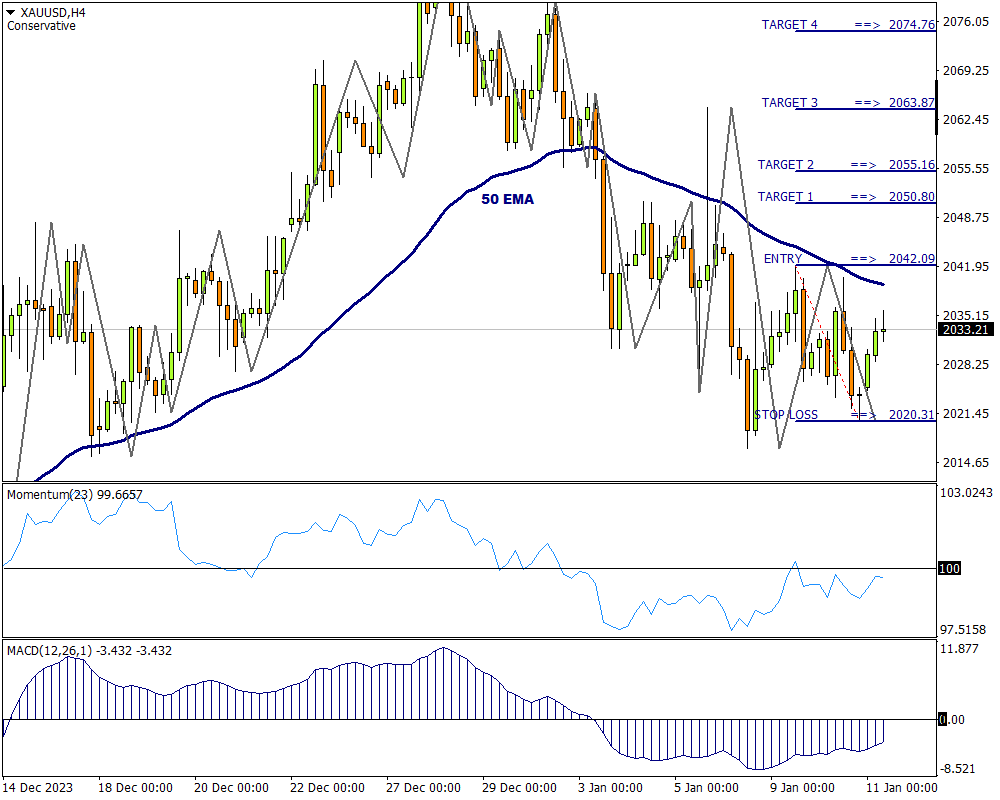

A look at the 4-hour time frame will yield more insight.

The 4-hour chart is still in negative territory with the price dipped below the 50 Exponential Moving Average. The market structure has given a warning though by making a higher bottom and traders will be watching closely to see how the market reacts to the upcoming CPI news event. If buying pressure increases and the price goes above 2042.09, a long opportunity will be on the books.

Attaching a modified Fibonacci tool to the trigger level at 2042.09 and dragging it to the higher bottom at 2020.31, four possible targets can be determined:

-

The first target is at 2050.80 (Target 1).

-

The second price target is likely to be 2055.16 (Target 2).

-

The third price target is possible at 2063.87 (Target 3.

-

The fourth and last price target is viable at 2074.76 (Target 4) if the buy pressure can continue for long enough.

If the price at 2020.31 is broken, this scenario is no longer valid.