-

This week set to be UK100’s 2nd most-volatile period so far in 2024

-

UK100 may even see a 1000-pip intraday move

-

Traders brace for BOE decision, UK economic data

-

UK100 still holding on to QTD gains, but 3.8% lower from ATH

- Wall Street predicts 15% future gains over next 12 months

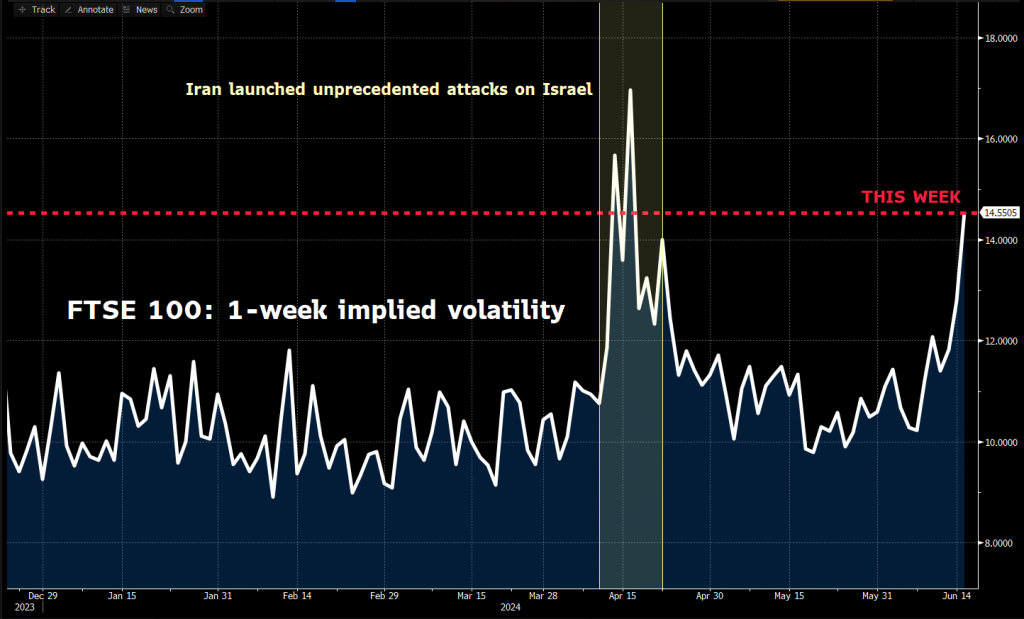

This week could see big price swings for the UK100 stock index.

Markets currently predict this week to be the 2nd most-volatile period so far this year for this benchmark stock index.

The year-to-date peak was back in April, when Iran launched its unprecedented attacks on Israel, which stoked risk-off sentiment across global financial markets.

NOTE: FXTM's UK100 stock index tracks the benchmark FTSE 100 index.

What could move the UK100 this week?

Traders will be highly tuned in to these 3 major economic events in the UK:

1) Wednesday, June 19th: UK May consumer price index (CPI)

The consumer price index, which measures headline inflation, is a key piece of economic data which tells investors and traders when the UK central bank can start cutting interest rates.

Here’s what economists predict for this week’s CPI releases:

-

CPI May 2024 vs. April 2024 (month-on-month): 0.4%

If so, that would be an uptick from April’s 0.3% month-on-month figure.

-

CPI May 2024 vs. May 2023 (year-on-year): 2.0%

If so, that would be considerably lower than April’s 2.3% year-on-year figure.

-

CPI core (excluding prices of energy, food, alcohol, and tobacco) year-on-year: 3.5%

If so, that would be considerably lower than April’s 3.9% year-on-year figure.

As the CPI trends lower to the central bank’s 2% target, that increases the likelihood of a BOE rate cut.

In addition to the above, markets will also be shown the latest inflation rates on services, housing costs, retail prices, and producer prices.

POTENTIAL SCENARIOS:

-

UK100 index may push higher: if UK inflation does moderate lower towards the BOE’s 2% target, perhaps paving the way for a UK rate cut.

- UK100 index may be dragged lower: if UK inflation proves higher-than-expected, taking its own sweet time in moderating towards the BOE’s 2% target, in turn delaying UK rate cuts.

Over the past 12 months, the UK CPI have triggered upside moves as much as 1.3%, or as much as 0.56% declines, in the 6 hours after the data release.

2) Thursday, June 20th: Bank of England (BOE) rate decision

To be clear, the BOE is not expected to lower its bank rate this week from its current 5.25% level.

If it does, that could be a major shocker for the UK100 index!

-

The odds for a rate cut on August 1st is down to a coin toss (47% chance).

- Meanwhile, there’s an 84% chance currently given for a mid-September rate cut.

With those expectations in mind, investors and traders worldwide will be scouring for clues as to what the BOE might say about the timing of its eventual rate cut.

POTENTIAL SCENARIOS:

-

UK100 index may push higher: if the BOE signals that its rate cut might happen sooner (August?) rather than later (September?)

- UK100 index may be dragged lower: if the BOE pushes back on the idea of imminent rate cuts, saying that its bank rate has to stay at the 5.25% peak for longer to convincingly subdue UK inflation.

Over the past 12 months, BOE rate decisions have triggered upside moves as much as 1.1%, or as much as 0.5% declines, in the 6 hours after the data release.

3) Friday, June 21st: UK May retail sales, June purchasing managers indexes (PMIs)

Overall, these data points are expected to show that the UK economy is on a steadier footing:

-

UK retail sales fared better in May, both on a month-on-month as well as year-on-year basis, compared to April 2024.

- The manufacturing, services, and composite PMIs are expected to hold above the 50 line, which denotes expanding conditions (as opposed to a sub-50 reading which points to contracting conditions for that sector).

POTENTIAL SCENARIOS:

-

UK100 index may push higher: if the UK retail sales and PMI data come in below market expectations, forcing the BOE to proceed with rate cuts sooner rather than later.

- UK100 index may be dragged lower: if the UK economic data exceeds market expectations and forces the BOE to delay its rate cuts.

Over the past 12 months, the UK retail sales data releases have triggered upside moves as much as 1.4%, or as much as 1.2% declines, in the 6 hours after the data release.

Political turmoil to inject more UK100 volatility?

As the French political turmoil has amplified investor angst surrounding European stock indexes (EU50, FRA40, etc.), the UK100 index has been able to hold on to its quarter-to-date (QTD) gains so far:

-

NETH25: +4.4%

-

UK100: +2.3%

-

GER40: -2.6%

-

EU50: -4.5%

- FRA40: -8.5%

The above performance has enabled the UK stock market to reclaim the title as Europe's largest stock market from France.

However, fundamental investors also note that the UK elections are set for merely two weeks away, on July 4th.

The closer we get to polling day, the more influence UK politics could hold over this benchmark stock index.

How might UK100 fare over the long term?

Wall Street analysts predict another 15% potential upside (12,000 pips / 1,200 index points) from the UK100’s current levels over the next 12 months.

But first, the above-mentioned near-term events must first be overcome before potentially crossing above the 9,300 level by this time in 2025, assuming Wall Street’s forecasts prove true.

From a technical perspective …

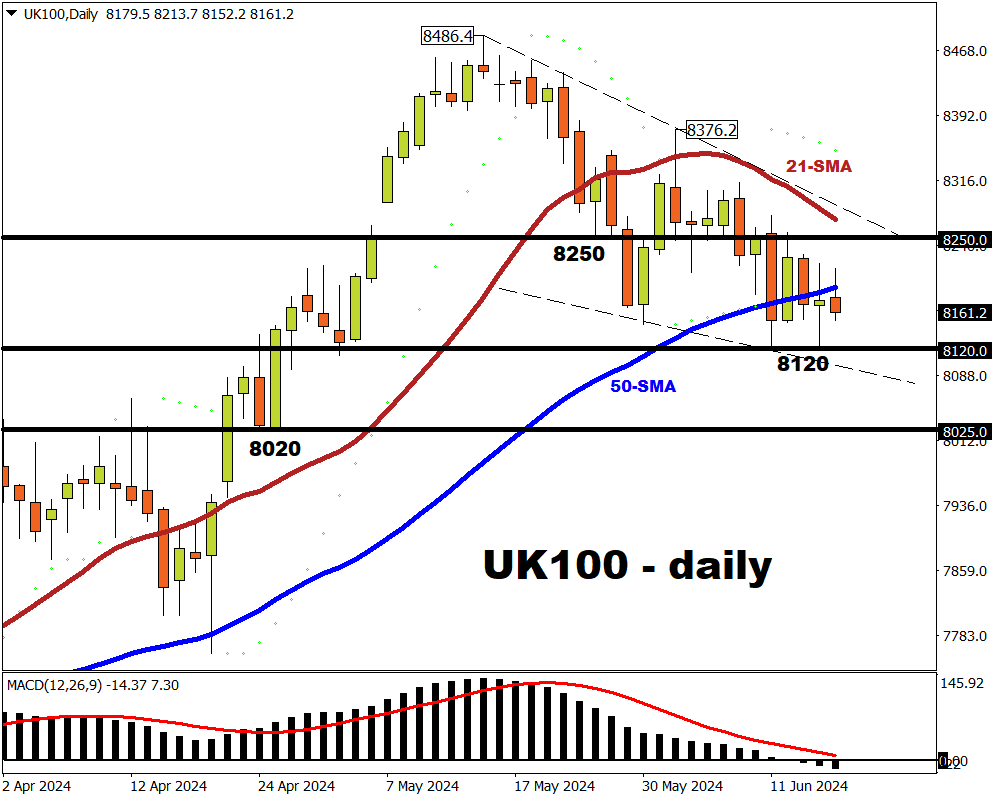

At the time of writing, the UK100 is trading about 3.8% below its all-time high (ATH), using intraday prices, of 8486.4 set on May 15th.

However, the 8120 level has provided support in recent sessions, with prices not straying far from its 50-day simple moving average (SMA) over the past week.

POTENTIAL RESISTANCE

-

50-day SMA: immediate resistance

-

8250: upper downtrend line

-

21-day SMA

POTENTIAL SUPPORT:

-

8120 area: crucial support from recent sessions.

-

8100: downward lower trendline

- 8020 area: support in late-April 2024

However, such a drastic decline (to 8020) would have to come by way of an aggressively hawkish BOE or a serious bout of risk-off sentiment across global financial markets.