- Gold bears pocket 120 pips

- Crude hits second profit target

- USDJPY bulls secure 65 pips

A peek at potential profits that you could have missed from our Daily Market Analysis.

1) Gold bears deliver

Last Friday, we discussed how gold could be injected with fresh volatility due to key risk events.

Only for the precious metal to collapse like a house of cards following the blow-out US jobs report!

Profit target hit: YES, gold hit the $2020 support level.

Why: Strong NFP report boosted USD and forced investors to claw back bets for aggressive Fed cut.

Technicals: Prices hovering around 50 SMA and strong resistance at $2060.

Note: More volatility could be on the cards due to US CPI revisions on Friday.

2) Crude hits 2nd profit target

Crude prices seem to be trending higher on the H4 timeframe after bouncing from weekly support.

Profit target hit: YES, 2 out of 4 profit targets have been hit so far…

Why: Geopolitical tensions in the Middle East raising supply side risks.

Technical forces: Stochastics Oscillator confirms the bullish momentum.

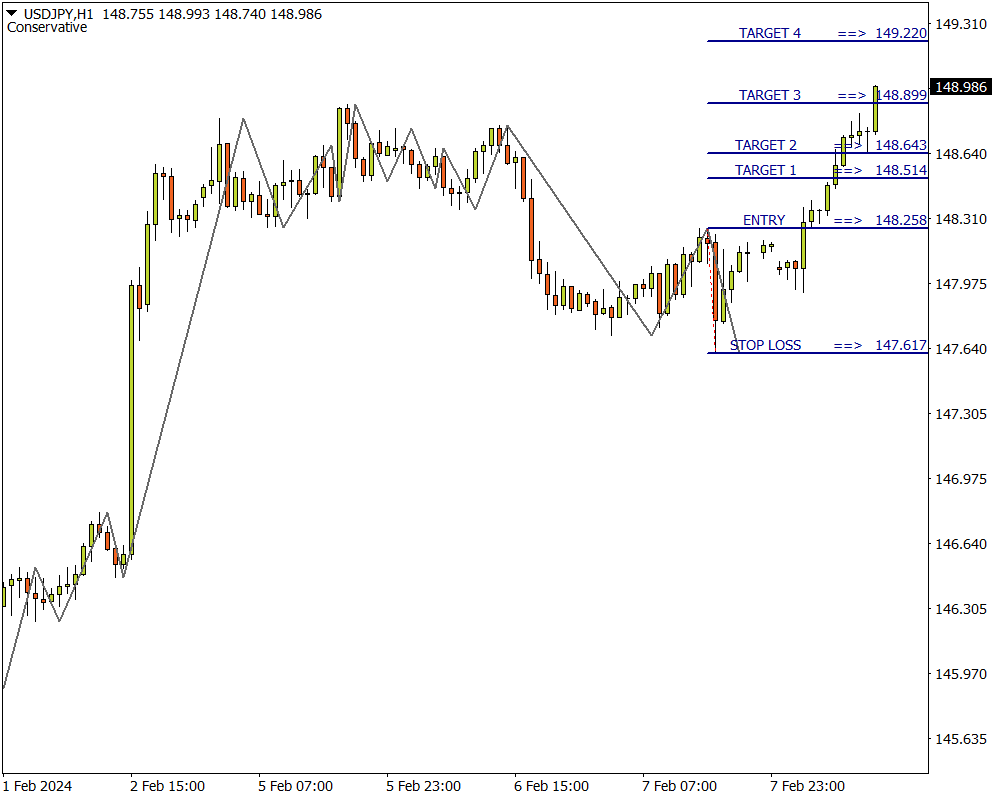

3) USDJPY hits 3rd profit target

The USDJPY is bullish on the H1 timeframe as prices charge through the 3rd target level.

Profit target hit: YES, 3 out of 4 profit targets have been hit so far…

Why: A stronger dollar seems to be leading the way

Technical forces: Prices trading above 50 LWMA while MACD trades above zero.

The above scenario (USDJPY) is based on the FXTM Signals that are posted twice a day (before the London and New York sessions) for all FXTM clients to follow.