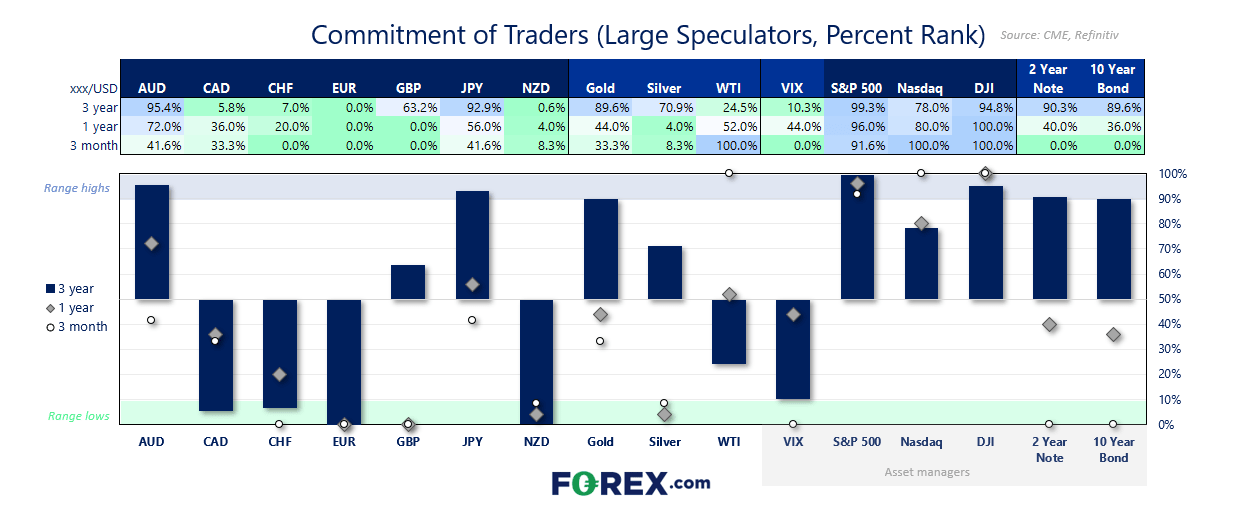

Market positioning from the COT report – Tuesday, 3rd December 2024:

- Asset managers reduced net-long exposure to the USD index for the first week in nine

- Yen futures flipped to net-long exposure for the first week in seven among large speculators flipped to net-long exposure (and asset managers are close to following them)

- Net-short exposure to EUR/USD futures rose to a 4.5 year high, although be a mere 1.5k contracts

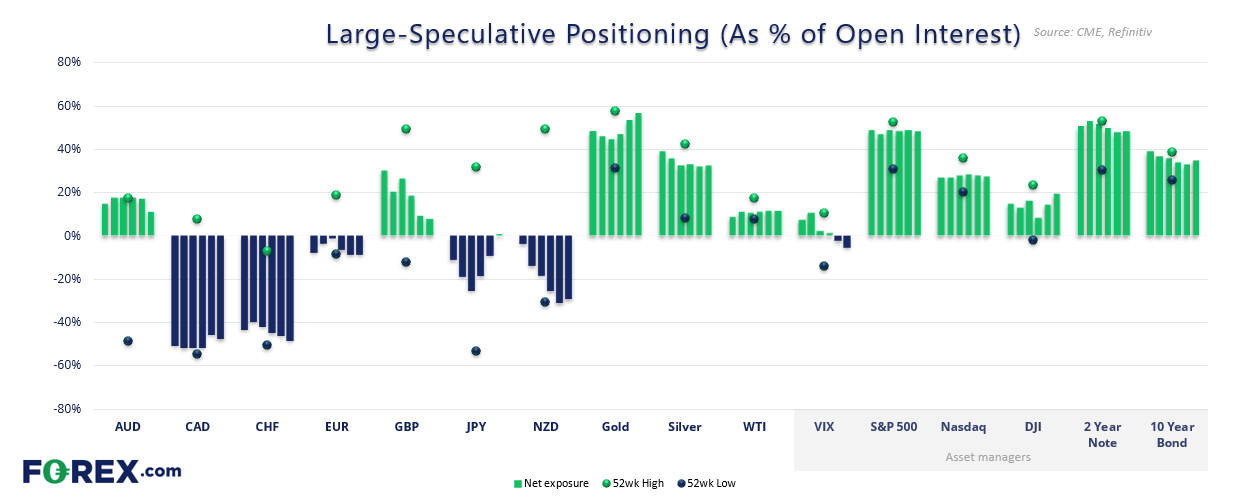

- Large speculators reduced net-long exposure to AUD/USD futures by -10.4k contracts, while asset managers increased their net-short exposure by 8.4k contracts

- Traders were their least bearish on GBP/USD futures in 28 weeks

- VIX futures were net-short for a second week among asset managers

- Net-long exposure to gold futures increased among large speculators and asset managers for a second week, by 9.4k and 1.5k contracts respectively

- Net-long exposure to silver and copper futures also ticked marginally higher, by 514 and 477 contracts, respectively

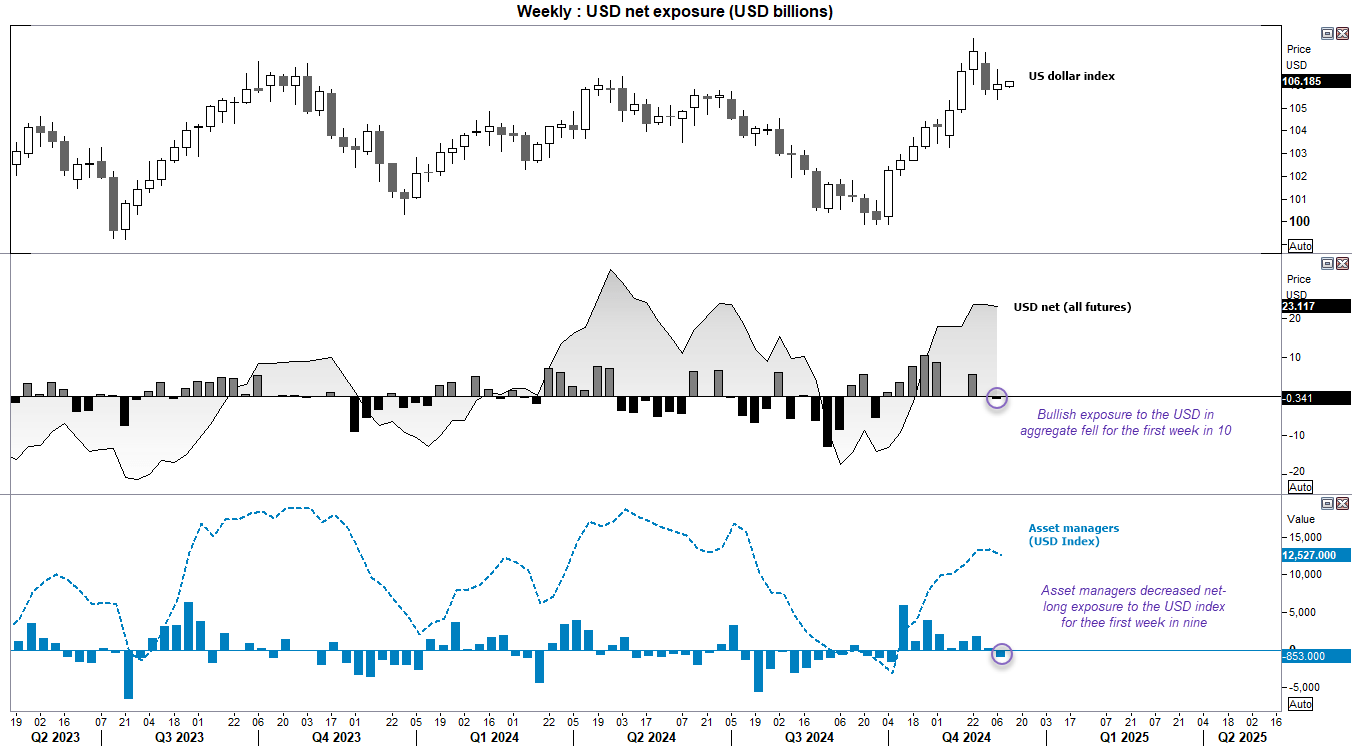

US dollar positioning (IMM data) – COT report:

Small but potentially important signs that the USD is in for some chop emerged in USD positioning last week. Asset managers trimmed net-long exposure for the first week in nine and traders were less bullish on the USD in aggregate for the first week in ten.

This is not a call to become overly bearish the USD, but more to highlight further clues that the strong run from 100 has changed character. I believe we could be looking at a higher USD in the first half of 2025, but first we need a pause in trend (if not a pullback) before that trend resumes. And an important first step is the slight reductio of long exposure among traders.

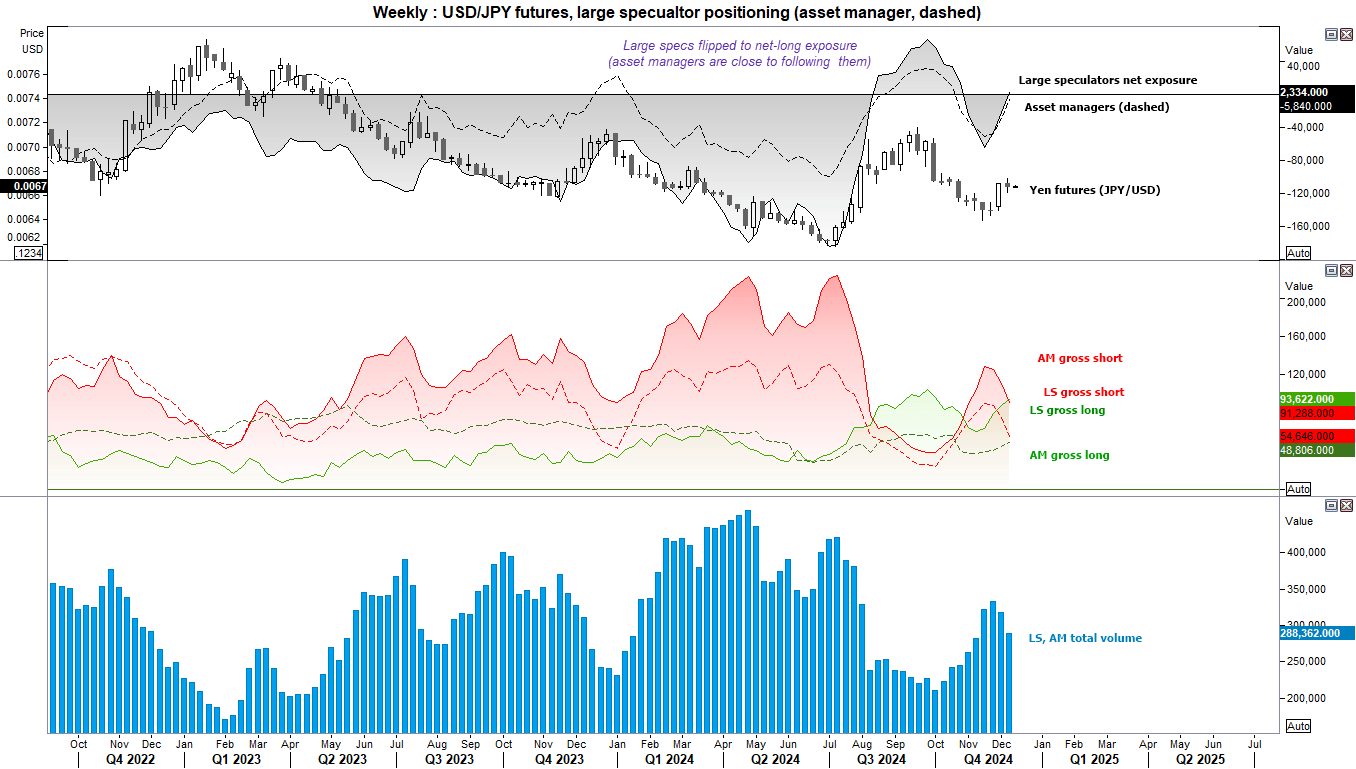

JPY/USD (Japanese yen futures) positioning – COT report:

Large speculators flipped to net-long exposure yen futures for the first time in six weeks. And it did not come without warning from myself or market positioning over the prior two weeks. Both sets of traders have increased long bets over the past four weeks and decreased shorts over the past three.

Bullish exposure is certainly not extreme at just 2.4k contracts, but with odds of a BOJ hike rising and asset managers net-short by just 5.8k contracts, we could be looking at a stronger yen as we head into the new year given the turbulence we may face during Trump’s second term.

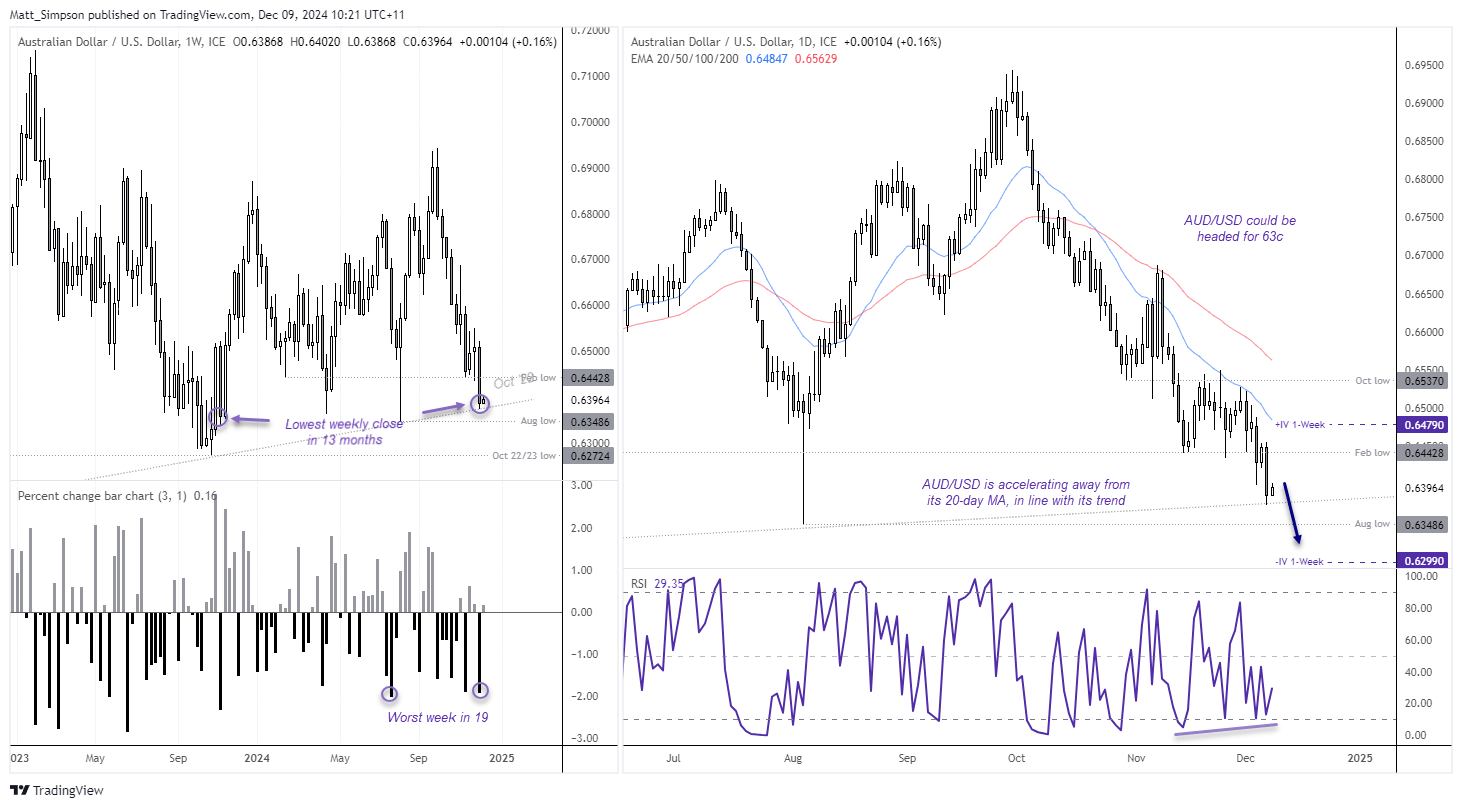

AUD/USD (Australian dollar futures) positioning – COT report:

Futures traders performed a bearish adjustment towards AUD/USD of around 19k contracts last week. Large speculators reduced net-long exposure by -10.4k contracts while asset managers increased their net-short exposure by 8.4k contracts. In both cases the move was driven by an increase of shorts and reduction of longs.

With prices testing 2022 trend support, a break beneath it seems more likely than not given the rising odds of RBA cuts, strong US economic data and underperformance of the Chinese yuan.