Key Events:

- USDJPY is consolidating near the 150-mark

- Silver is rebounding from one-year support

- The US Dollar index is holding above its one-year resistance ahead of today’s NFP data

- Key market catalyst next week: US CPI data release on Wednesday

The Dollar's pullback below the 108 zone, coupled with rising inflation figures in Japan, is shifting market sentiment. The latest Tokyo Core CPI has risen from 1.8% to 2.2%, boosting expectations for a potential BOJ rate hike on December 19th, just after the anticipated Fed rate cut on December 18th.

Another crucial factor is the "Trump effect" on the US Dollar, which is countering the bearish pressure from priced-in Fed rate cuts as we head into the December holidays. Demand for the US Dollar may increase alongside interest in precious metals, including silver. This dynamic is likely to keep a relatively bullish foundation for both assets unless key support levels are breached.

Technical Analysis: Quantifying Uncertainties

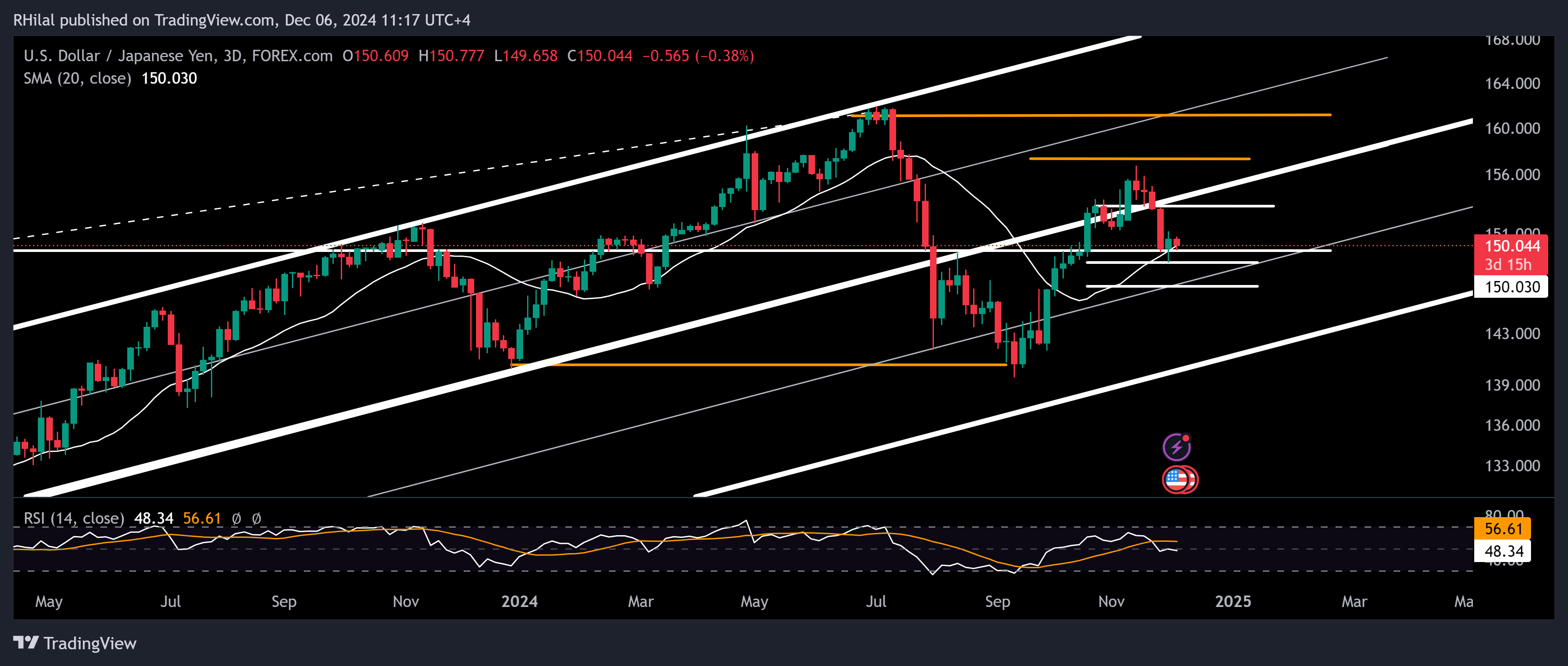

USDJPY Forecast: 3Day Time Frame – Log Scale

Source: Tradingview

USDJPY is currently testing key support at 148.60, with the next level to watch at 146.80 in the event of further downside. Deeper declines could retest levels 144 and 140. The current technical setup, however, leans bullish:

- The 3-day RSI has rebounded from the neutral zone

- Price action is holding above the 20-period SMA following the November drop

- The 150-mark continues to serve as psychological support

If the 148.60 low holds firm, the next resistance is at 153.30, aligning with the lower boundary of the long-term trendline connecting consecutive lows from January 2023 to 2024. Longer-term resistance levels include 157 and 160, reflecting significant Yen weakness and potential BOJ intervention risks.

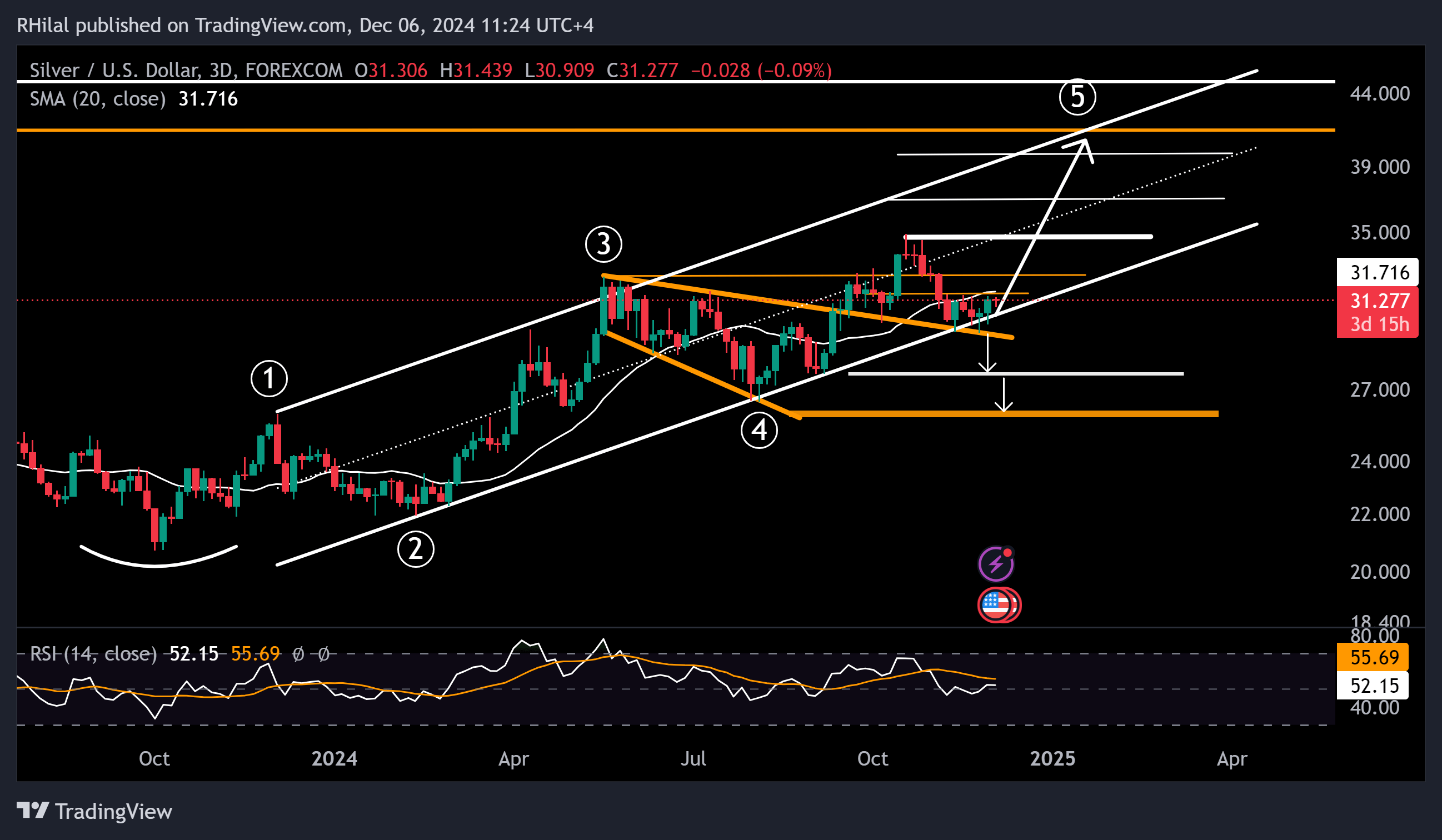

Silver Forecast: 3Day Time Frame – Log Scale

Source: Tradingview

Silver is in rebound mode, trading above the $29.80 support, which aligns with the trendline connecting consecutive higher lows over the past year. Resistance remains strong at $31.50. Key technical indicators signal that the primary uptrend is intact:

- Silver continues to respect the lower channel boundary and May-November support levels

- The 3-day RSI is rebounding from the neutral zone

While gold has broken below the lower boundary of its primary uptrend following the US presidential election, silver remains resilient. Critical support levels are intact until convincingly breached.

Upside potential: Above $31.50, resistance levels to watch include $32.50, $35, $37, and $40

Downside Potential: Below $29.60, support levels lie at $27.80, $26.80, and $26.00

--- Written by Razan Hilal, CMT – on X: @Rh_waves and Forex.com Youtube Channel