- Data heavy week for GBPUSD

- UK data dump set to influence Pound

- Dollar volatility also on the cards

- Significant move on horizon

- Key levels of interest at 50 SMA and 200 SMA

This could be a wild week for the GBPUSD due to key economic reports from both the UK and the US.

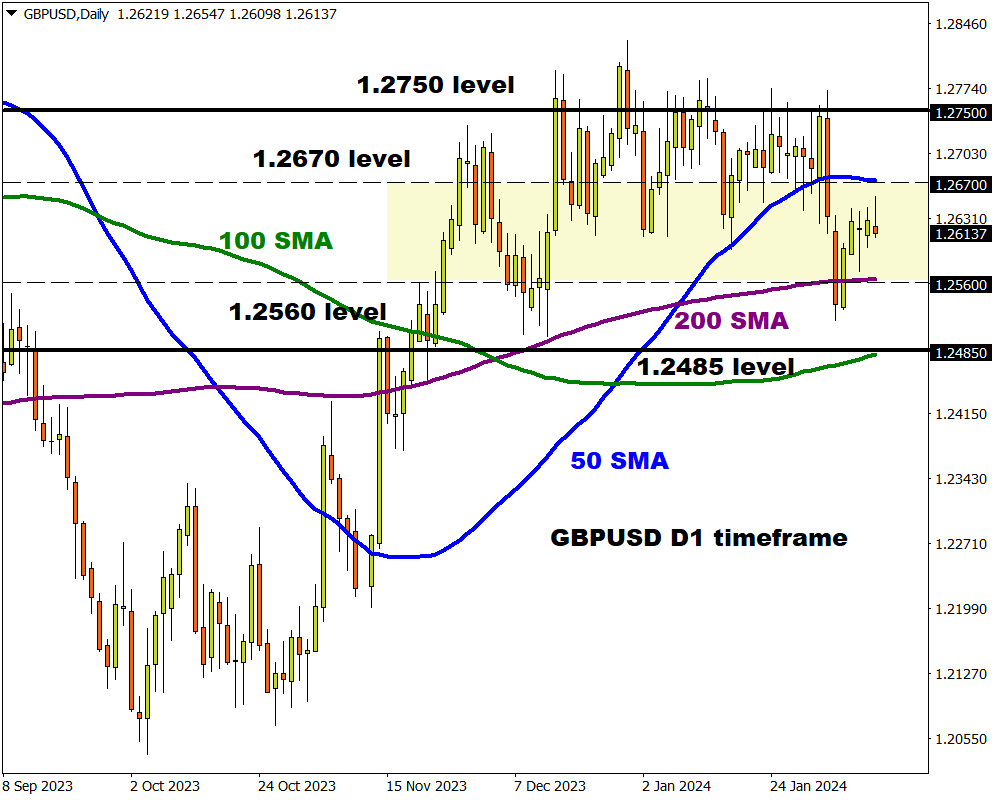

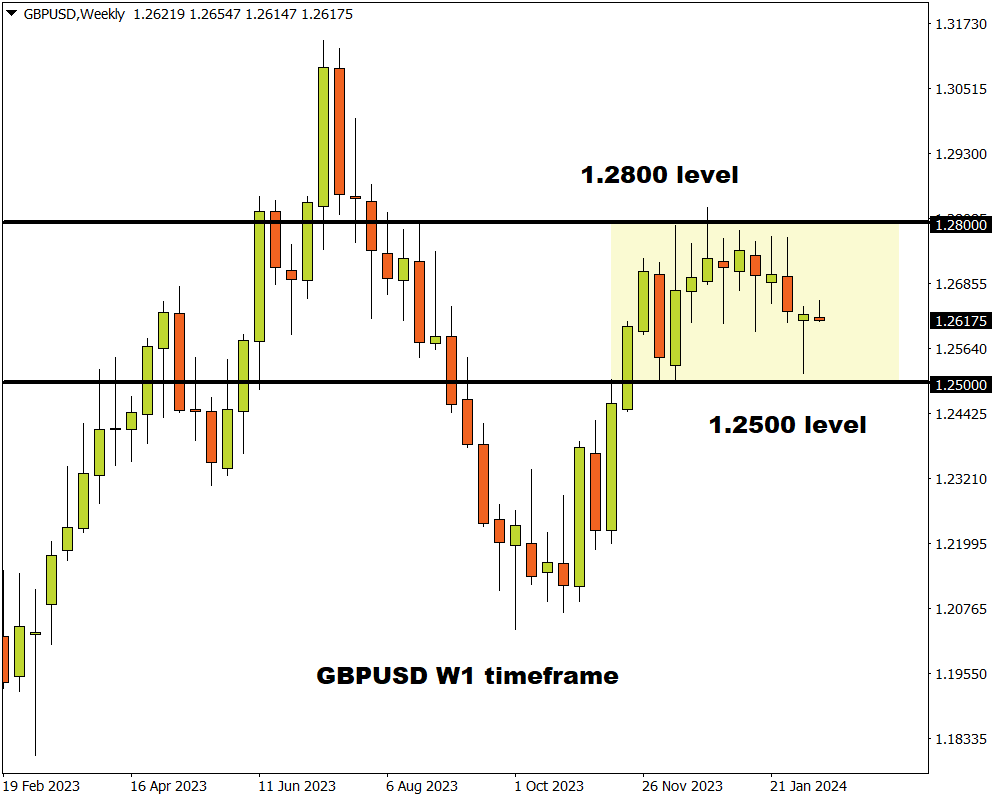

Although prices have edged higher over the past few days, a massive range can be observed on the weekly charts.

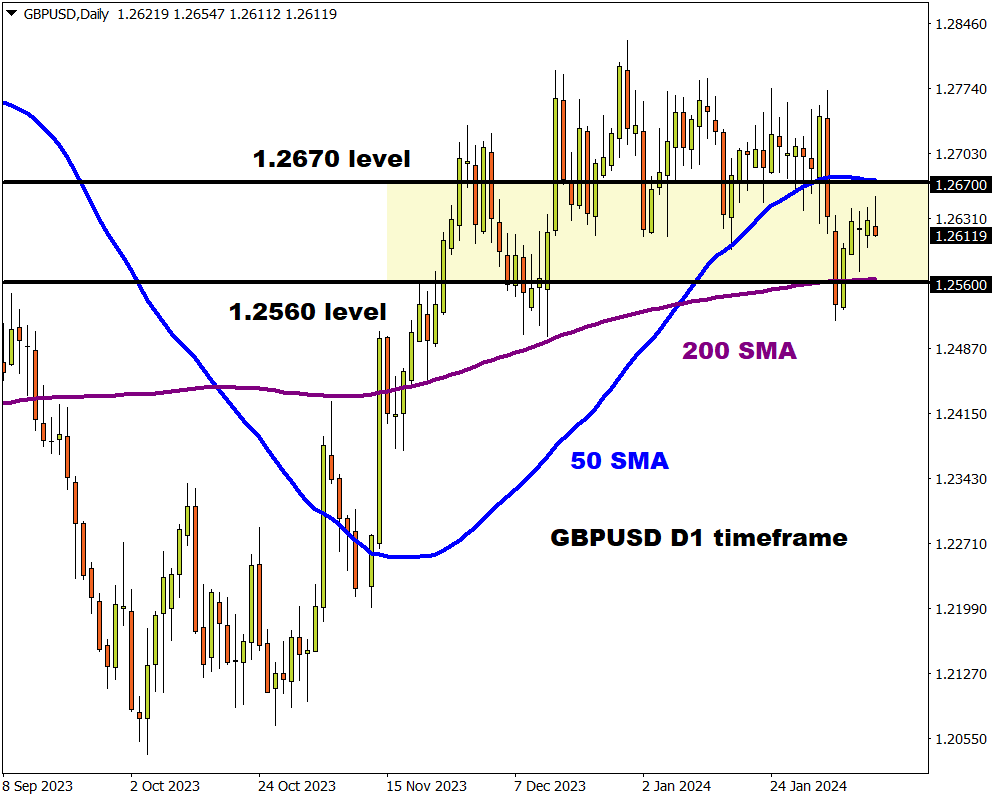

There is a similar theme on the daily charts with resistance at the 50 SMA and support at the 200-day SMA.

After the aggressive US NFP-induced selloff witnessed earlier this month, the GBPUSD could resume its decline with the right fundamental forces.

Here are 3 factors to keep a close eye on:

-

UK data dump

The mid-month data dump featuring employment, inflation, and GDP among other key releases could offer fresh insight into the health of the UK economy.

- Tuesday, February 13: UK January unemployment report

The unemployment rate is expected to rise to 4.0% in Q4 from Q3.

- Wednesday, February 14: UK January CPI report

The latest inflation report could rock Sterling, especially if it could offer more clues on the outlook for Bank of England (BoE) rates in 2024. Inflation is forecast to rise 4.1% year on year, up from 4% in December while the core is also forecast to hit 5.2%, up from 5.1%.

- Thursday, February 15: UK industrial production & Q4 GDP

Another major release will be the fourth quarter GDP report which is expected to show a second consecutive drop of 0.1% - confirming that the UK slipped into a technical recession at the end of 2023.

- Friday, February 16: UK January retail sales

UK retail sales are forecast to fall -1.8% year-on-year in January compared to -2.4% in the previous month.

Potential GBP scenarios:

- Sterling could appreciate if UK data including CPI exceed market forecasts – forcing investors to push back BoE cut bets.

- Should overall data disappoint with UK inflation printing below forecasts, this may bolster BoE cut expectations – weakening the pound as a result.

-

Key US data

Dollar volatility could be a key theme due to a string of top-tier data and Fed speeches. It may be wise to keep a very close eye on the US CPI report and retail sales figures.

- Tuesday, February 13: US January CPI report

US inflation is forecast to cool to 2.9% from 3.4% on an annual basis. The core which strips out food and energy prices is forecast to cool 3.7% from 3.9% in the prior month.

- Thursday, February 15: US January Retail sales

US retail sales are forecast to slip -0.1% in January MoM compared to 0.6% in the prior month.

Potential USD scenarios:

- Dollar bulls could receive a boost if strong economic data and hot inflation figures prompt investors to claw back bets for aggressive Fed cuts.

- Dollar bears could jump back into the scene on weak US data and further signs of cooling price pressures.

-

Technical forces

The GBPUSD could be gearing up for a breakout on the daily charts with resistance at the 50-day SMA and support at the 200-day SMA.

- A solid breakdown below the 200-day SMA at 1.2560 could open a path towards 1.2485.

- Should prices push beyond the 50-day SMA at 1.2670, bulls may target the next resistance around 1.2750.