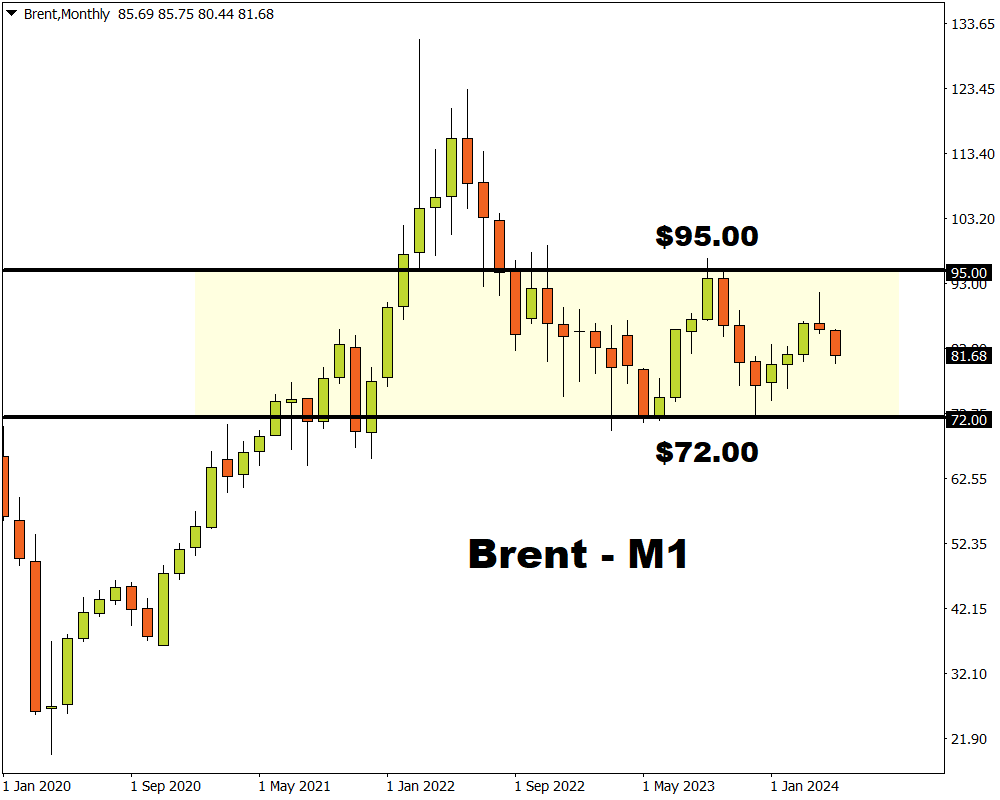

- Brent ↑ 6% year-to-date

- Headed for biggest monthly ↓ in 2024

- OPEC+ decision, EIA data & NFP in focus

- Over past year NFP triggered moves of 1% ↑ or ↓

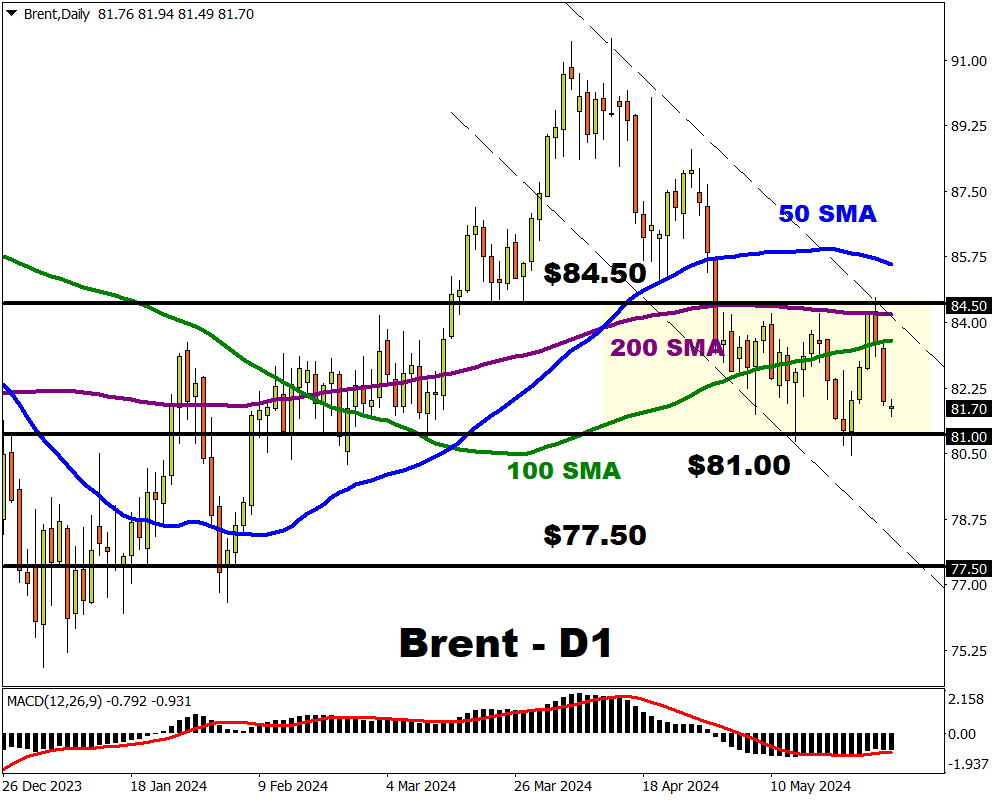

- Technical levels - $84.50 & $81.00

Key central bank decisions and top-tier economic data could rock markets in the week ahead:

Sunday, 2nd June

- OIL: OPEC+ virtual meeting

Monday, 3rd June

- CN50: China Caixin manufacturing PMI

- EU50: Eurozone/Germany manufacturing PMI

- JPY: Japan capital spending

- UK100: UK manufacturing PMI

- US500: ISM manufacturing

Tuesday, 4th June

- GER40: Germany unemployment

- ZAR: South Africa GDP

- RUS2000: US factory orders, JOLTS

Wednesday, 5th June

- CN50: China Caixin services PMI

- AU200: Australia GDP

- EU50: Eurozone services PMI, PPI

- CAD: Canada rate decision

- US30: US ISM services

- OIL: EIA weekly report

Thursday, 6th June

- AU200: Australia trade balance

- EUR: ECB rate decision, retail sales

- GER40: Germany factory orders

- TWN: Taiwan CPI

Friday, 7th June

- CNH: China trade, forex reserves

- CAD: Canada unemployment

- EU50: Eurozone GDP (final), Germany industrial production

- TWN: Taiwan trade

- USDInd: US May nonfarm payrolls (NFP)

The spotlight shines on oil benchmarks thanks to the OPEC+ decision over the weekend.

Brent has shed almost 5% this month but is still up roughly 6% since the start of 2024.

In the first quarter of 2024, oil prices were initially supported by geopolitical risks and hopes around OPEC+ supply cuts tightening global markets. But gains have been capped in Q2 amid uncertainty over China’s demand and rising US crude inventories.

Still, oil benchmarks could kick off the first week of June with a bang! Here are 4 reasons why:

1) OPEC+ virtual meeting.

Over the weekend, OPEC+ is expected to extend current production cuts - possibly to the end of this year.

Considering that the cartel accounts for roughly 40% of total global oil supply, any decisions are likely to impact oil prices.

Note: Back in November 2023, OPEC+ agreed to voluntarily cut production by 2.2 million barrels per day through the first quarter of 2024. In March, these were extended through the end of June 2024.

- Oil prices could respond positively if the cartel extends production cuts.

- Any surprises in the form of deeper cuts may trigger a stronger bullish reaction.

- If OPEC+ fails to extend production cuts, this could send oil prices lower.

2) US Energy Information Agency (EIA) report

With the spotlight on oil markets, attention will be directed toward the next EIA report published on Wednesday 5th June.

Interestingly, crude oil inventories decreased by 4.2 million barrels in the week ended May 24. However, US oil stockpiles have been climbing since the final quarter of 2023.

- A decline in US crude inventories could spark optimism around demand, pushing the global commodity higher as a result.

- Oil prices may slip if a build in US crude inventories hits the demand outlook.

Fun fact: Over the past year, the US EIA report has triggered upside moves of as much as 0.9% or declines of 1.3% in the 6 hours post-release.

3) US May nonfarm payrolls (NFP)

The US economy is expected to have created 180k jobs in May, while the unemployment rate to remain steady at 3.9%.

Considering how the NFP directly impacts interest rate expectations, it could influence oil prices.

Note: Lower interest rates could stimulate economic growth, translating to increased demand for oil. This may also weaken the dollar – supporting oil which is priced in dollars.

- A solid jobs report that supports the case for “higher for longer rates” could send oil lower.

- Oil could jump if a disappointing report weakens the dollar and fuels rate cut bets.

Fun fact: Over the past 12 months, the US jobs report has sparked upside moves of as much as 1% or declines of 1% in the 6 hours post-release.

4) Technical forces

Brent is trapped within a range on the daily charts with support at $81.00 and resistance at $84.50. However, prices are trading below the 50, 100 and 200-day SMA while the MACD trades below zero.

- A solid breakdown below $81.00 may open a path toward $80.00 and $77.50.

- Should prices push back the 100-day SMA, this could open a path toward $84.50. and the 50-day SMA.

Note: Oil prices may be influenced by the incoming US PCE data later today.