US Non-Farm Payrolls (NFP)

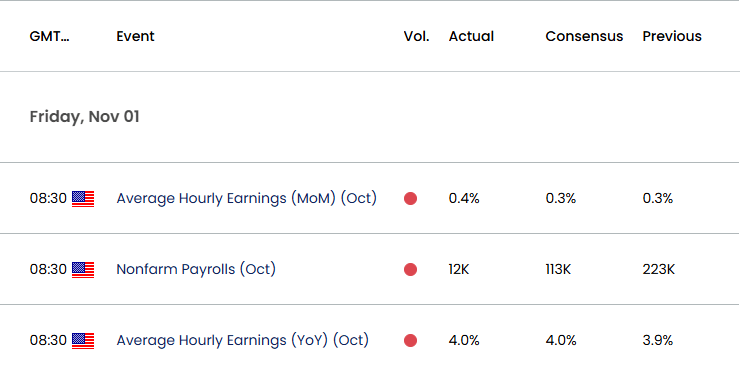

The US Non-Farm Payrolls (NFP) report showed a 12K rise in October versus forecasts for a 113K print, while Average Hourly Earnings widened to 4.0% from 3.9% during the same period.

US Economic Calendar – November 1, 2024

A deeper look at the report showed the Unemployment Rate holding steady at 4.1% in October, while the Labor Force Participation Rate narrowed to 62.6% from 62.7% the month prior.

The update from the Bureau of Labor Statistics (BLS) also revealed that ‘employment continued to trend up in health care and government,’ with the report going onto say that ‘employment showed little or no change over the month in other major industries, including mining, quarrying, and oil and gas extraction; wholesale trade; retail trade; transportation and warehousing; information; financial activities; leisure and hospitality; and other services.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

The US Dollar came under pressure after the weaker-than-expected NFP print, with EUR/USD spiking to a fresh session high of 1.0906. Nevertheless, the market reaction was short lived as EUR/USD closed the day at 1.0834, with the exchange rate struggling to hold its ground following the US election as it closed the following week at 1.0719.

Looking ahead, the US is anticipated to add 200K jobs in November, while the Unemployment Rate is expected to increase to 4.2% from 4.1% during the same period.

With that said, signs of weakening labor market may drag on the US Dollar as it fuels expectations for US lower interest rates, but a better-than-expected NFP report may generate a bullish in the Greenback as it curbs speculation for a Federal Reserve rate-cut in December.

Additional Market Outlooks

EUR/USD Struggles to Trade Back Above Former Support Zone

GBP/USD Recovery Vulnerable as Bear Flag Formation Takes Shape

USD/CHF Pullback Faces Positive Slope in 50-Day SMA

USD/CAD Defends Post-US Election Rally to Eye November High

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong