- Gold outlook indicates near-term consolidation with possible bearish momentum despite long-term bullish prospects

- Upcoming US CPI data and the Fed's December meeting are likely to influence gold prices

- Watch $2668 for potential bullish reversal and $2580 as critical short-term support

Consolidation period for gold

Gold prices (XAU/USD) have been range-bound recently, following a pullback from record highs in late October. This decline ended a nine-month winning streak, with November closing in the red. Some investors anticipate a more significant correction before re-entering the market, leading to a cautious short-term gold outlook. With the US Consumer Price Index (CPI) report and the Federal Reserve’s final meeting of the year approaching, gold’s next moves will hinge on these critical events.

A Stronger Dollar Limits Gold’s Appeal

Since September, the US dollar has rallied sharply, affecting gold prices by making the metal more expensive in key markets like India and China. Together, these nations account for over half of the global jewelry market, according to the World Gold Council. Additionally, investors’ pivot toward riskier assets, including equities and cryptocurrencies, has weakened gold demand.

Geopolitical developments also play a role. While a fragile ceasefire between Israel and Hezbollah temporarily reduced safe-haven demand, ongoing tensions and uncertainties in Europe and Asia maintain gold’s relevance as a hedge. This dynamic reflects gold’s delicate balance between its bullish long-term fundamentals and short-term pressures.

Friday’s jobs report unlikely to be a game changer for gold

Friday’s release of US Non-Farm Payroll (NFP) report highlighted mixed economic signals. While headline job growth exceeded forecasts, a 355K drop in household employment and an uptick in the unemployment rate to 4.2% tempered optimism. Wage growth of 0.4% month-over-month surpassed expectations but failed to overshadow broader concerns. With the Fed increasingly focused on employment, the upcoming CPI report may only influence gold prices significantly if it delivers a surprising result.

Technical gold outlook

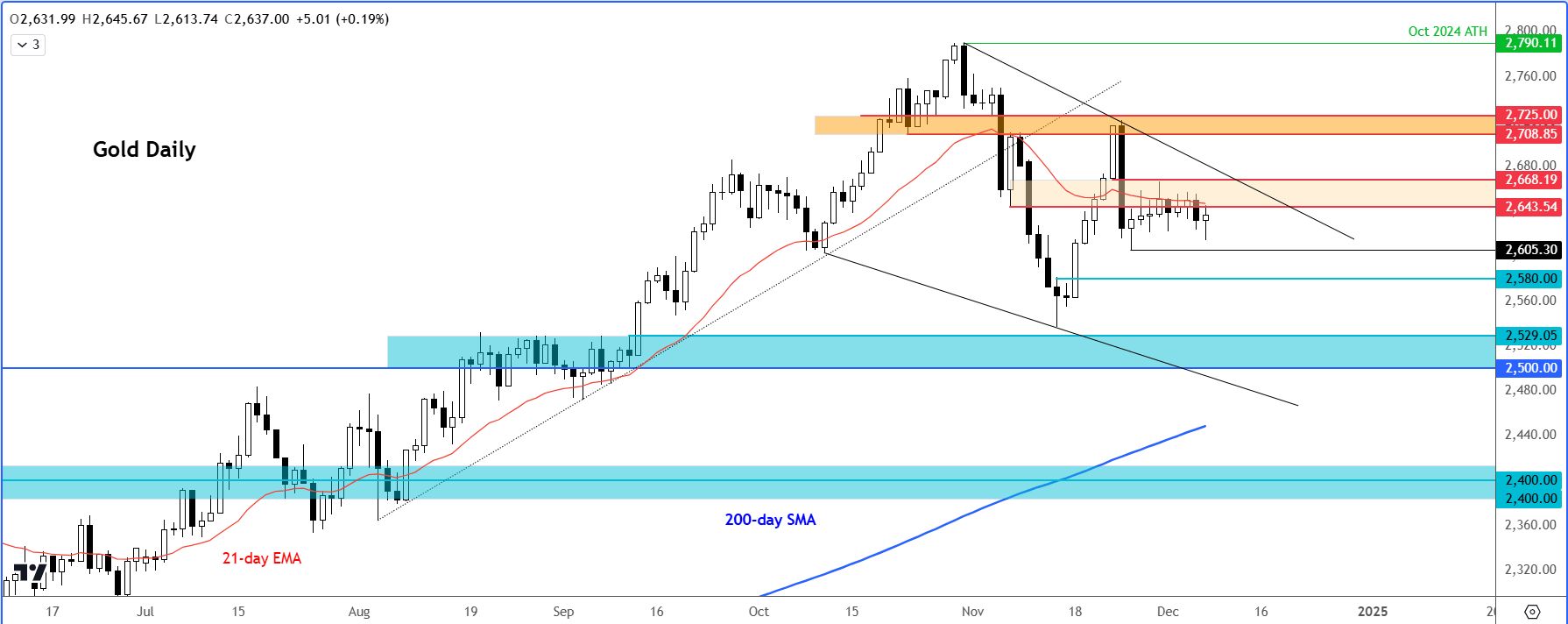

From a technical standpoint, gold faces short-term downside risks. A bearish engulfing candle formed two weeks ago, reinforcing resistance at $2708-$2725. This zone, once a support level, now serves as a major obstacle to upward momentum.

Source: TradingView.com

Key levels include:

- $2668: A daily close above this level could signal a bullish reversal as it would mark an interim higher high

- $2580: Breaching this base may pave the way for a decline towards $2500-$2530, a vital support zone

- $2440-$2400: Here, the 200-day moving average ay provide long-term support if selling intensifies

All told, the gold outlook in the near term remains cautious as traders weigh various factors, including dollar strength, geopolitical risks, and upcoming US economic data. While long-term trends support a bullish perspective, short-term resistance and bearish momentum warrant a careful approach. The upcoming CPI data on Wednesday and the Fed’s meeting in the following week will likely define the trajectory for gold price heading into year-end.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R