Canadian Dollar, USD/CAD Talking Points:

- USD/CAD spiked last Tuesday after a social media post from President-elect Trump threatened a 25% tariff on goods coming from Mexico and Canada until they clamped down on drugs and migrants crossing the border.

- Canadian Prime Minister Justin Trudeau went to Florida to appeal to Trump while noting the differences between the northern and southern borders. And it was widely reported that President-elect Trump then responded that if tariffs impose too much hardship on Canada, they could be welcomed in as the 51st U.S. state. Canadian Public Safety Minister Dominic LeBlanc who attended the dinner clarified that the comment was a joke and said in jest despite the media frenzy that followed.

- Nonetheless, USD/CAD continues to trade above the 1.4000 handle after the spike from the initial tariff threat faded, with the psychological level coming in as support late last week.

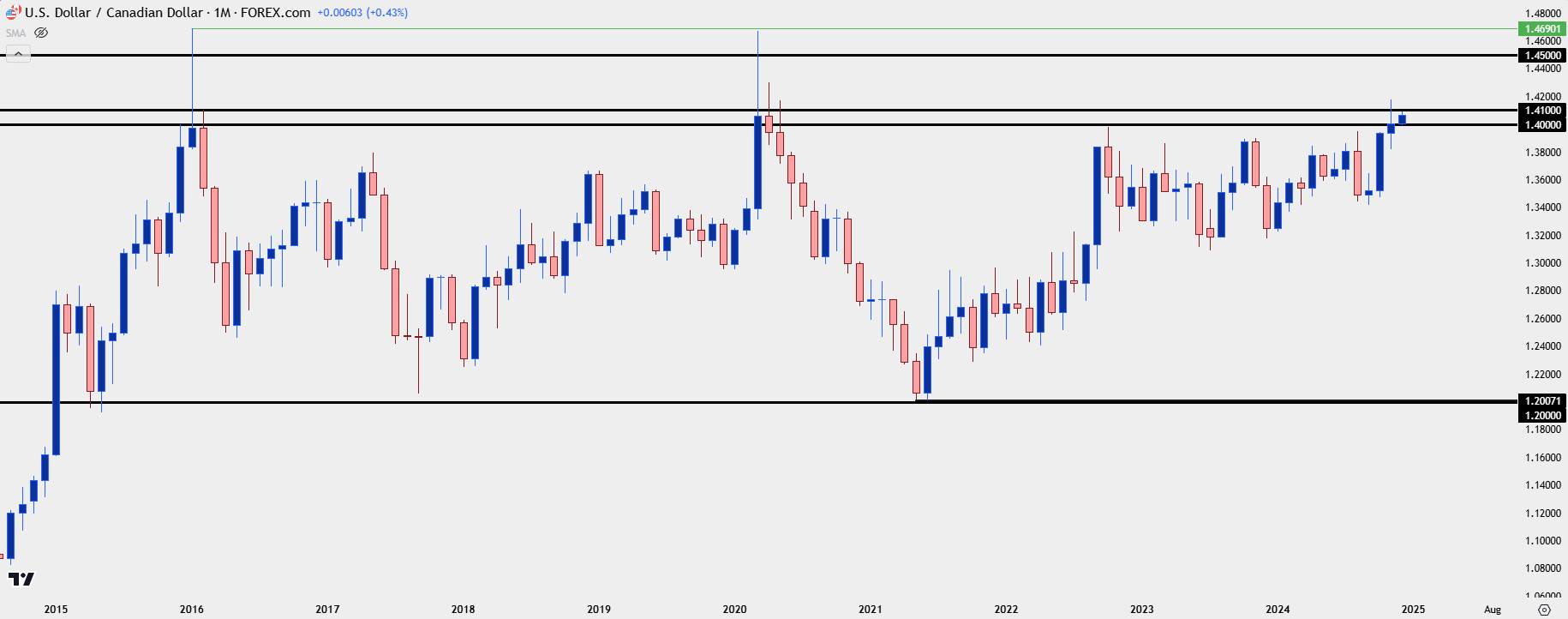

We’re at the stage now where markets are trying to factor in 2025 drivers and the messiness of political headlines appear to be impacting price action. USD/CAD finished the month of November with only its second monthly close above the 1.4000 handle in the past decade. And the other time that took place was in the immediate aftermath of the Covid pandemic, when a fast rush of US Dollar strength had created a massive spike in the pair.

The November close was a mere six pips above the big figure and that price had even showed as support on the final trading day of the month. But buyers held it above and that has since led into a bounce in early-trade this week.

USD/CAD Monthly Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

Chart prepared by James Stanley, USD/CAD on Tradingview

USD/CAD Daily

From the daily chart we can get better view of that recent trend in the pair, along with the spike from last week on the back of the tariff threat. That spike created a fresh four-year-high in the pair, at which point prices began to pull back. And that pullback ran for the rest of the week, into Friday, until support eventually showed at the 1.4000 handle.

To be sure, the trend is stretched, and RSI has been diverging on the daily chart for more than a month. The indicator went into overbought territory in early-November, even before election results had come in. Since then, as higher-highs have shown in price, lower-highs have shown via RSI and that’s usually indicative of a trend that’s getting a bit long in the tooth. As a case in point, RSI was diverging but on the other side, as oversold, from August into September for both the US Dollar and USD/CAD before a strong reversal showed at the start of Q4.

That highlights reversal potential, but it doesn’t necessarily denote timing or when such a theme may begin. And given how aggressively retail traders are holding short positions, with 90% of retail traders holding short in the observed sample, as of this writing; combined with that 1.4000 support hold, there could be more topside scope before a bearish trend emerges.

USD/CAD Daily Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

Chart prepared by James Stanley, USD/CAD on Tradingview

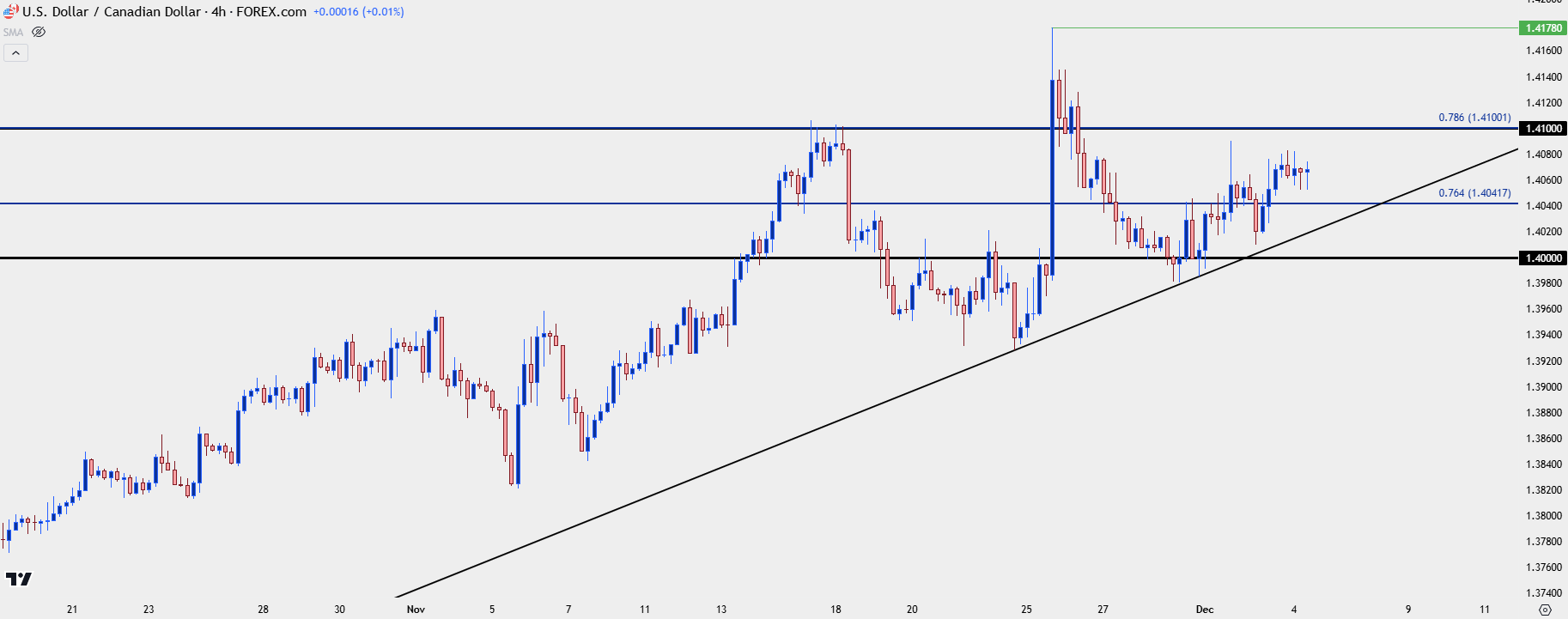

USD/CAD Shorter-Term, Positioning

The spike that showed in the pair last Tuesday appears to be at least partially driven by short-squeeze dynamics. And given the driver of tariff threats as price was holding very near longer-term resistance, that makes sense.

But the corresponding pullback has so far held a higher-low at that key spot of 1.4000 and since then, it’s been a series of higher-highs and lows which further denotes bullish control.

For bears, a drive below that 1.4000 level would be an important item, as it would show that bulls are no longer finding perceived value on tests of the big figure, such as what happened last Thursday and Friday. On a shorter-term basis, there’s Fibonacci levels at 1.4100 and 1.4041, with the former functioning as potential resistance and the latter as a spot for possible higher-low support, which also showed as short-term resistance last week, just before the last higher-low support hold at 1.4000.

USD/CAD Four-Hour Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

Chart prepared by James Stanley, USD/CAD on Tradingview

--- written by James Stanley, Senior Strategist