- GBP & USD in fierce tug of war

- UK data dump could rock Sterling

- Watch out for potential dollar volatility

- GBPUSD rising wedge pattern in play

- Key levels of interest at 1.2800 and 1.2600

Over the last few weeks, it has been a fierce tug-of-war between the British Pound and the US dollar.

Indeed, GBPUSD remains trapped within a range – waiting for a fresh fundamental spark to shift the scales of power in one direction.

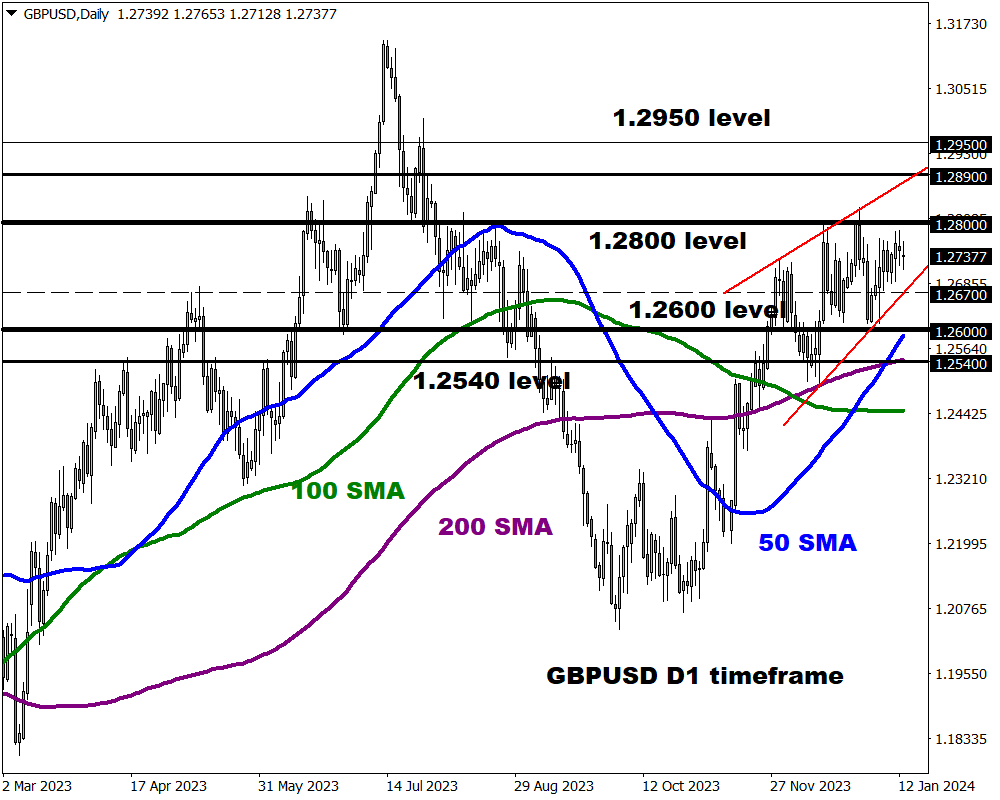

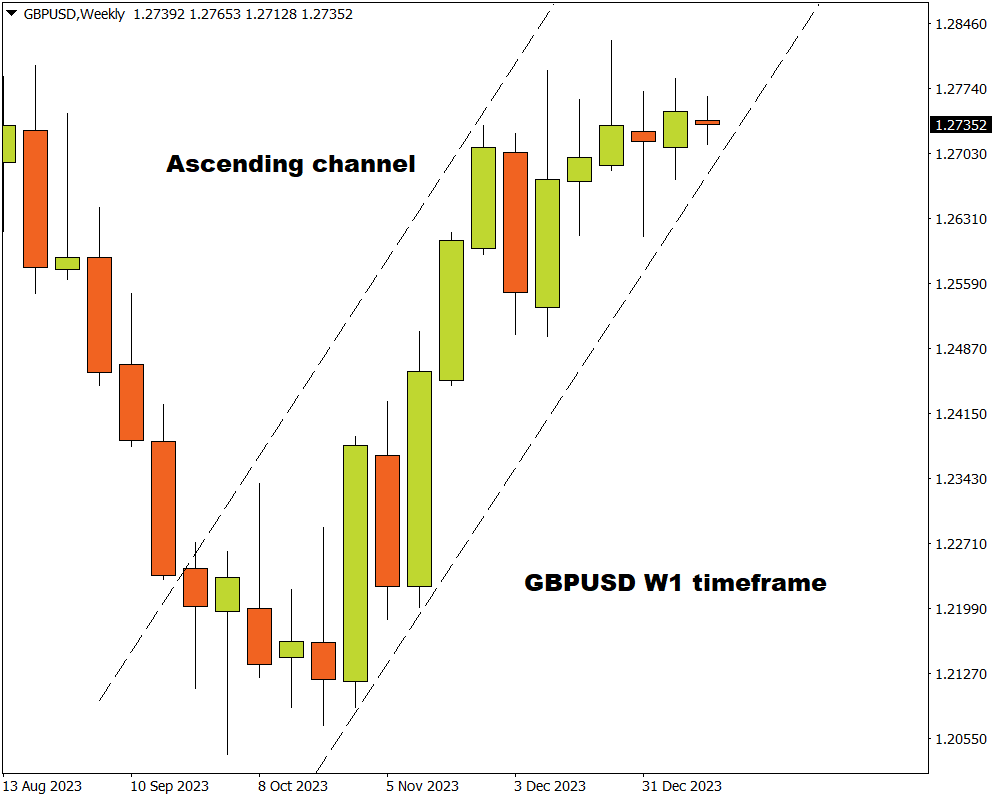

Despite this period of consolidation, GBPUSD bulls linger in the vicinity as prices respect an ascending channel on the weekly charts.

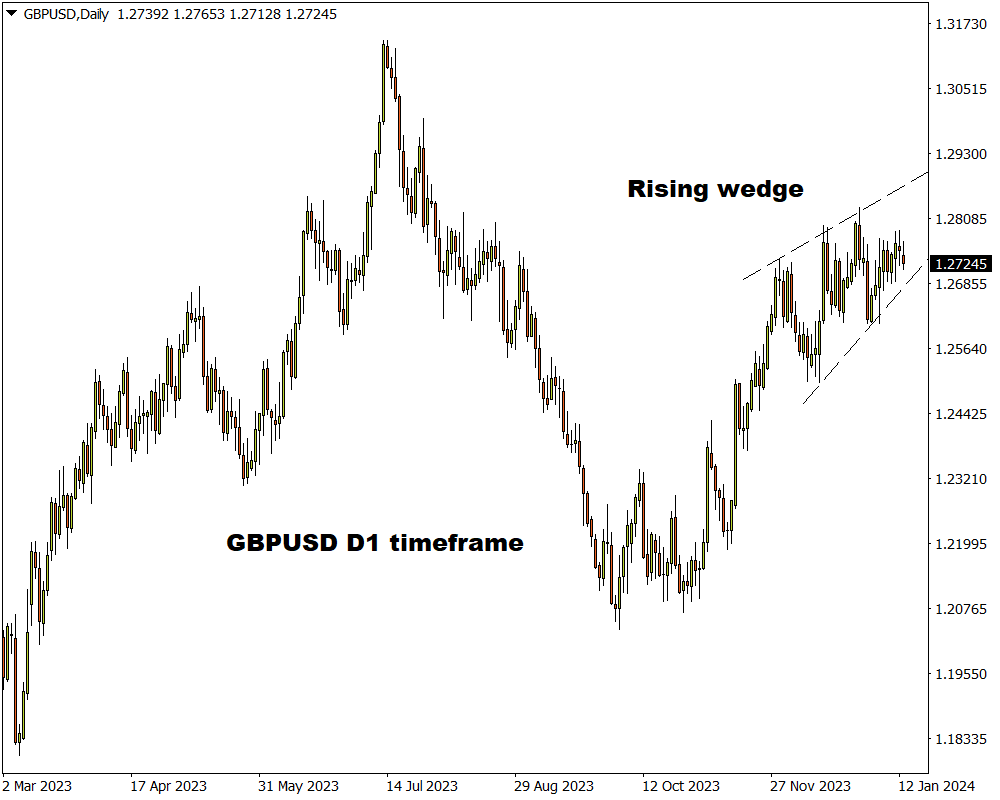

However, the daily timeframe paints a different picture with a rising wedge chart pattern in play.

Note: A rising wedge is a technical chart pattern that signals a possible bearish reversal.

A big move may be brewing for the GBPUSD and here are 3 reasons why:

-

UK data dump

The mid-month data dump featuring employment, inflation, and retail sales figures could provide fresh insight into the outlook for Bank of England (BoE) rates in 2024.

- On Tuesday, all eyes will be on the UK jobs report which is expected to show the unemployment rate increasing to 3.4% in November – its first uptick in five months.

- Wednesday sees the CPI data for December with markets forecasting the rate to be 3.8% year-on-year, down from 3.9% in November. The core, which excludes volatile food and energy prices, is also projected to slow to 4.9% from 5.1% in the previous month.

- This will be topped off with the UK December retail sales report on Friday which is projected to have contracted by 0.5% month-on-month in December, from 1.3% in November.

As of writing, traders see a 33% probability of a 25-basis point BoE rate cut by March 2024, with a move fully priced in for May.

- Sterling could receive a boost if overall data is stronger than expected and hot inflation figures push back UK rate cut bets.

- Should overall data disappoint, and inflation drop again in December, this may send the pound lower rate cut hopes jump.

-

Dollar volatility

Dollar volatility could be the name of the game this week thanks to top-tier US economic data.

Much focus will be on US retail sales data and consumer sentiment among other key reports. This will be complemented by speeches from various Fed officials which could influence speculation around Fed cuts in 2024.

It is worth noting that traders see a 75% probability of a 25 basis point Fed cut by March 2024.

- The dollar is likely to appreciate if strong US economic data and hawkish comments by Fed officials support the dollar. Such a development may drag the GBPUSD lower.

- Should the dollar end up weakening on soft data and cautious Fed officials, this has the potential to push the GBPUSD higher.

-

Technical forces

After coiling upwards within a 200-pip range since mid-December, the GBPUSD could be preparation for a major breakout.

Although prices are still trading above the 50, 100, and 200-day SMA while the MACD trades above zero - it will be wise to keep a close eye on the rising wedge technical chart pattern.

- A solid breakout and daily close above 1.2800 may encourage an incline towards 1.2890 and 1.2950 – levels not seen since late July 2023.

- Should prices slip below 1.2670, this may inspire a selloff towards 1.2600 – where the 50-day SMA resides. Below this point, the next significant level can be found at 1.2540 – at the 200-day SMA.