-

BOE left its bank rate unchanged today, but …

-

Meeting minutes hinted at support for rate cuts

-

Markets raised odds for August rate cut from 48% to 62%

-

Higher odds for UK rate cuts typically boost UK100, drag GBP lower

- UK100 index completes 1,000-pip move, as forecasted

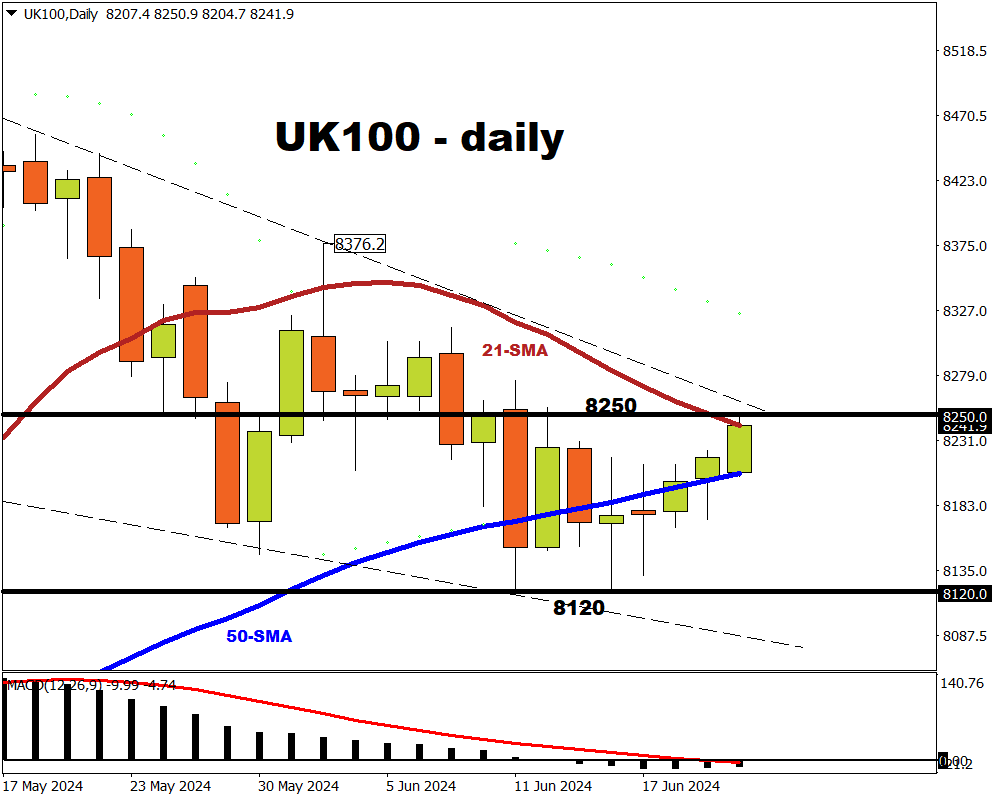

The UK100 index has completed a 1,000-pip move this week, as expected.

When our “Trade of the Week” was published on Monday, the UK100’s intraday low was 8131.7.

Following the just-concluded Bank of England policy meeting, it touched the 8250 psychological level, which we had previously cited as a key resistance level.

That 8250 region duly acted as resistance and immediately sent prices back downwards.

That journey from 8131.7 to 8250.9, with the latter being the highest intraday price so far on Thursday at the time of writing, marked a move of 1192 pips (119.2 index points).

Why did the UK100 jump higher?

As we wrote this past Monday:

- UK100 index may push higher: if the BOE signals that its rate cut might happen sooner (August?) rather than later (September?)”

To be clear, today the BOE decided to keep its benchmark rates unchanged at its 16-year high of 5.25% - as widely expected.

However, according to the minutes from the just-concluded meeting, the officials on the 9-member Monetary Policy Committee (MPC) – which votes on rates - made a “finely balanced” decision not to cut interest rates.

Markets saw this as a sign that the BOE is warming up to rate cuts!

Markets are now pricing in a 62% chance (greater than even) of a UK rate cut by August 1st.

Those 62% odds are higher than the 48% chance accorded as of Monday.

With the British Pound falling as a post-BOE meeting reaction, the UK100 stock index pushed higher instead, once again demonstrating its inverse relationship (move in opposite directions) with GBP.

And there could be even more price gains this week.

Tomorrow (Friday, June 21st), the UK is due to release some major economic data including May’s retail sales and June’s purchasing managers’ indexes (PMIs).

Weaker-than-expected economic data may raise the prospects of BOE rate cuts, which helps support economic momentum.

That in turn might boost the UK100 even higher past the 8250 level.