- Silver ↑ 33% year-to-date

- One of the best-performing major commodities

- Relatively “cheap” compared to gold

- Bullish on D1 but RSI overbought

Gold is not the only metal delivering glittering returns this year…

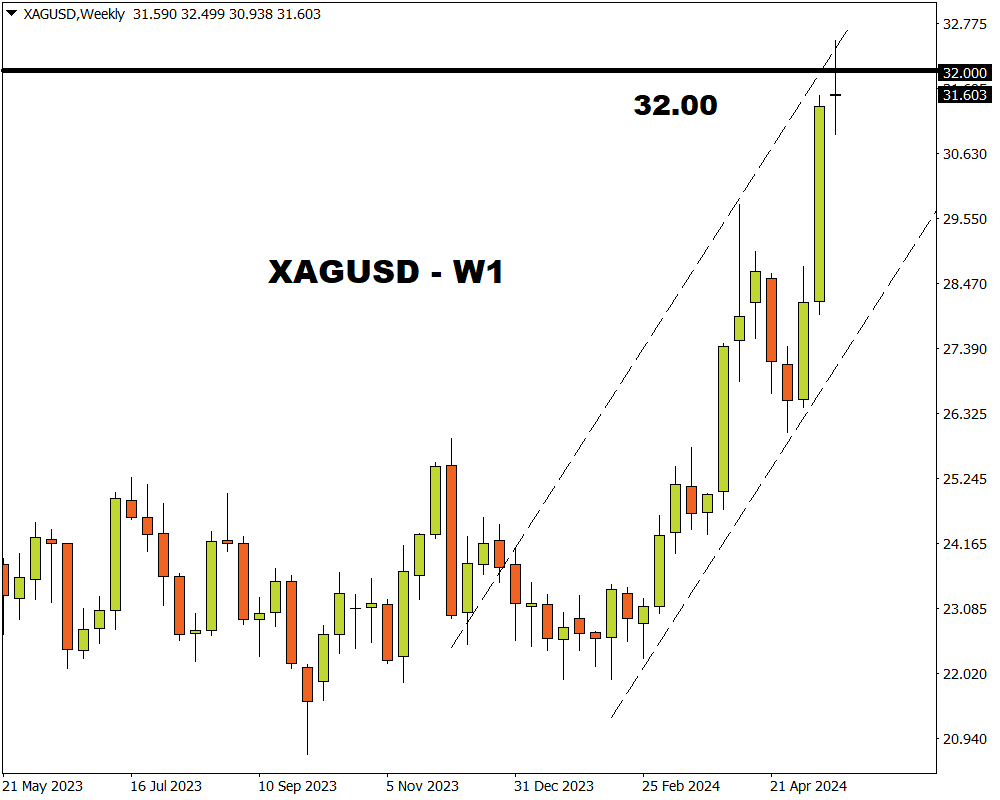

Silver has also been on a tear, soaring to its highest level in more than a decade.

The precious metal punched above $32 this week, and is currently up 33% since the start of 2024.

When compared with year-to-date gains of:

-

Tin: 35%

-

Copper: 31%

-

Nickel: 30%

-

Gold: 17%

-

Zinc: 17%

-

Platinum: 6%

Silver is the second-best performer in the metal space and one of the top gainers in the wider commodity arena.

Why is silver soaring?

Various forces have propelled the precious metal higher - ranging from growing investor interest to macroeconomic forces and supply-side factors, among other themes.

But gold’s bullish momentum has also provided silver ample support.

Gold hit fresh all-time highs this week due to geopolitical risks with central bank buying and prospects of lower US interest rates keeping bulls in power.

Silver often follows gold’s lead, with interest rate expectations impacting appetite for non-yielding assets like precious metals.

To put things into perspective, silver and gold have moved in tandem over 80% of the time in any given 10-day period over the past 20 years.

What other forces are in play?

Beyond the macroeconomic forces, silver is also influenced by industrial demand.

Given how it’s a key component for clean energy technologies, the usage of the metal is expected to reach records in 2024 amid robust growth in the industry.

Interestingly, copper which is also a crucial element in the creation of solar panels, wind turbines and hydro systems has also reached all-time highs.

It does not end here…

Silver markets are heading for their fourth consecutive year of shortages.

According to the Silver Institute, the precious metal is expected to experience its second-highest deficit on record in 2024. As demand continues to outpace supply of silver, the deficit is forecast to increase by 17% this year amid robust industrial consumption.

Can silver push higher?

When considering all the bullish fundamentals at play, further upside could be on the cards.

But most importantly, silver is still considered relatively cheap compared to gold.

Looking at the gold-silver ratio, it takes around 76 ounces of silver to buy 1 ounce of gold.

Given how the 20-year average is 68, silver has scope to extend gains if the ratio rebalances down the road.

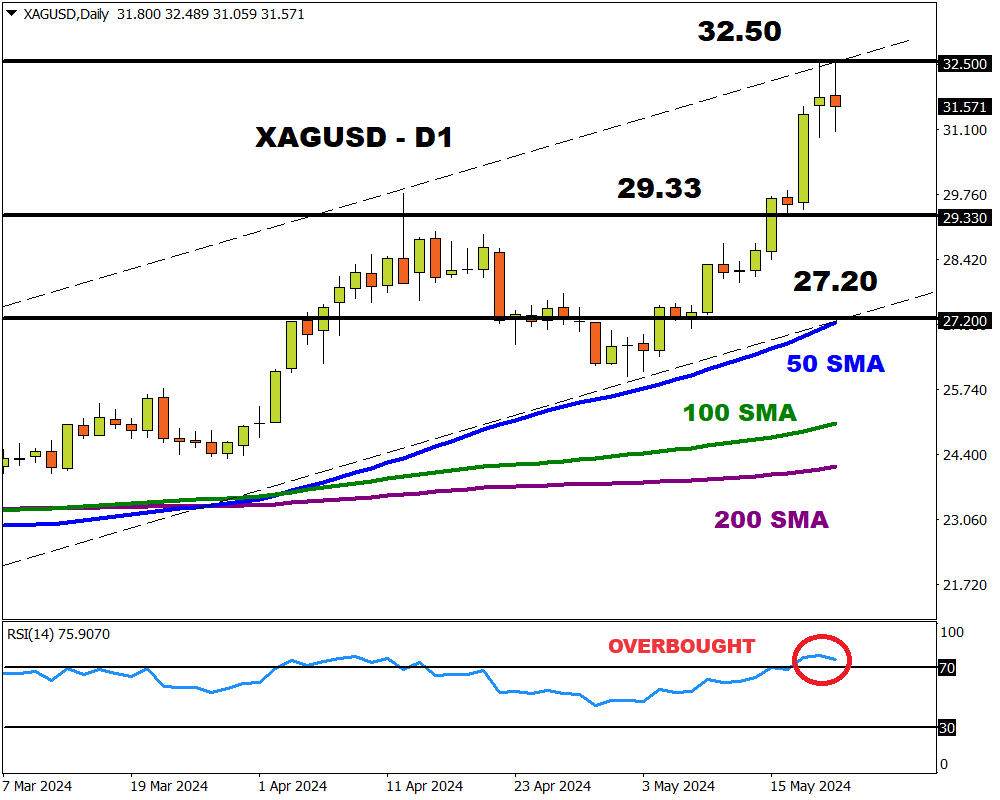

Technical outlook:

Silver is firmly bullish on the daily timeframe as there have been consistently higher highs and higher lows.

Prices are trading above the 50, 100 and 200-day SMA while the MACD above zero. However, the Relative Strength Index (RSI) is above 70 – indicating that prices are heavily overbought.

-

A solid breakout above $32.50 will open doors to fresh all-time highs with the next level of interest rate $33.00.

-

Sustained weakness below $32.50 may encourage a decline toward $29.33.

-

Should prices slip below $29.33 this could open the doors towards the 50-day SMA.