All week, traders were waiting for the release of the November jobs report to see whether it will confirm market pricing of a 25 basis point rate cut in December. In short, it may well have. Although wages remained strong and the headline nonfarm payrolls data beat expectations, it was the reports other metrics that caused the dollar to wobble. Traders saw rising unemployment rate, falling participation rate and the weak household survey – with the latter showing a big drop – as reasons to sell the USD/JPY. But with the EUR/USD dropping as well, it wasn’t just a clean dollar reaction you would have expected. The USD/JPY forecast is subject to change greatly in the coming weeks with US CPI due next week followed by FOMC and BoJ decisions the following week.

NFP fails to impress

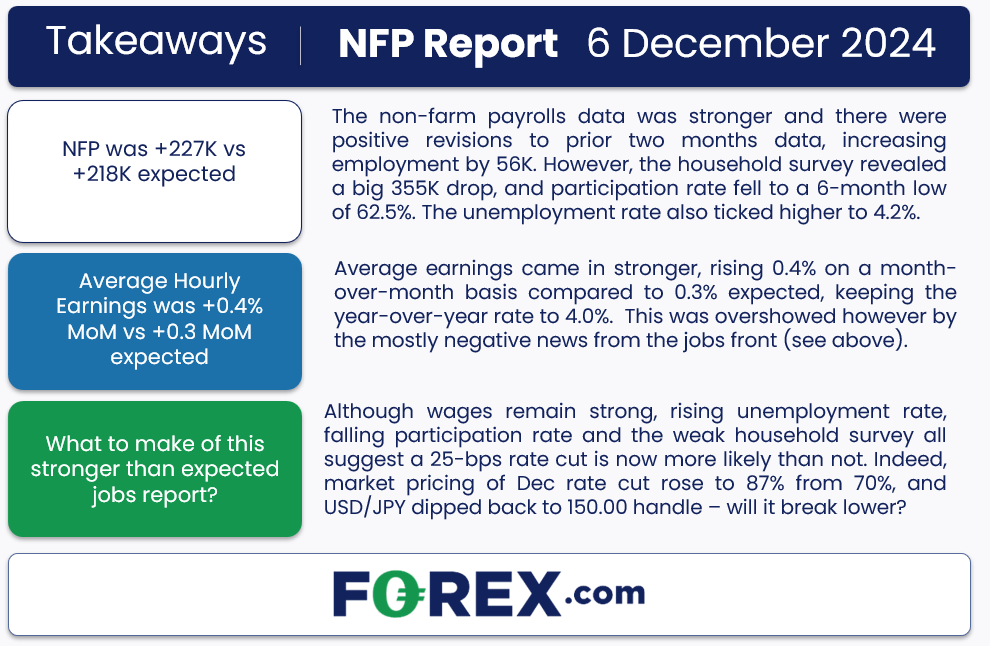

The non-farm payrolls data was stronger and there were positive revisions to prior two months data, increasing employment by 56K. However, the household survey revealed a big 355K drop, and participation rate fell to a 6-month low of 62.5%. The unemployment rate also ticked higher to 4.2%.

Average earnings came in stronger, rising 0.4% on a month-over-month basis compared to 0.3% expected, keeping the year-over-year rate to 4.0%. This was overshowed however by the mostly negative news from the jobs front.

US CPI among next week’s data highlights

US inflation data (CPI and PPI) will be released next week, the last set of key data before the Fed meets the following week. CPI will be published on Wednesday, December 11 at 13:30 GMT. Following Trump’s victory in the presidential election race, investors have sharply reduced their expectations about further US interest rate cuts in 2025. The upcoming December rate decision is unlikely to be impacted by this CPI report, unless we see a super-hot print. But whether the Fed will go ahead with a cut at its initial 2025 meetings will be influenced, among other key data highlights, by this CPI report, although it is employment that the Fed is now more focused on.

But after today’s NFP report, a 25-bps rate cut is now more likely than not. Indeed, market pricing of a December rate cut rose to around 87% from 70%, and USD/JPY dipped back to 150.00 handle – will it break lower now?

Yen strengthens again ahead of BoJ decision

The EUR/JPY fell along with the USD/JPY, suggesting a broad-based yen rally following the US nonfarm payrolls report. In recent weeks, the yen has strengthened against most major currencies, particularly commodity dollars, the euro, and to a lesser extent, the US dollar. This surge has been driven by investor speculation that the Bank of Japan might raise interest rates at its final meeting of 2024, scheduled for later this month.

However, a couple of days ago comments from BoJ board member Toyoaki Nakamura tempered this momentum. Nakamura struck a dovish tone, urging a cautious approach to policy tightening and raising concerns about the sustainability of wage growth.

Technical USD/JPY forecast: Key levels to watch

Source: TradingView.com

The USD/JPY has again dropped to test the key 149.40-150.00 support zone where it was residing at the time of writing. A close below this zone could potentially pave the way for this week’s earlier of 148.65 and then 146.50 – the next potential support level. A daily close above or within this zone 149.40-150.00 support zone will keep the bulls interested and we may then see a potential recovery towards the 151.20-152.00 resistance range. All told, the odds of a breakdown look the more likely scenario, owing to the drop in bond yields and expectations about a potential BoJ rate hike in two weeks’ time.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R