The US dollar has been on a strong rally in recent weeks, which has helped USD/CHF achieve a 7% rise from its September low. This surely pleases the SNB, who desire a weaker Swiss franc and were rumoured to have been intervening whenever USD/CHF dipped below 0.84.

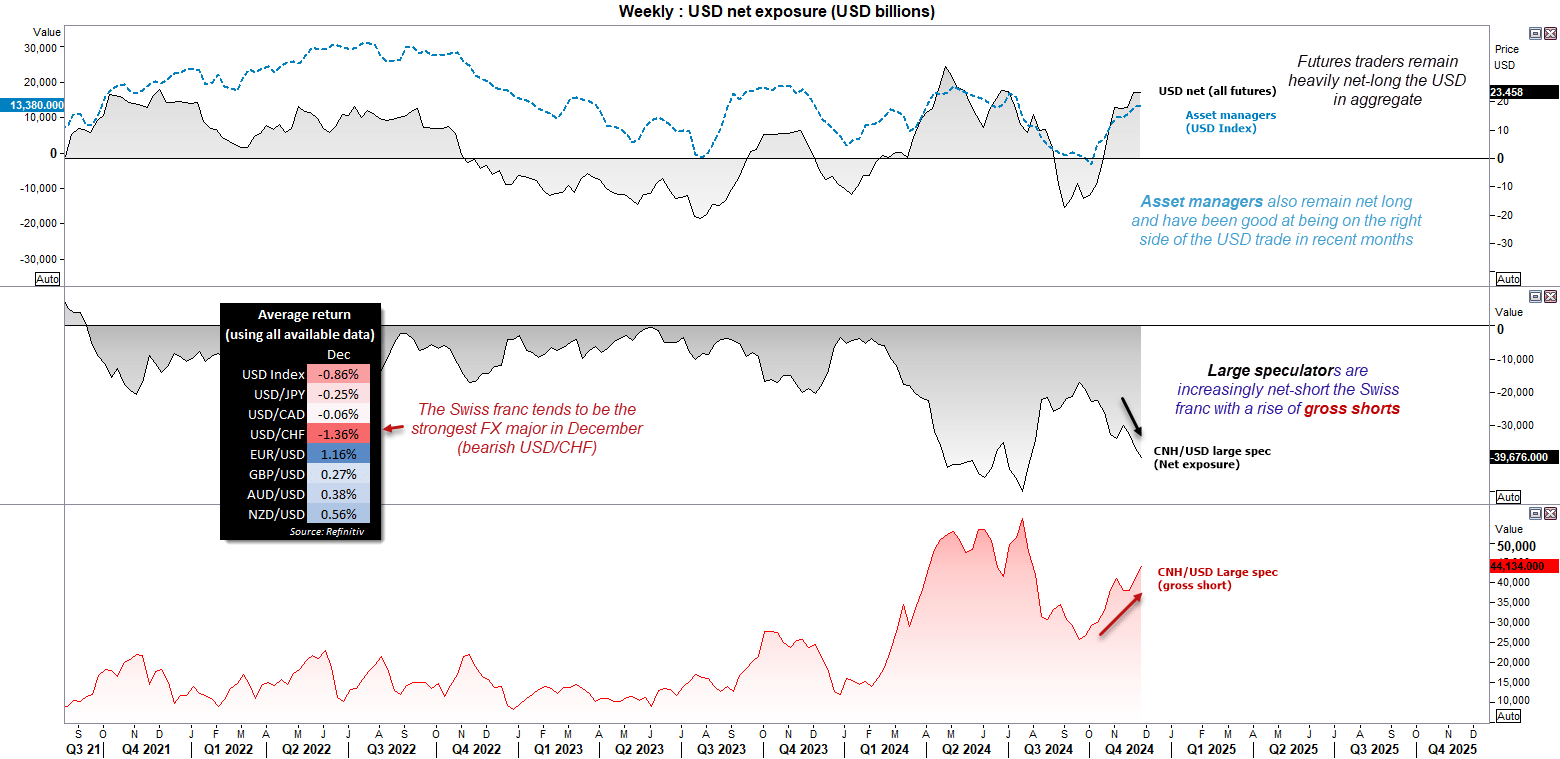

Futures traders have also been supportive of the trend, with large speculators increasing net-short exposure to the Swiss franc, while asset managers (who have been great at calling USD direction) remain net-long USD index futures. In fact, futures traders remain near their most bullish on the USD index in aggregate in nearly six months. All in all, this points towards a limited pullback for USD/CHF.

However, December is usually associated with losses for the US dollar, and the Swiss franc tends to outperform its FX peers alongside the euro in December. And this it at odds of current market positioning. The question now is whether seasonality will kick in to drag USD/CHF lower, or fundamentals and current market positioning will overshadow

Related analysis: The US dollar, seasonality and what that could mean for December

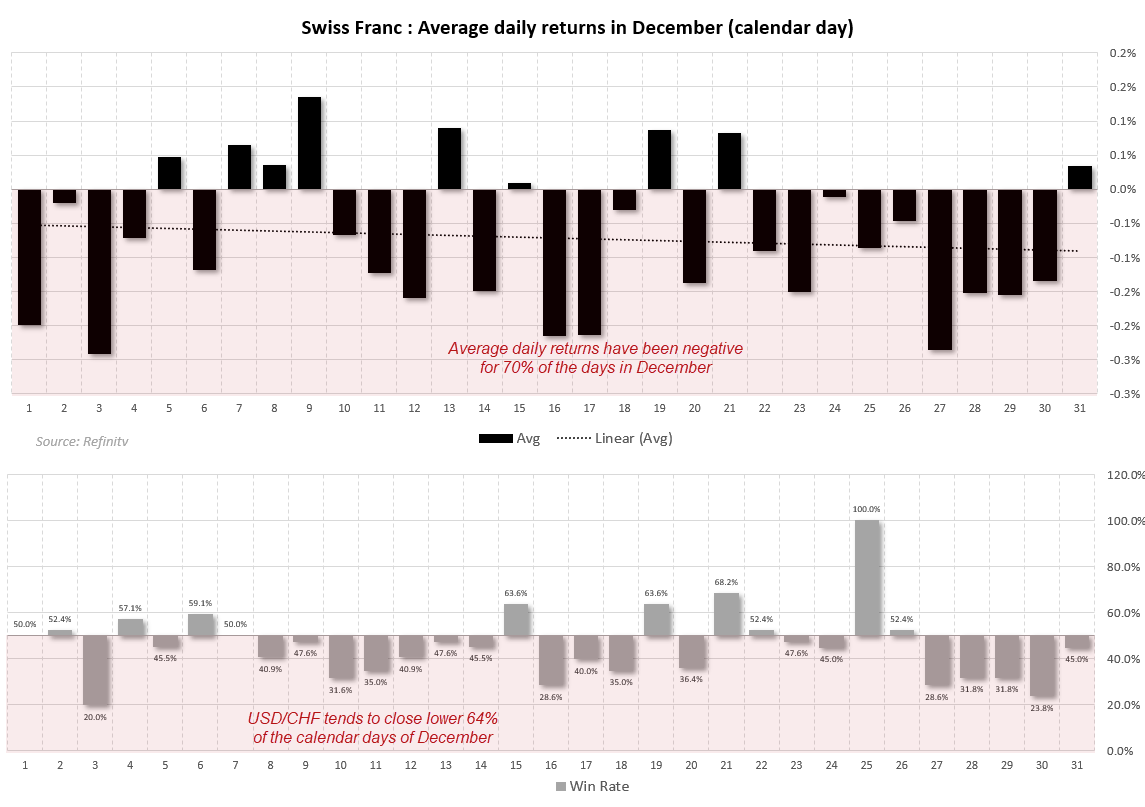

USD/CHF seasonality for December:

You can read the article above for a broader look at how the USD tends to perform during December, but the basic takeaway was that price action was choppy heading into Christmas and notably bearish between Christmas and new year.

Yet that doesn’t seem to be the case on USD/CHF, which shows a stronger tendency to trade lower throughout the month of December. There is also a more pronounced relationship between negative average returns and down days throughout the month, which suggests seasonality might stand a greater chance of success on USD/CHF, than say the USD index futures contract.

- USD/CHF has an average return of -1.36% in December

- This has generally made the Swiss franc the strongest FX major in December

- During December, 70% of the tradable days have posted negative returns

- And 64% of them have closed lower

- Unlike the US dollar index, the bearish bias is more consistent throughout the month in December alongside the negative win rate

USD/CHF technical analysis

The daily chart shows a strong rally from 0.8400 to 0.8950, but a countertrend move is clearly underway. A head and shoulders top has also formed, which projects a downside target of 0.8652. However, I am questioning whether USD/CHF can reach that target unless fundamentals supporting the rally and market positioning changes.

Furthermore, USD/CHF is also heading towards a series of moving averages such as the 200-day EMA (0.8764), 100-day EMA (0.8723) and 50-day EMA (0.8742) which could make it a bit trick for bears along the way. Also factor in the potential for a strong NFP figure today, we could see a bounce higher before losses resume.

Ultimately, I suspect bears could be frustrated over the near-term and prices hold above the EMAs. There is also a risk that the H&S top becomes invalidated, before its next leg lower kicks in towards the end of the year. This could see gains capped and losses limited, before prices head towards 0.8700. At which point I think the USD rally could regain traction as we head into January, a month usually associated with a strong dollar performance.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge