- High-risk events could move GBPUSD

- Fed/BoE combo + NFP in focus

- GBPUSD bound within symmetrical triangle

- Key levels of interest at 1.2800 & 1.2600

- Who will win tug of war?

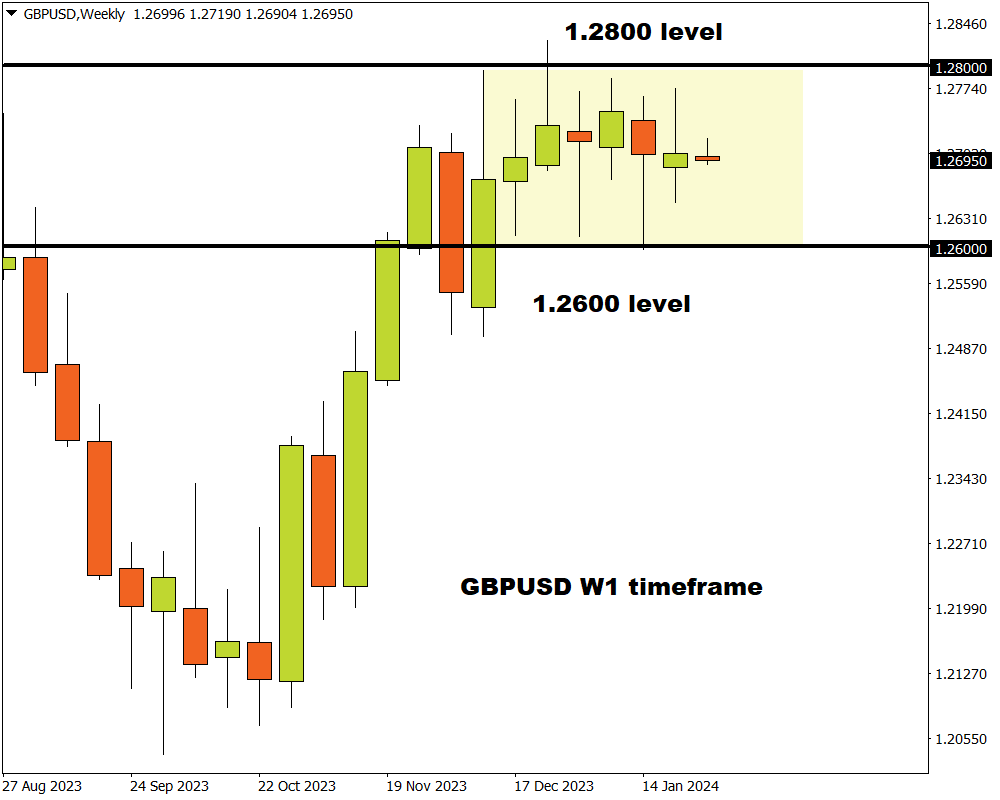

After swinging within a 200-pip range since mid-December, the GBPUSD could be on the verge of a big move.

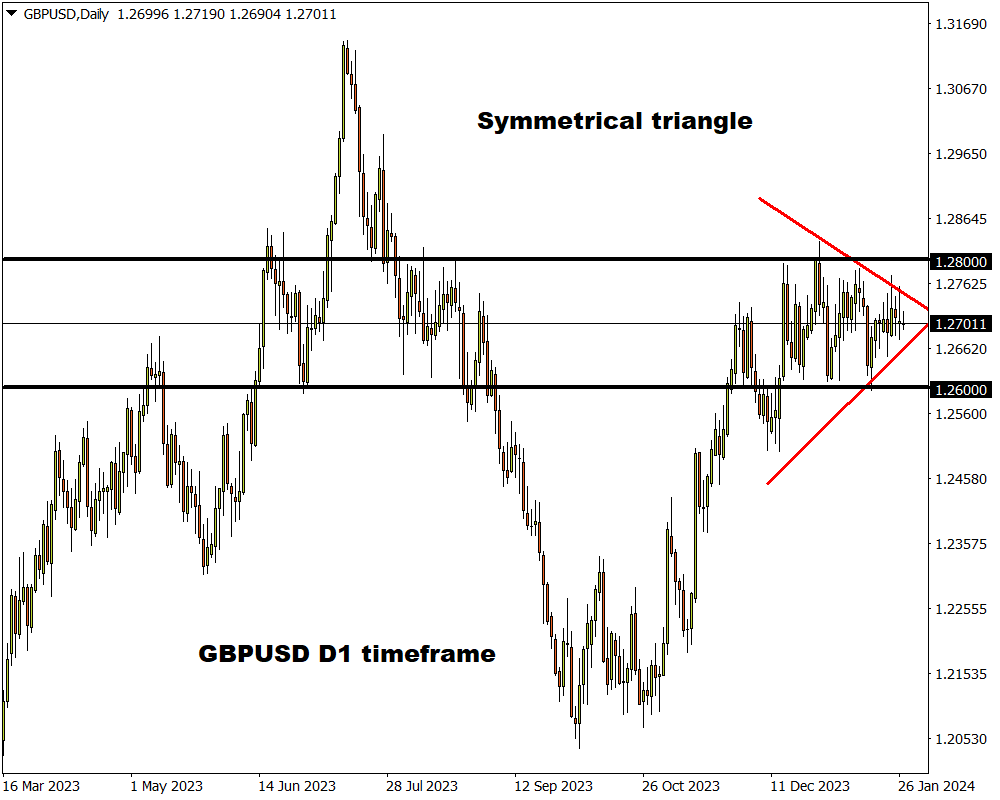

This may be triggered by a selection of high-risk events featuring central bank decisions and key economic data. In addition, the symmetrical triangle pattern on the daily charts has the potential to intensify the direction of any breakout/down opportunity.

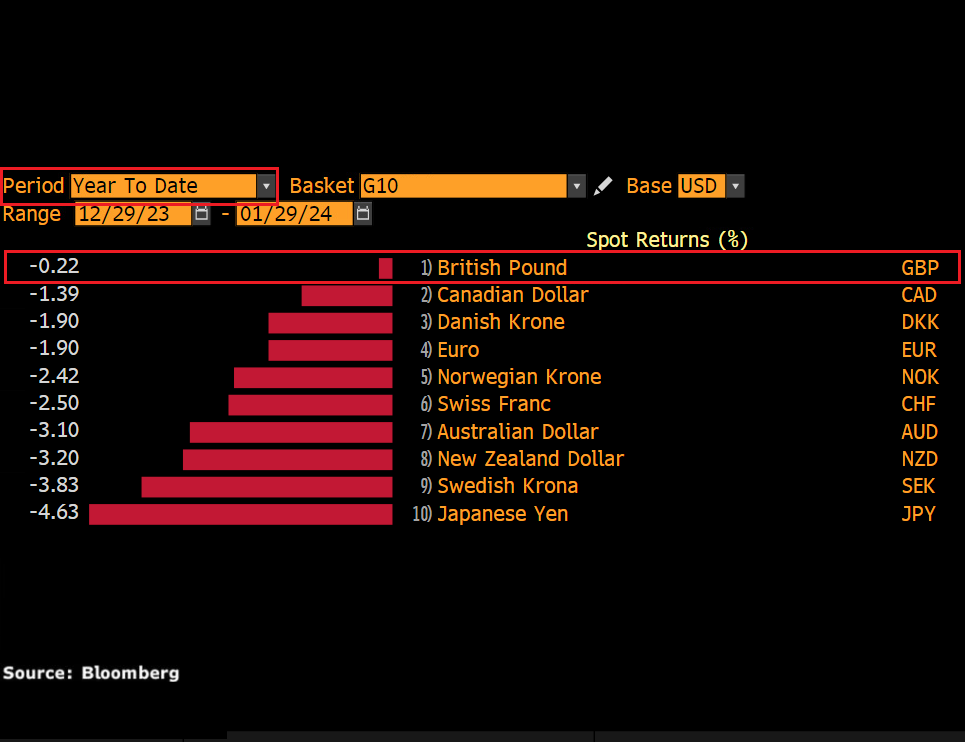

In the G10 space, Sterling has held its ground against the dollar year-to-date thanks to the BoE’s relatively hawkish tone amid stubborn inflation.

Nevertheless, the GBP and USD remain trapped in a fierce tug of war with a fresh catalyst needed to shift the scales of power in one direction.

Here are 3 factors that could trigger a breakout in the GBPUSD:

-

BoE rate decision

On Thursday 1st February, the Bank of England (BoE) will meet for the first time this year to decide on interest rates. This will be accompanied by the minutes of the meeting, the quarterly Monetary Policy Report (MPR), and MPC press conference.

Markets widely expect the BoE to leave interest rates unchanged at 5.25% for a fourth straight meeting. Although there has been evidence of disinflation, hawks remain in the building with the central bank not expected to kick off its easing cycle until Summer.

Traders are currently pricing in a 60% probability of a 25-basis point cut by May 2024, with a cut by June 2024 fully priced in.

- If the BoE sounds hawkish and pushes back on rate-cut bets, this could boost GBPUSD.

- A dovish-sounding BoE that hints at potential cuts down the road could weaken GBPUSD.

-

Fed rate decision + NFP

Over the United States, the Federal Reserve meeting and US jobs data could rock the dollar.

The Fed is expected to leave interest rates unchanged this week but the odd of a March rate cut has now moved to roughly 50% according to Fed Fund futures. Regarding the NFP report, the US economy is expected to have created 180,000 jobs in December compared to 216,000 in the previous month. Ultimately, this combo of heavy-hitting events could translate to increased volatility for the USD – influencing the GBPUSD as a result.

- Should the Fed meeting and jobs data support the dollar, this may pull the GBPUSD lower.

- A dovish-sounding Fed and soft data is dollar bearish, providing support for GBPUSD.

-

Technical forces

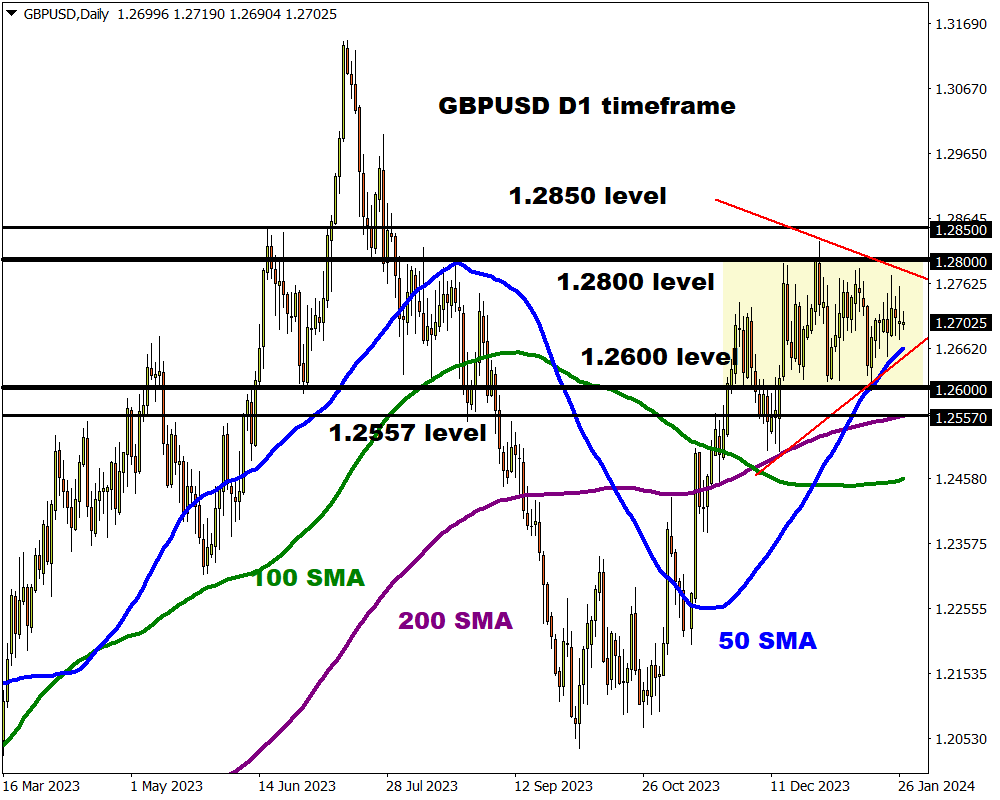

The GBPUSD has entered standby mode with prices bound within a symmetrical triangle pattern.

Bulls and bears remain entangled in a fierce battle despite prices trading above the 50, 100, and 200-day SMA. Major resistance can be found at 1.2800 and support at 1.2600.

- A decisive breakout above 1.2760 may open the doors towards 1.2800 and levels not seen since July 2023 at 1.2850.

- Should prices drop below the 50-day SMA at 1.2666, bears may be inspired to attack 1.2600 and the 200-day SMA at 1.2557.