- EURUSD ↓ 1% MTD, lingering near key 1.05 level

- French government faces no-confidence vote today

- Mounting political uncertainty could hit euro

- Over past year NFP triggered moves of ↑ 0.4% & ↓ 0.6%

- Bloomberg FX model – EURUSD has 73% of trading within 1.0349 – 1.0641 over 1-week period

The French government is on the brink of collapse.

In July when France’s legislative election ended with a hung parliament outcome, we suggested months of political instability.

Although France unveiled a new government in September after almost 3-months of deadlock, it looks like things are back at square one.

The low down…

Earlier in the week, French Prime Minister Michel Barnier failed to secure an agreement with Marine Le Pen’s party on the budget.

This deadlock prompted opposition parties to table a motion of no-confidence against Barnier.

What next?

Today at 4 p.m. Paris time, a debate on a motion to topple the government is scheduled to take place with voting roughly three hours after.

If the current government is ousted with a no-confidence vote, this could throw France into political chaos until July 2025 when a new legislative election can take place.

More pain for EURUSD?

The EURUSD may sink due to political uncertainty, with prices keeping below the psychological 1.050 level.

Looking beyond the developments in France, the major currency pair could be influenced by Powell’s incoming speech and the US jobs report on Friday.

Note: Over the past 12 months, the US jobs report has triggered upside moves as much as 0.4% or declines of 0.6% in a 6-hour window post-release.

Investors will be seeking for any fresh clues on the Fed’s plans for December and beyond. Powell’s comments and Friday’s NFP could influence the USD and by default the EURUSD.

However, the political developments in France and ECB cut bets may set the tone for the EURUSD this week.

Note: Traders have fully priced in a 25-basis point ECB cut by December with another cut priced in by January 2025.

Looking at the technicals

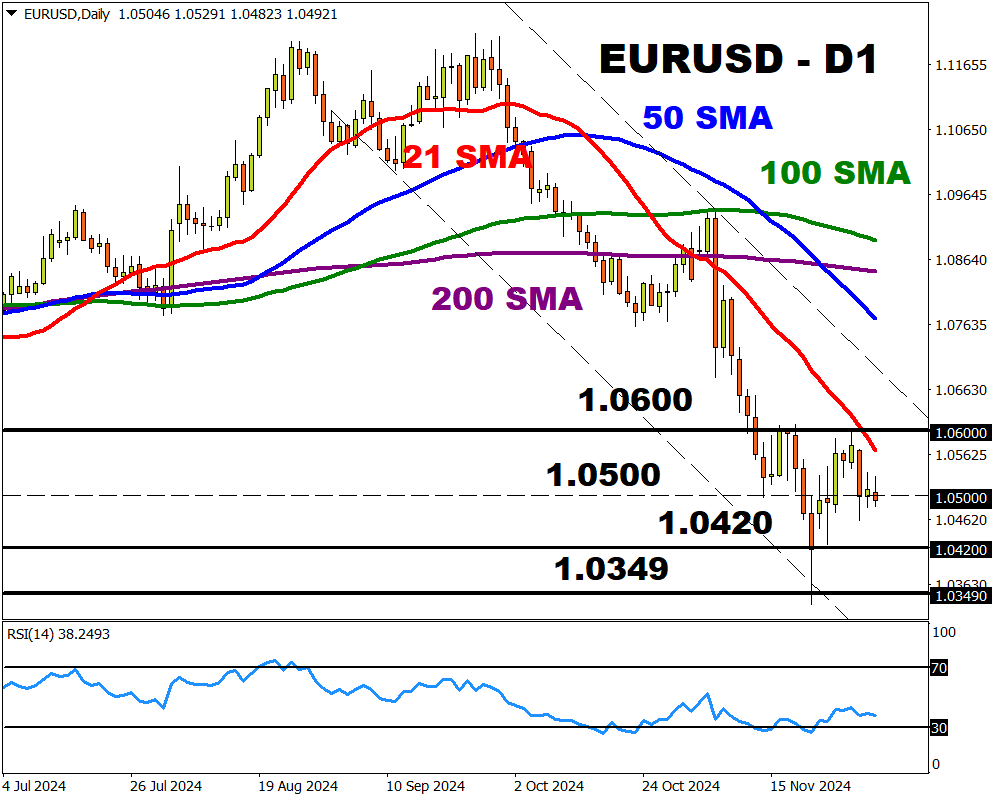

The EURUSD is under pressure on the daily charts with prices trading below the 50, 100 and 200-day SMA. However, the Relative Strength Index (RSI) is near oversold levels.

- Sustained below 1.0500 could see a decline back toward 1.042 and 1.0349 - the lower bound seen on the Bloomberg FX model.

- Should prices push back above 1.0500, this could see an incline toward 1.0600 and 1.0641.