-

AUD stronger against all G10 peers today (except against CHF)

-

RBA today discussed a rate hike instead of a rate cut!

-

Markets now predict no rate cuts by RBA in 2024

-

AUD bulls offered another boost from weaker US retail sales

- Bloomberg model: 74% chance of 0.6540 – 0.6700 one-week trading range

It’s yet another week filled with G10 central bank policy decisions.

As highlighted in our Week Ahead article (published on Fridays), we highlighted the upcoming decisions by the Bank of England (BOE) as well as the Swiss National Bank (SNB).

This week also features policy decisions by the central banks of China, Chile, Brazil, Indonesia, and Norway.

This article focuses on the Reserve Bank of Australia (RBA), and how its just-concluded meeting could impact the Australian dollar (AUD).

What did the RBA say?

The Reserve Bank of Australia issued a “hawkish” message to the markets, which raises the prospects of Australia’s cash rate being maintained at its 4.35% peak, its highest level in 12 years, for longer than expected.

Coming into today’s meeting, markets predicted a 70% chance that the RBA could trigger a rate cut later this year.

The odds for an RBA rate cut in 2024 has now essentially been wiped out.

That’s because RBA Governor, Michele Bullock, revealed that policymakers today actually discussed a rate HIKE, but not a cut.

This shows the stubborn fight that central banks have in subduing the post-pandemic inflation.

NOTE: Central banks use higher interest rates as their main weapon for subduing inflation.

After all, Australia’s consumer price index (CPI), which measures headline inflation, actually ticked up to a higher-than-expected 3.6% in April.

Hence, today’s “hawkish” message out of the RBA.

How might a "hawkish" RBA impact the Australian dollar?

No surprise that, following the RBA’s “hawkish” message, the Aussie is stronger against most of its G10 peers, except against the Swiss Franc (CHF).

NOTE: A currency tends to strengthen when markets believe that country's interest rates are higher relative to its peers.

NOTE: CHF is seen as a safe haven asset, which helps protect investors’ wealth during times of heightened fear and uncertainty.

CHF has been benefitting from the France’s recent political turmoil.

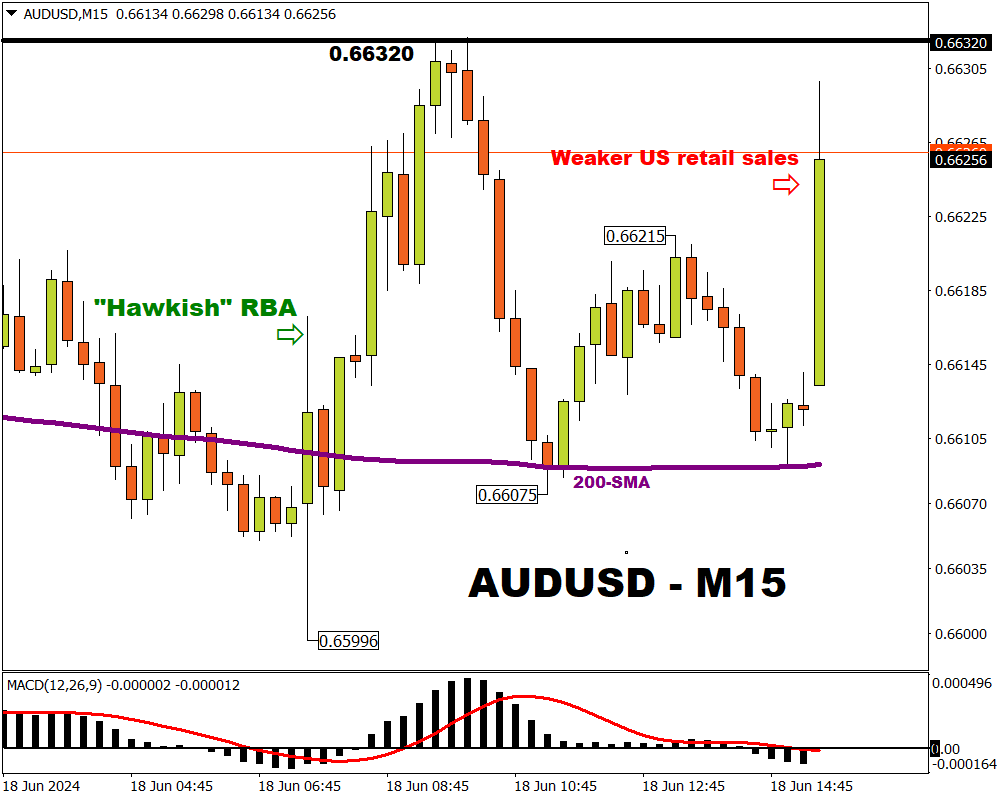

However, looking at the AUDUSD chart on the 15-minute timeframe, the Aussie failed to hang on to most of its gains against the US dollar following the RBA's policy decision earlier today (Tuesday, June 18th).

AUDUSD bulls (those hoping prices will go up) however were able to restore some of their gains following the weaker-than-expected US retail sales data.

Weakening economic conditions in the US may prompt the Fed to cut interest rates sooner rather than later.

Such a narrative prompted a softer US dollar and sent AUDUSD slightly higher.

However, AUDUSD's upside may remain limited.

After all, the US central bank (Federal Reserve a.k.a. the Fed) also just last week issued its own “hawkish” message.

Fed officials forecasted just one rate cut this year, fewer than the 3 rate cuts previously predicted back in March 2024.

Hence, in the face of a resilient US dollar, AUDUSD may struggle to carve out substantial gains.

AUD bulls instead may well see better fortunes against the likes of EUR, GBP, and JPY moving forward.

How might AUDUSD perform over the near term?

According to Bloomberg’s FX model, it predicts a 74% chance that AUDUSD will trade between 0.6540 – 0.6700 over the next one week.

Looking at the daily timeframe, the 0.6700 upper bound of the Bloomberg model’s predicted trading range is consistent with the key resistance area for AUDUSD since mid-May.

The 0.6540 lower bound of the predicted trading range also makes sense.

That price area also features AUDUSD’s 200-day simple moving average (SMA) - a popular long-term technical indicator – potentially offering support.

- DOWNSIDE SCENARIO: A break below its 50-day SMA could entice AUDUSD bears (those hoping prices will fall) to test the 200-day SMA for support.

A stronger US dollar might still be the catalyst for a lower AUDUSD, especially upon greater demand for safe haven assets (including the US dollar).

- UPSIDE SCENARIO: AUDUSD must first conquer the 0.66350 resistance, which had been limiting gains since March, before returning to the 0.6700 round figure.