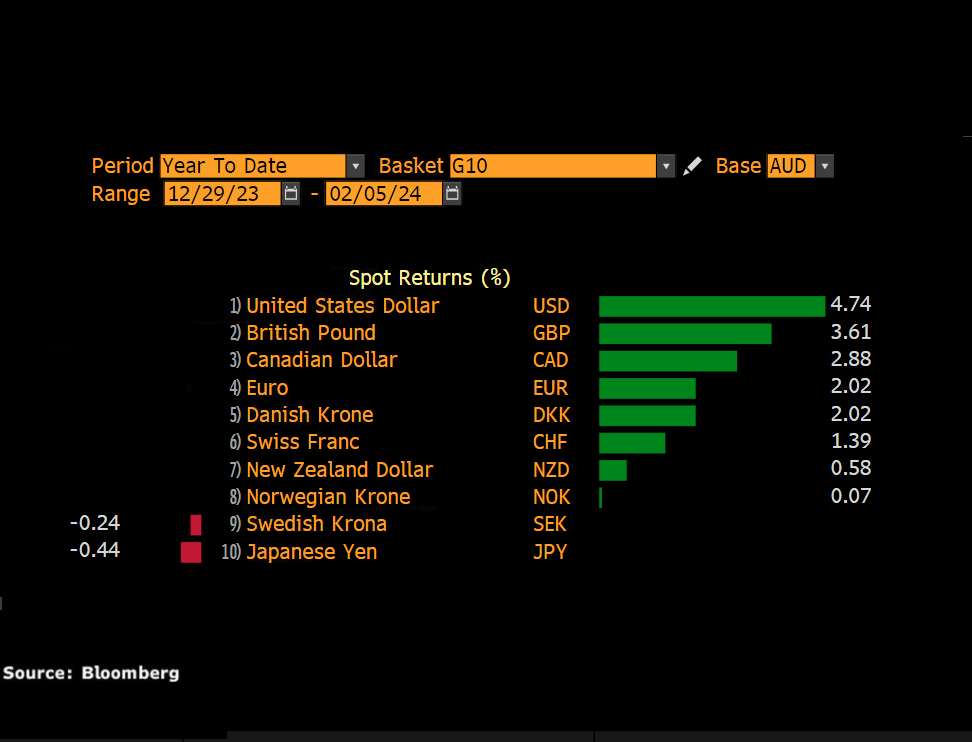

- AUD down against most G10 YTD

- RBA decision + US data in focus

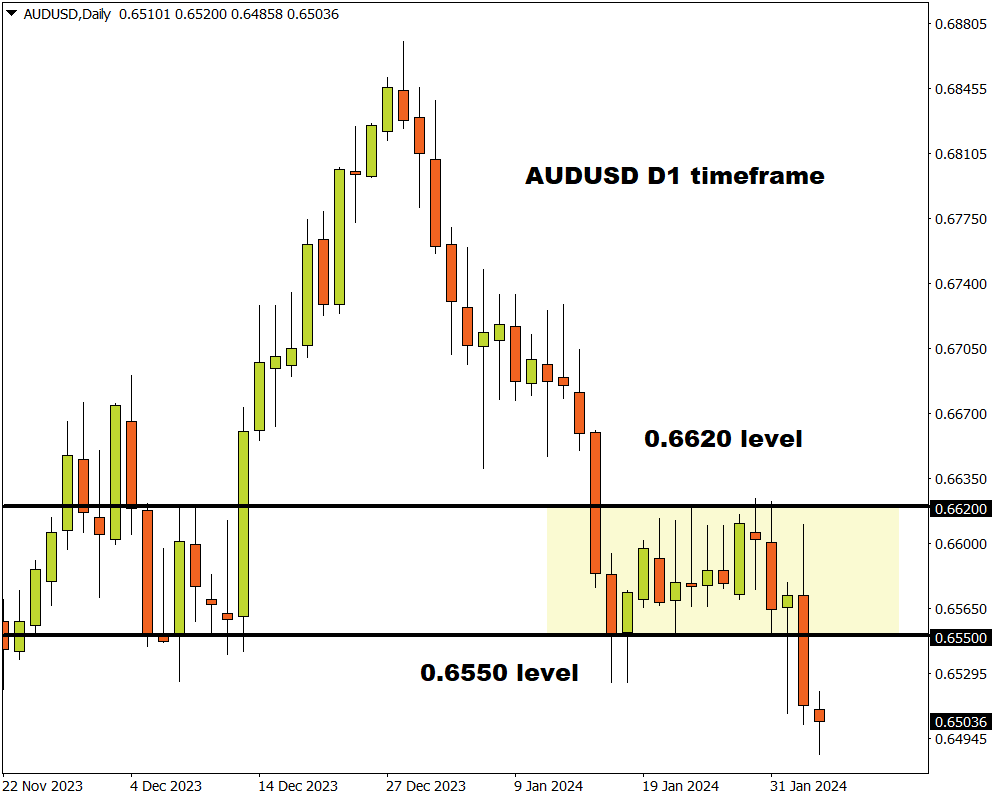

- AUDUSD bearish on D1 chart

- Strong USD could spell more pain

- Key level of interest at 0.6550

The past few weeks have certainly been rough and rocky for the Australian dollar!

It has weakened against almost every single G10 currency so far in 2024, shedding over 4.5% versus the dollar.

After closing almost 1% lower last Friday following the blow-out NFP report (that saw 353k US jobs added in January), the AUDUSD has entered the new week on a shaky note. It is worth noting that the commodity currency was already pressured by growth concerns and signs of falling inflation in Australia.

With the dollar set to appreciate as investors claw back bets for aggressive Fed rate cuts, this could mean more pain for Aussie.

Here are 3 reasons why the AUDUSD is on our radar:

-

RBA decision

The Reserve Bank of Australia is expected to leave interest rates unchanged at its February 6th policy meeting, keeping the cash rate at 4.35%.

Signs of rapidly cooling inflationary pressures in the final quarter of 2023 have reinforced bets around the central bank’s next move being a rate cut. This development coupled with the shaky economic outlook could lend RBA doves further support.

Traders are currently pricing in a 67% probability of a rate cut by the RBA in June with a cut fully priced in by August 2024.

- The Aussie is likely to weaken if the RBA strikes a dovish tone and signals that it’s next move will be a cut this year.

- Should the RBA sound more hawkish and express intentions to keep rates higher for longer, this could push the Aussie higher.

-

Dollar volatility

Dollar volatility could be a key theme this week as investors not only digest last Friday’s strong US jobs data but prepare for more key data and speeches by Fed officials.

The biggest event risk may be the US CPI revisions published on Friday. As highlighted in our week ahead report, this could heavily influence expectations around Fed rate cuts if there are any major revisions.

As of writing, traders are pricing in a 77% probability of a Fed rate cut by May with a cut fully priced in by June 2024.

These odds could look different by the end of the week depending on incoming data and Fed speeches.

- Should overall data and Fed speeches boost the dollar, this may drag the AUDUSD lower.

- If the dollar ends up weakening, the AUDUSD could experience a technical bounce.

-

Technical forces

Aussie bears are back in power after securing a daily close below the 0.6550 support. Prices are trading below the 50, 100 and 200-day SMA while the MACD trades below zero.

- Sustained weakness below the 100-day SMA may encourage a decline towards 0.6430 and 0.6410, respectively.

- Should prices push back above 0.6550, this could open a path towards the 200-day SMA at 0.6570.