-

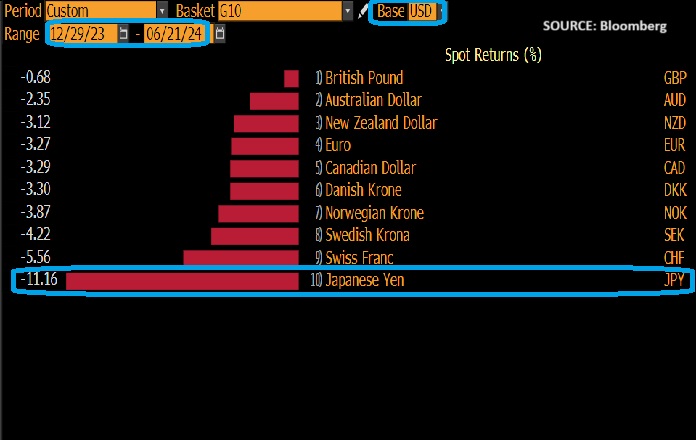

JPY is worst-performing G10 currency vs. USD in 1H24

-

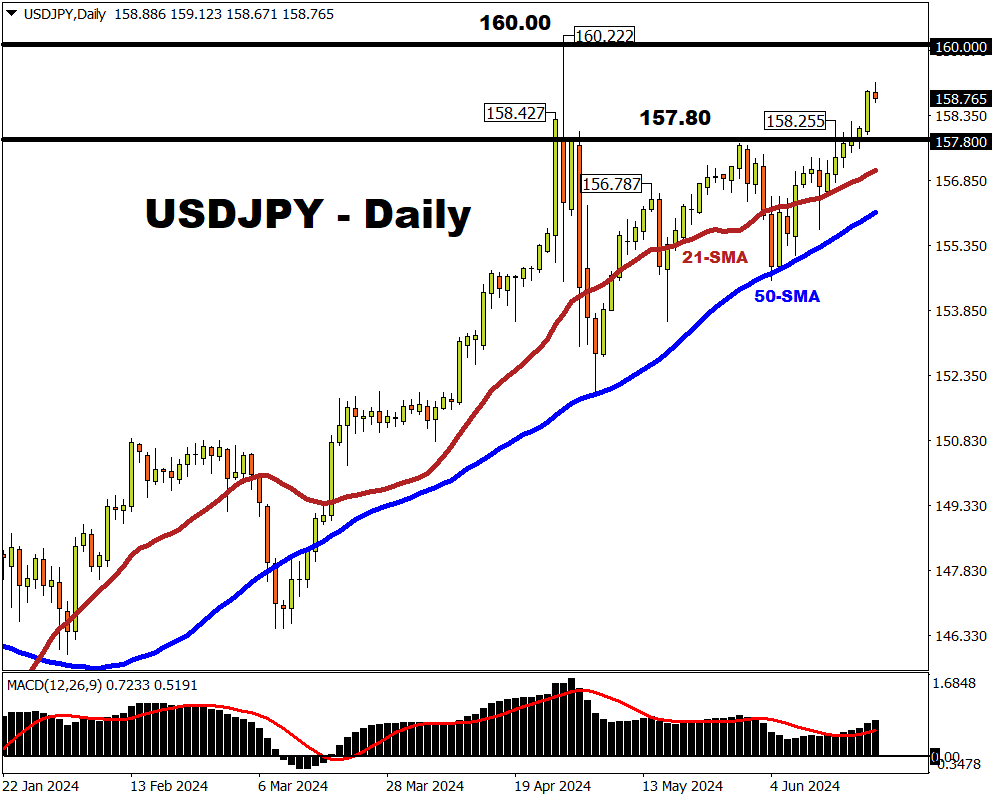

USDJPY's 160 price area triggered largest-ever JPY intervention in late-April

-

Besides intervention risk, traders watching Friday’s US/Japan inflation data

-

Bloomberg model: 77% chance of 156.69-160.58 trading range next week

The Japanese Yen is returning closer towards a 34-year low against the US dollar.

This widely-traded FX pair posted its 6th straight day of gains, with the Yen set for its longest losing streak against the US dollar since March.

Already the Yen is set to wrap up the first half of 2024 with the title of worst-performing G10 currency against the US dollar, by a mile.

Why is the Yen so weak?

USDJPY’s stunning ascent has been primarily driven by the surprise reluctance by both the US and Japanese central banks to change their policy stances:

-

The Bank of Japan has not been as quick to HIKE interest rates so far this year

- The US Federal Reserve has not been as quick to CUT interest rates so far this year

Recall that a currency tends to weaken when its country’s interest rates are lower than its peers, and vice versa.

This persistent policy divergence has resulted in a still-wide spread between US Treasury yields and their Japanese counterparts, which greatly favours USD demand over JPY.

In other words ...

With Japan’s interest rates staying lower-for-longer, while the Fed’s benchmark rates remain higher for longer, that has resulted in a resilient US Dollar and a weaker Japanese Yen, i.e. soaring USDJPY.

What should traders look out for?

Traders, especially Yen bears, are entering the final trading week of 1H24 with memories from end-April, which was the last time USDJPY was seen around these current levels.

Starting April 26th, the Japanese government had spent a record US$62.2 billion to defend its currency.

That record intervention contributed to USDJPY’s largest one-day price swing since 2022, as the FX pair breached 160, only to plummet to as low as 154.52.

That was a painful lesson for Yen bears (those hoping that USDJPY can move higher), although another showdown appears to be shaping up.

Hence, if we do see another round of intervention on the Yen, that could translate into massive profits for Yen bulls (those hoping for lower USDJPY).

Beyond the threat of another round of government intervention, the coming week also features scheduled events that could rock USDJPY:

Monday, June 24

- NZD: New Zealand May trade balance

- JPY: BoJ Summary of Opinions

- SG20 index: Singapore May CPI

- TWN index: Taiwan May unemployment, industrial production

- GER40 index: Germany June IFO business climate

- US30 index: Speech by San Francisco Fed President Mary Daly

Tuesday, June 25

- AU200 index: Australia June consumer confidence

- CAD: Canada CPI

- USD index: US June consumer confidence; speeches by Fed Governors Lisa Cook and Michelle Bowman

Wednesday, June 26

- AUD: Australia May CPI

- GER40 index: Germany July consumer confidence

Thursday, June 27

- JP225 index: Japan May retail sales

- CNH: China May industrial profits

- TRY: Turkey rate decision

- SEK: Sweden rate decision

- EU50 index: Eurozone June economic confidence

- USD: US weekly initial jobless claims; 1Q GDP (final)

- Nike earnings

- Biden vs. Trump: US Presidential election debate

Friday, June 28

- JP225 index: Japan June Tokyo CPI; May jobless rate and industrial production

- EUR: Germany June unemployment; France June CPI

- GBP: UK 1Q GDP (final)

- USD index: US May PCE deflators, personal income and spending; June consumer sentiment (final)

USDJPY set for freaky Friday?

Two events out of either side of the Pacific may hold greater potential to rock USDJPY on the final trading day of 1H24:

1) Tokyo June consumer price index (CPI)

Here’s what economists expect:

-

CPI year-on-year (June 2024 vs. June 2023): 2.3%

If so, that would be slightly higher than May’s 2.2% year-on-year figure.

-

CPI year-on-year (excluding fresh food): 2.0%

If so, that would be slightly higher than May’s 1.9% year-on-year figure.

-

CPI year-on-year (excluding fresh food and energy): 1.6%

If so, that would be slightly higher than May’s 1.7% year-on-year figure.

Over the past 12 months, the 6 hours after these Tokyo CPI releases had triggered upwards moves for USDJPY as much as 0.38%, or declines as much as 0.3%.

2) US May PCE Deflators

(this is the Fed’s preferred measure of inflation)

Here’s what economists expect:

-

PCE Deflator month-on-month (June 2024 vs. May 2024): 0.0%

If so, that would be a notable drop from May’s 0.3% month-on-month figure.

-

PCE Deflator year-on-year (June 2024 vs. June 2023): 2.6%

If so, that would be slightly lower than May’s 2.7% year-on-year figure.

-

PCE Core Deflator month-on-month (excluding food and energy prices): 0.1%

If so, that would be slightly lower from May’s 0.2% month-on-month figure.

- PCE Core Deflator year-on-year (excluding food and energy): 2.6%

If so, that would be lower than May’s 2.8% year-on-year figure.

Over the past 12 months, the 6 hours after these US PCE Deflators had triggered upwards moves for USDJPY as much as 1%, or declines as much as 0.35%.

POTENTIAL SCENARIOS:

- USDJPY may fall if we see higher-than-expected Tokyo inflation (which is a frontrunner to the National CPI due later) which could allow the Bank of Japan to hike rates – a thought which should prompt a stronger Yen.

On the US dollar side of the USDJPY equation, lower-than-expected US inflation might pave the way for the Fed to lower interest rates this year - potentially prompting the US dollar to weaken.

- USDJPY may rise if we see lower-than-expected Tokyo inflation, which could further deter the Bank of Japan to hike rates – a thought which should prompt an even weaker Yen.

On the US dollar side of the USDJPY equation, higher-than-expected US inflation might further delay the expected Fed rate cuts for later this year - potentially prompting a stronger US dollar.

Key levels

POTENTIAL RESISTANCE

-

160.00

The closer USDJPY moves towards this psychologically-important number, the louder the echoes of April’s intervention may haunt traders.

Though to be clear, Japanese government officials have often warned that it’s the magnitude of the move, rather than a specific number, that invokes intervention.

Hence, an only gradual break above 160 may well prolong this battle between Yen bears and the Japanese government.

POTENTIAL SUPPORT

-

158.427 – 157.80 region

If traders grow wary of the intervention threat, that may prompt some profit-taking and push USDJPY back towards recent peaks-turned-support

-

21-day SMA

- 156.787: mid-May cycle high

According to the Bloomberg FX forecast model, there’s a 77% chance that USDJPY will trade between 156.69 – 160.58 before we enter July.