- Sugar ↑ almost 3% month-to-date

- Roughly 25% away from 2024 high

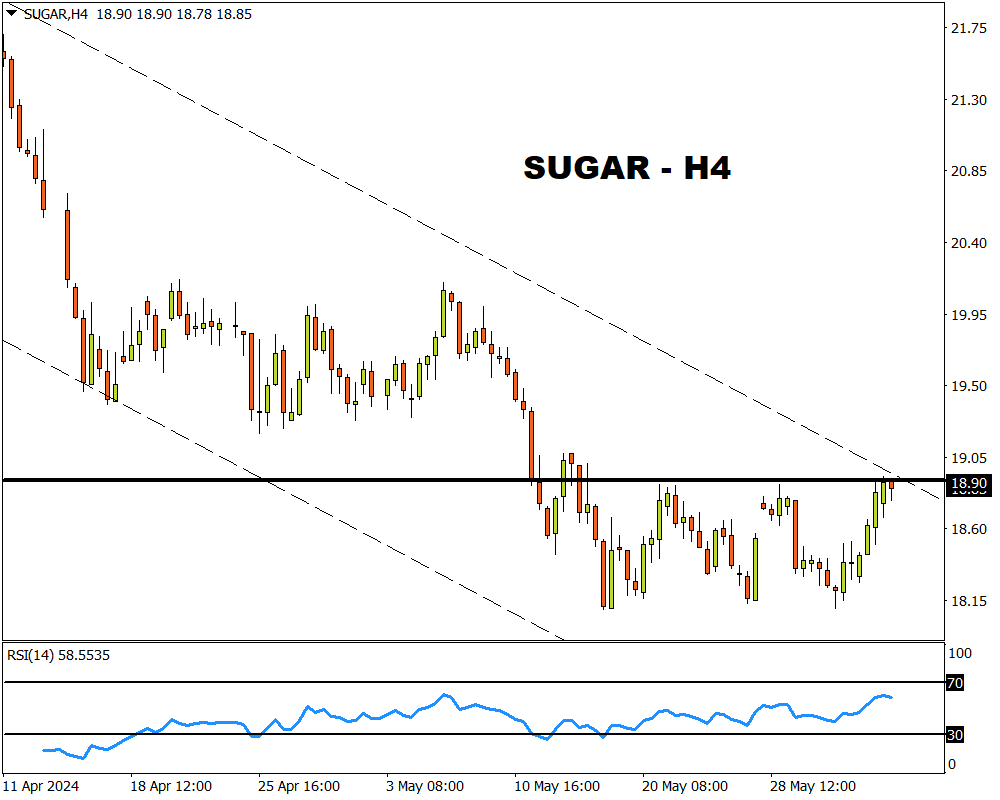

- H1 prices bullish but RSI overbought

- Technical levels – 19.08, 18.90 and 18.50

Check this out, FXTM’s new Sugar commodity has just touched a fresh three-week high!

After wobbling near multi-week lows, prices clipped above 18.90 cents per pound on Tuesday.

Note: Sugar is priced per pound.

Before we break down the fundamentals, here are some fun facts about sugar:

- Been around for over 10,000 years

- Introduced in the West as a “spice”

- Brazil is the biggest producer

- We are all wired to crave sugar!

- Gained almost 3% month-to-date

What is Sugar?

It is a sweet substance obtained from plants such as sugarcane or sugar beets.

Sugar is a very versatile ingredient, used for drinks, cereals, sweets, cakes, jams, and so on.

What does FXTM’s Sugar track?

FXTM’s Sugar tracks the Sugar No. 11 futures, the world benchmark for raw sugar trading.

The lowdown?

Sugar prices are down almost 10% year-to-date.

The soft commodity initially gained 17% in January amid concerns that El Nino weather patterns could disrupt global sugar production. Fears over severe weather conditions in the world’s two largest producers (Brazil & India) sent prices above 24.00 cents per pound.

Since then, sugar has been under pressure - posting four consecutive months of losses thanks to improving supply prospects.

The bigger picture…

An improving supply outlook from Brazil and a potentially longer monsoon season in India could boost global sugar production.

This may lead to lower sugar prices, especially when factoring in how these two countries account for over 40% of world production.

Conversely, India has extended its sugar export restrictions beyond October 2024. But this could change if the current elections result in a change of leadership and trade policies.

What does this mean?

According to the United States Department of Agriculture (USDA), global consumption of sugar is forecast to rise to a new record high of 179.0 million tons in 2024.

However, global production is also forecast to hit 186.0 million tons this year. This potential surplus of 7.0 million tons could limit upside gains for sugar.

Technical Outlook

Sugar is trending higher on the H1 timeframe with prices above the 50, 100, and 200 SMA. However, the Relative Strength Index (RSI) has crossed above 70 – indicating that prices are overbought.

- Sustained weakness below 18.90 could open a path towards 18.50 and 18.10.

- A strong break above 18.90 may see bulls challenge 19.08 and 19.30.