After falling a big 3% last Monday, gold has been trading in tight ranges since, holding mostly within that day’s range. In other words, it hasn’t fallen any further, although it has also made little upside progress. In yet another words, it has been consolidating. Traders have not yet found any burning desire to buy the gold dip after it retreated from its all-time highs from the end of October. That drop meant gold would end lower the month of November, and in doing so ending a 9-month winning run. Last week saw gold close lower, too. So, both on the monthly and weekly time frames, there is a modest bearish bias, underscoring the metal’s inability to rise more meaningfully on the daily time frame this week. Investors are awaiting a fresh buy signal, but probably feel a more significant correction is needed before the metal becomes attractive again. So, the near-term gold forecast remains modestly bearish for now, as the focus turns to the upcoming US data.

Dollar and reduced haven demand holding gold back

Indeed, with global bond yields still elevated and dollar staging a sharp rally in the last couple of months, most notably against the euro, yuan and commodity dollars, gold is becoming increasingly expensive for buyers in those currencies. This is significant because according to the World Gold Council, India and China are by far the largest jewellery markets, together - accounting for over 50% of the global total.

Investors have been pouring funds into more risky assets in recent weeks. Bitcoin, XRP and other altcoins have seen significant gains. In the stocks space, the S&P 500 and German DAX have achieved new all-time highs. These latest gains have come after Trump’s election victory. Unsurprisingly, gold has fallen out of favour somewhat just as these assets have surged higher.

Gold has also been undermined by a temporary – yet shaky – ceasefire between Israel and Hezbollah, reducing safe-haven demand. That said, fires have already been exchanged between the two parties, straining the ceasefire agreement. Meanwhile, political uncertainty in France and Germany, and not to mention the developing situation in South Korea, are all helping to offset any reduction in gold’s appeal arising from the Middle East.

Gold forecast: US data to determine metal’s short-term path

This week, the US economic calendar is packed with pivotal reports, including the ISM services PMI today and the monthly jobs report on Friday. These other data releases will provide crucial insights into the health of the US economy and the Federal Reserve’s next moves. Any signs of weakness in these indicators could bolster hopes for a December rate cut further, after mixed messages were delivered from Fed speakers earlier this week. The market is currently attaching a 25bps cut a 75% probability, offering potential support for gold prices.

The November non-farm payrolls report, due Friday, is particularly critical. After October’s unexpectedly robust job growth, the market is revaluating its expectations for the Fed’s 2025 policy trajectory. A weaker-than-expected jobs report could renew hopes for a dovish Fed, possibly lifting gold in the short term. However, in the event the data is not weak then gold may extend its losses.

Key US Data highlights this week:

- Wednesday (Dec 4): ISM Services PMI and ADP private payrolls

- Thursday (Dec 5): Unemployment claims and OPEC meeting

- Friday (Dec 6): Non-Farm Payrolls, Unemployment Rate, and Average Hourly Earnings

Technical analysis: Gold faces downside risks

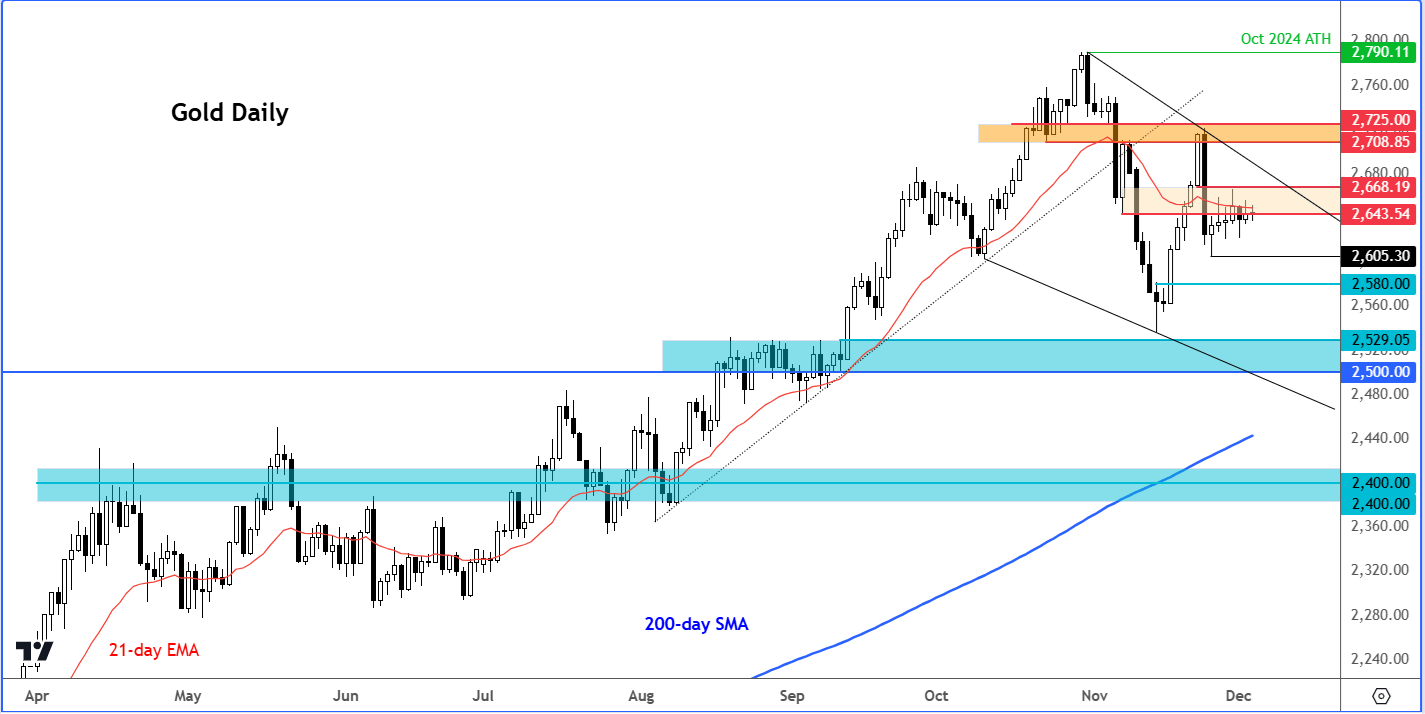

Source: TradingView.com

From a technical standpoint, gold has recently exhibited some mildly bearish signal. That sell-off last Monday marked a key turning point, after XAU/USD formed a bearish engulfing candle on the daily chart. That helped to reinforce resistance between $2708 and $2725—a zone previously critical as support but now acting as a barrier. This confirmed resistance raises questions about whether the current downturn marks a temporary correction or the start of a more sustained bearish trend.

Gold’s long-term trend remains bullish, suggesting that the current pullback may represent a period of consolidation. However, the near-term risks appear skewed to the downside. Traders should monitor price action carefully, focusing on key levels to determine whether bearish momentum persists.

Gold forecast: XAU/USD key levels to watch

Resistance zone:

- $2643-$2668: This range is critical for the short-term gold forecast. As of now, gold prices are testing this zone. A daily close above $2668 could negate the current bearish setup, but it wouldn’t necessarily signal a bullish reversal due to the recent pattern of lower highs and lows.

Support levels:

- $2580: This marks the breakout base from mid-November. If gold breaks below this level, further declines toward the $2500-$2530 range—a significant support area from early September—are likely.

- Longer-Term Support: Should selling intensify, the 200-day moving average at $2440 and the $2400 zone may come into focus.

Gold prices are also forming a falling wedge pattern, which signals long-term bullish continuation. However, in the near term, this pattern may restrict upward momentum, requiring additional confirmation before optimism returns.

The bottom line

The short-term gold outlook remains mixed-to-bearish as traders weigh a range of influencing factors, from US economic data to geopolitical developments. While long-term trends remain supportive, the near-term XAUUSD forecast is clouded by technical resistance and bearish momentum, all thanks to a rising US dollar and a weakening yuan. This week’s US data will be pivotal in shaping gold’s trajectory, with any signs of economic resilience potentially reinforcing the bearish sentiment. The opposite is also true. For now, caution is advised as the precious metal navigates a challenging landscape.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R