- Australian household spending rises strongly, defying bearish sentiment

- RBA rate cuts priced in sooner, weighing on AUD/JPY

- AUD/JPY faces key battle at 96.22

Overview

Australia's latest household spending data offers a timely reminder not to get too bearish on the consumer despite the gloomy Q3 GDP headlines. Spending rose across all categories in October, especially discretionary. For AUD/JPY, which has been heavily influenced by Australia’s interest rate outlook recently, this warning is particularly relevant as traders shift forward the timing of expected RBA rate cuts next year.

Australians find cash to rock out

The headlines may paint a picture of Australian consumers running on empty, but October’s household spending data tells a different story. Households still found cash for Metallica and Pearl Jam tickets, with spending in the ‘Recreation and Culture’ category rising 1.5%, leading a broader 0.8% increase in total spending. Outlays climbed across all states and territories, led by New South Wales, the nation’s most populous and most indebted state.

While some households are feeling the pinch from elevated inflation and higher interest rates, the strong labour market continues to underpin spending. Australians, it seems, can still open their wallets when they want to.

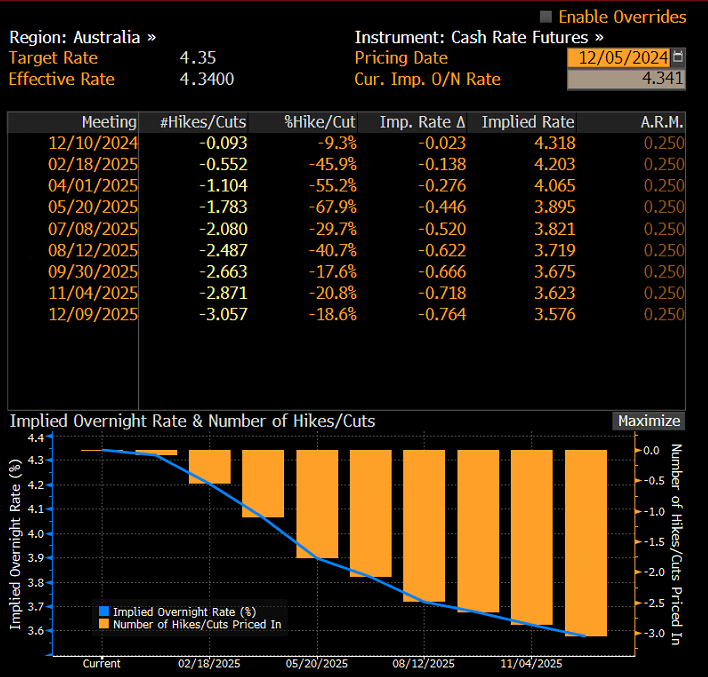

The strength in the data contrasts with market pricing for when the RBA is expected to begin lowering interest rates with swaps fully priced for the first 25bps move by April. While that partially reflects offshore factors such as the scale of expected Fed rate cuts next year, it’s quite the shift from only a month ago when the first move was not priced until August.

Source: Bloomberg

Australia’s Q3 GDP report released Wednesday was particularly influential, especially the flat household spending figure which was more a function of how the government’s energy subsidies were treated in the national accounts. However, the data is dated with more timely information pointing to the potential for stronger household demand, especially with savings being replenished.

The pull-forward of expected RBA rate cuts has driven recent volatility in AUD/JPY. As shown in the chart below, the 20-day rolling correlation with Australian three-year bond yields – which are shaped by the RBA’s cash rate outlook – currently stands at 0.9. Rate differentials between Australia and Japan for two, five, and ten-year yields are similarly strong.

The readthrough is that AUD/JPY has been strongly correlated with Australian interest rates, and they have been falling for much of the past month. That may need to continue to deliver additional AUD/JPY downside beyond that already seen.

AUD/JPY finding bids at 96.22

Source: TradingView

The price action in AUD/JPY suggests a reluctance to add to bearish bets near-term, with long downside wicks in each of the past three daily candles from 96.22. The hammer candle from Wednesday is another sign we may be nearing a bottom, even if momentum indicators such as RSI (14) and MACD continue to provide bearish signals, favouring selling rallies.

With Australian rates pricing arguably rich relative to timely economic data, another failure to break cleanly through 96.22 would present a decent bullish setup, allowing for longs to be established above the level with a stop beneath Wednesday’s low for protection. Resistance may be encountered around 97.50 and 98.00, with a sterner test likely at 99.44. Any could be used as targets, depending on risk-reward you desire from the trade.

Alternatively, if the price were to break and hold beneath Wednesday’s low, shorts could be established with a tight stop above 96.22 for protection. Aside from big figures at 95 and 94, another potential target would be 96.30, the low hit on September 11.

-- Written by David Scutt

Follow David on Twitter @scutty