US Dollar Outlook: USD/JPY

USD/JPY pulls back a fresh weekly high (151.23) as the ISM Services survey prints at 52.1 in November versus forecasts for a 55.5 reading, but the US Non-Farm Payrolls (NFP) report may keep the exchange rate afloat as the update is anticipated to show a resilient labor market.

USD/JPY Snaps Bearish Price Series Ahead of US NFP Report

USD/JPY may stage a large recovery over the remainder of the week as it snaps the recent series of lower highs and lows, and speculation surrounding US monetary policy may sway the exchange rate as there appears to be a dissent within the Federal Reserve.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

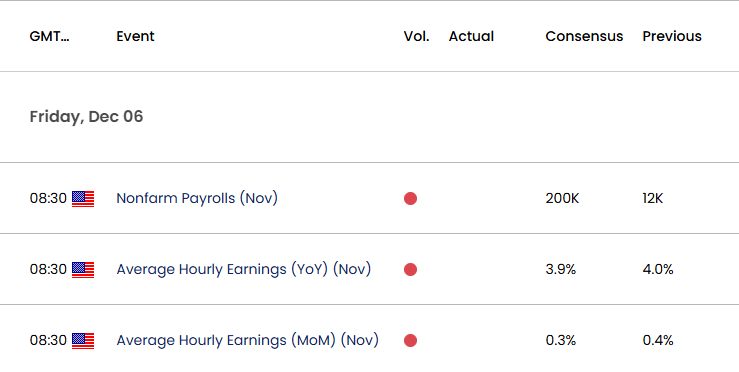

At the same time, the NFP report may influence foreign exchange markets as the US economy is expected to add 200K jobs in November, and a positive development may push the Federal Open Market Committee (FOMC) to the sidelines as Chairman Jerome Powell acknowledges that ‘the economy is strong, and it’s stronger than we thought it was going to be in September’ while speaking at an event held by the New York Times.

US Economic Calendar

In turn, signs of a resilient labor market may generate a bullish reaction in the Greenback as it curbs speculation for a Fed rate-cut in December, but a weaker-than-expected NFP report may keep the exchange rate below the 50-Day SMA (151.08) as it fuels expectations for lower US interest rates.

With that said, lack of momentum to trade back above the moving average may undermine the recent rebound in USD/JPY amid the lack of response to the positive slope, but the exchange rate may attempt to retrace the decline from the November high (156.75) as it clears the bearish price series carried over from last week.

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY trades to a fresh weekly high (151.23) following the failed attempt to break/close below the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone, with a move above 151.95 (2022 high) bringing 153.80 (23.6% Fibonacci retracement) back on the radar.

- Next area of interest comes in around 156.50 (78.6% Fibonacci extension), but the rebound in USD/JPY may turn out to be temporary amid the lack of response to the positive slope in the 50-Day SMA (151.08).

- Need a break/close below the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone to open up the 144.60 (50% Fibonacci retracement) to 145.90 (50% Fibonacci extension) region, with the next area of interest coming in around the October Low (142.97).

Additional Market Outlooks

GBP/USD Recovery Vulnerable as Bear Flag Formation Takes Shape

USD/CHF Pullback Faces Positive Slope in 50-Day SMA

USD/CAD Defends Post-US Election Rally to Eye November High

US Dollar Forecast: USD/JPY Gives Back Post-US Election Rally

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong