- US CPI, Fed & BoJ decision in focus

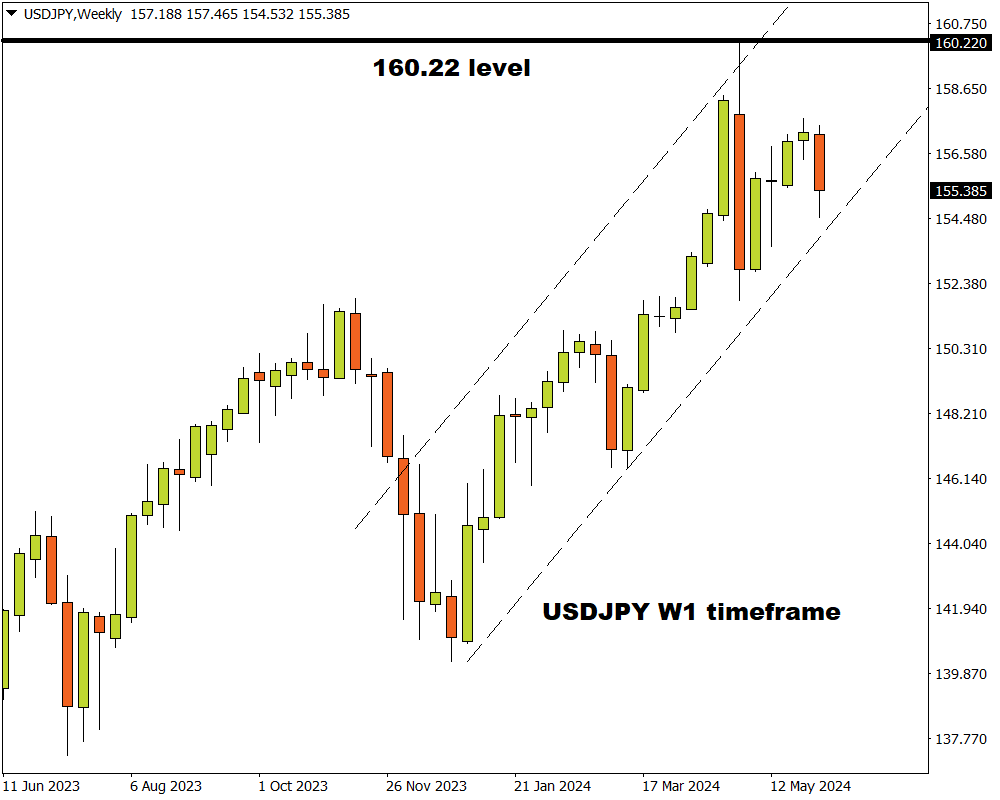

- USDJPY 3% away from multi-decade top

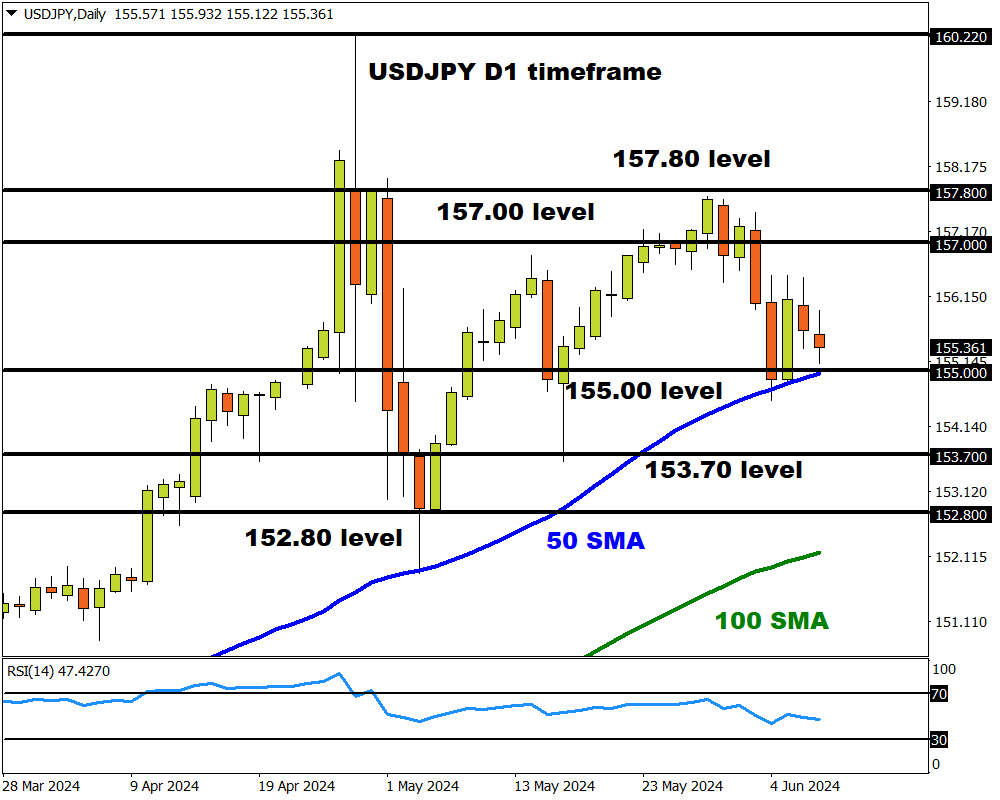

- Key level of interest – 155.00

- Bloomberg FX model – 74% USDJPY – (152.33 – 158.11)

Even as anticipation mounts ahead of the US jobs report this afternoon (Friday, 7th June), traders are bracing for more high-risk events in the week ahead.

Top-tier economic reports from across the globe and key central bank decisions will be in focus:

Monday, 10th June

- NZD: New Zealand home sales

- Nvidia: 10-for-one stock split

Tuesday, 11th June

- UK100: UK jobless claims, unemployment

- ZAR: South African manufacturing production

Wednesday, 12th June

- CN50: China PPI, CPI

- GER40: Germany CPI

- JP225: Japan PPI

- UK100: UK industrial production

- US500: US May CPI, FOMC rate decision

Thursday, 13th June

- AU200: Australia unemployment

- EU50: Eurozone industrial production

- TWN: Taiwan rate decision

- USDInd: US PPI, initial jobless claims, Fed speak

Friday, 14th June

- JPY: BoJ rate decision, industrial production

- NZD: New Zealand food prices, PMI

- US30: US University of Michigan consumer sentiment, Fed speak

The USDJPY is back in focus thanks to the incoming US CPI, Fed & BoJ rate decision.

Over the past few weeks, we have discussed how this major currency pair required a fresh catalyst to trigger its next major move.

Roughly 6-weeks ago, the currency pair saw monster swings which fuelled speculation around currency intervention. These suspicions were confirmed by Japan’s ministry of finance which reported that a record Y9.8tn ($62bn) was spent from late April to May to boost the Yen from multi-decade lows.

Still, the Yen gave back most of its gains in May with prices trading roughly 3% away from the multi-decade top at 160.22.

Here are 4 reasons why the USDJPY could see significant moves next week:

1) US May CPI report

The May US Consumer Price Index (CPI) report published on Wednesday is likely to shape expectations around when the Fed will start cutting rates.

Markets are forecasting:

- CPI year-on-year (May 2024 vs. May 2023) to remain unchanged at 3.4%.

- Core CPI year-on-year to cool 3.5% from 3.6% in the prior month.

- CPI month-on-month (May 2024 vs April 2024) to cool 0.1% from 0.3%.

- Core CPI month-on-month to remain unchanged at 0.3%.

Although headline inflation is expected to remain unchanged at 3.4%, the annual core is forecast to have cooled to 3.5% - its lowest since April 2021.

- A soft US CPI report may send the USDJPY lower.

- Should inflation remain sticky, the USDJPY could push higher.

2) Fed rate decision

A few hours after the key US CPI data, the Federal Reserve rate decision will be in focus.

No changes to US interest rates are expected. However, much focus will be on the press-conference and economic projections, especially ones for interest rates known as the dot plot.

Note: Back in March, the dot plot indicated three 25-bp cuts were on the cards for 2024.

Traders are currently pricing in an 80% probability of a 25-basis point Fed cut by September with a move fully priced in by November.

- The USDJPY may slip if the Fed strikes a dovish note and dot plot indicates two or more rate cuts in 2024.

- Should the Fed sound hawkish or the “dot plot” indicate less than two rate cuts this year, the USDJPY could jump.

Golden nugget: Over the past year, the Fed decision has triggered upside moves of as much as 0.5% or declines of 1.2% in a 6-hour window post-release.

3) BoJ rate decision

The Bank of Japan is likely to keep rates unchanged, but Governor Ueda could signal that a hike may around the corner.

It was only last week that a policymaker stated that higher rates could be a possibility if the Yen’s weakness translates to higher inflation.

Traders are currently pricing in a 78% probability that the BoJ hikes rates by 10bp in July.

- The USDJPY may trade lower if the BOJ strikes a hawkish note and signals rate hikes down the road.

- Should the central bank provide no fresh clues or dovish, this could push the USDJPY higher.

Golden nugget: Over the past year, the BoJ decision has triggered upside moves of as much as 1.0% or declines of 0.1% in a 6-hour window post-release.

4) Technical forces

The USDJPY is under pressure on the daily charts with prices approaching the 155.00 support level. However, prices are trading above the 50, 100 and 200-day SMA.

- A solid breakout and daily close below 155.00 may open a path toward 153.70 and 152.80.

- Should 155.00 prove to be reliable support, this could send prices towards 157.00 and 157.80.