- Rate differentials, not politics, are driving moves in EUR/JPY and GBP/JPY

- Morning star patterns suggest potential turning points in both pairs

Overview

Considering some of the headlines coming out Europe, especially regarding French politics, you’d imagine Japanese yen crosses such as EUR/JPY and GBP/JPY would be getting slaughtered. But they’re not. That’s telling. Instead, political chaos in France should be treated as the norm rather than exception, leaving other factors to drive FX market movements.

As this note will discuss, in this instance, it’s relative longer-dated rate differentials with Japan that have been highly influential over the past month, providing a guide on what traders should be watching when assessing setups.

EUR/JPY delivers bottoming signal

Source: TradingView

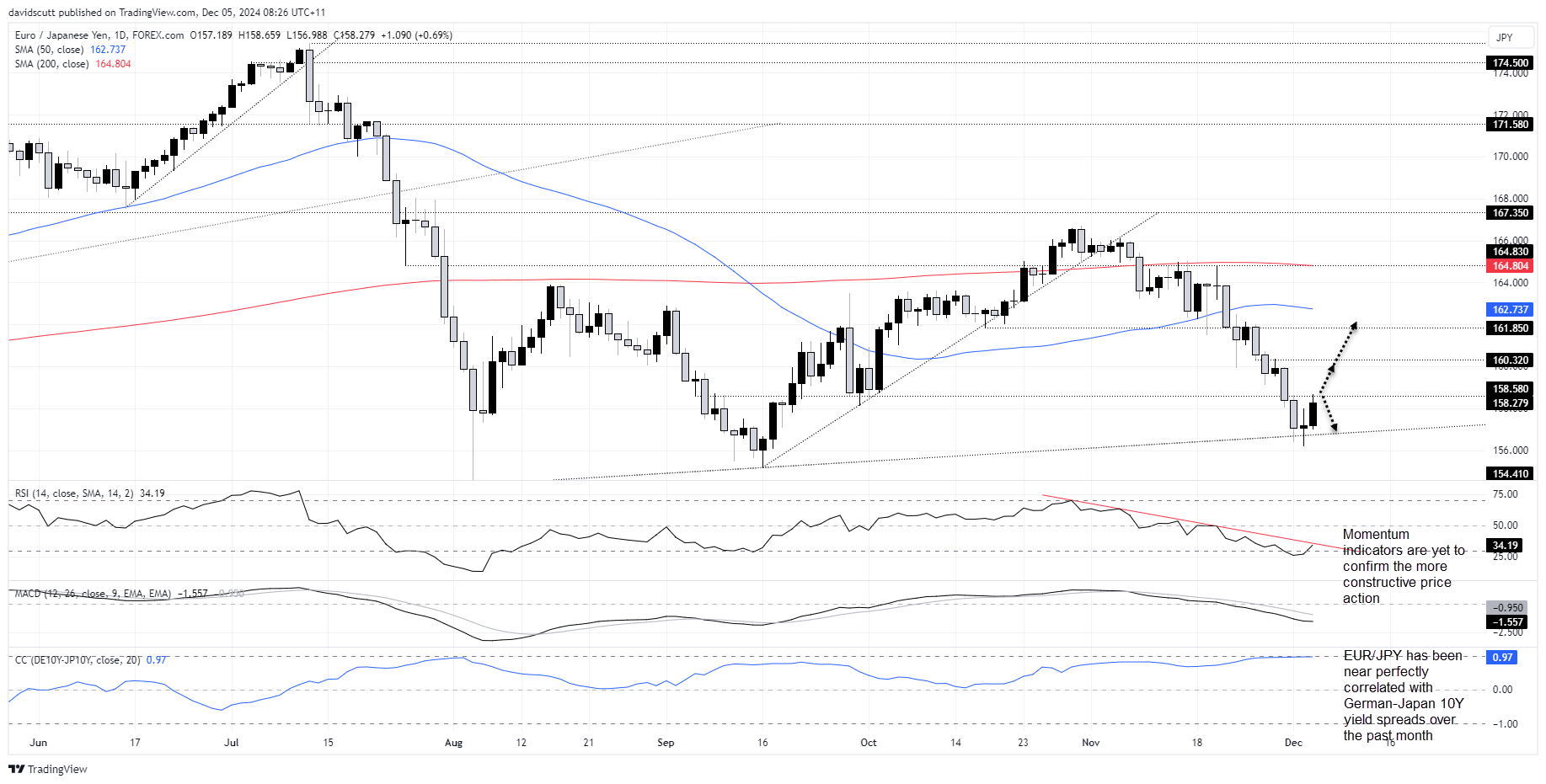

Before looking at setups in EUR/JPY, take note of the rolling 20-day correlation it has seen with 10-year bond yield differentials between Germany and Japan in the bottom pane, sitting at an extremely strong 0.97. Where spreads have moved, EUR/JPY has almost always followed.

EUR/JPY has completed a three-candle morning star pattern on the daily timeframe, a signal often seen around market bottoms. Two failed bearish breaks of the uptrend established in early August bolsters the signal from the pattern. While the price action has become more constructive for bulls, momentum indicators such as RSI (14) and MACD are yet to confirm, continuing to generate bearish signals. As such, there is no need to force trades in this environment. Let the price action tell you how to procced.

EUR/JPY stalled above 158.58 on Wednesday, making that a near-term level of note. If the price were to push above this level again and hold there, it would present a potential bullish setup, allowing for longs to be established above with a stop beneath for protection. 160.32 is a minor level that acted as both support and resistance earlier this month, making that an initial trade target. Above, tougher tests await at 161.85 and the 50-day moving average.

Alternatively, if the price is unable to break and hold above 158.58, another setup would be to sell beneath with a stop above for protection. Potential targets include the uptrend located around 156.75 today or 156.25, the low set on Wednesday.

GBP/JPY: bearish momentum turning?

Source: TradingView

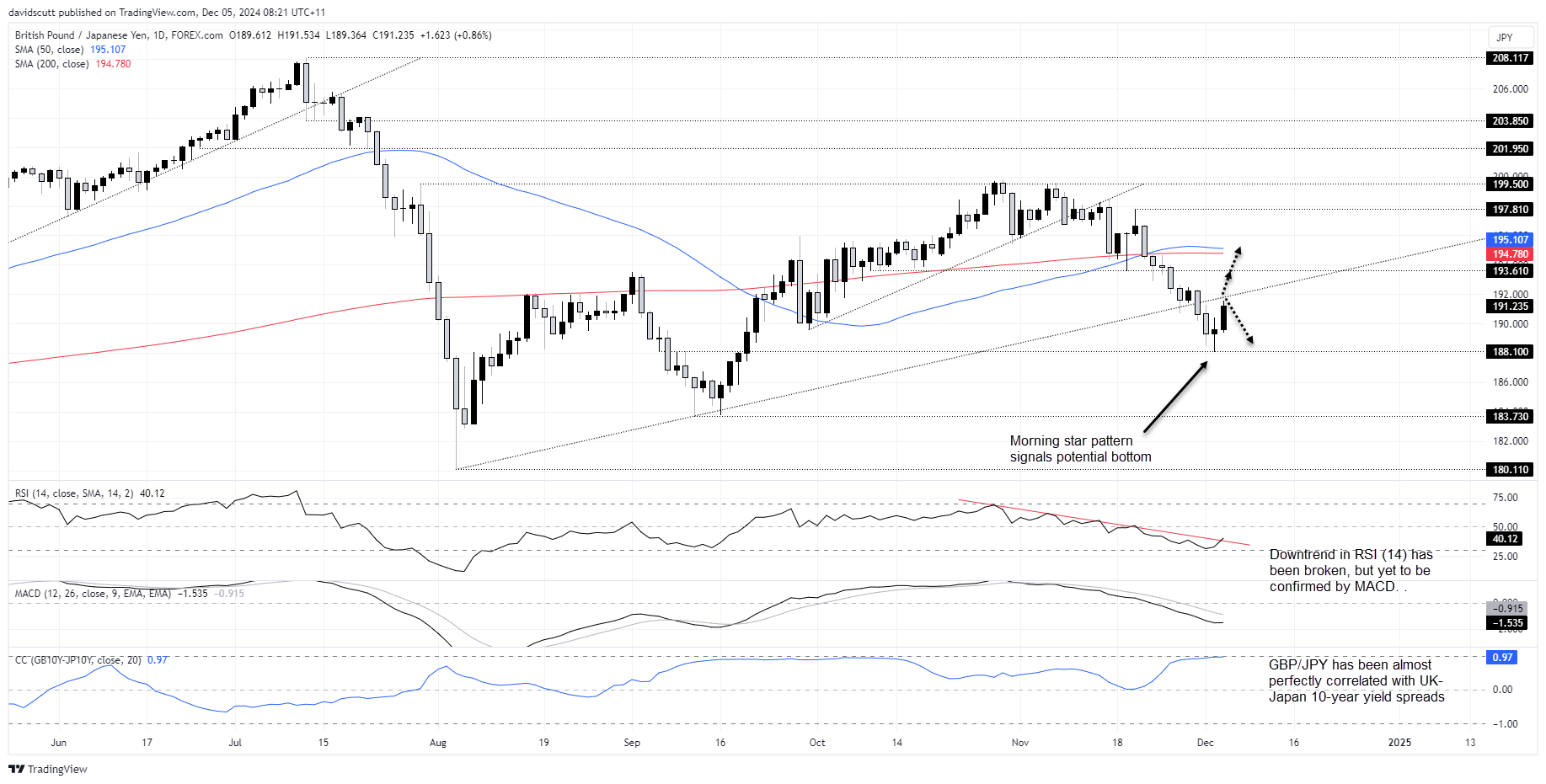

Like EUR/JPY, GBP/JPY has been strongly correlated with rate differentials between the UK and Japan over the past month on a daily timeframe, sitting at 0.96. There’s one checklist item to monitor when considering potential setups.

GBP/JPY has completed a three-candle morning star pattern, with the low struck on Tuesday coinciding with minor support at 188.10. If we have seen a near-term bottom, the first topside level of note is the uptrend established in early August. Prior to being broken earlier this month, the price bounced off this level on multiple occasions, suggesting it may now act as resistance.

Above, 193.61 and 50 and 200-day moving averages are located in close proximity, providing only limited runway for upside from a technical perspective. Even though RSI (14) has broken its downtrend, hinting momentum may be in the early stages of turning, MACD has yet to confirm the signal.

As for potential setups, a break and hold above the August uptrend would allow for longs to be established with a tight stop beneath entry level for protection. Targets as listed above. Alternatively, of the price is unable to break above the uptrend, the setup could be flipped with shorts established below with a tight stop above for protection. The obvious target would be 188.10 with 186 and 183.73 the next after that.

-- Written by David Scutt

Follow David on Twitter @scutty