US futures

Dow future 0.12% at 44,663

S&P futures -0.01% at 6085

Nasdaq futures -0.14% at 21579

In Europe

FTSE 0.64% at 8359

Dax 0.19% at 20405

- US stocks await the next catalyst

- Fed December rate cut expectations rose after the NFP

- Global geopolitical risks keep mood cautious

- Oil rises after China signals a change in monetary policy stance

Stocks muted awaiting the next catalyst

U.S. stocks are all set for a muted open after reaching record highs last week and as investors look ahead to inflation data later in the week.

Stocks in the US have rallied across the past three weeks as the Trump trade continued to play out.

The main focus this week is the CPI report, which is scheduled to be released on Wednesday and is expected to show a 0.2% MoM and a 2.7% Yo, up from 2.6%.

The data will come as expectations for a 25 basis point rate cut in December shot up to 85% after Friday's nonfarm payroll report. The NFP showed job growth increased in November, but the unemployment rate also rose to 4.2%. After a December rate cut, the Fed is expected to cut rates around once a quarter.

Investors are also monitoring developments in Sri Lanka, France, and South Korea, keeping the mood cautious while lifting safe-haven Gold.

Corporate news

Macy’s is set to open 3% higher following reports that activist investor Barrington Capital is urging the retailer to create a real estate unit and consider options with Bloomingdale's and Bluemercury Chains after building an undisclosed stake.

Tesla is up over 2% after Deutsche Bank highlighted the EV maker as one of its top picks for 2025. The bank cited its leadership in autonomous driving and its position to withstand industry headwinds.

Nvidia trades 2% lower after China launched an investigation into the chip maker over suspected violations of anti-monopoly law.

You ask listed shares of Chinese companies are expected to open sharply higher after the Chinese politburo hinted at a shift to looser monetary policy next year. Alibaba is up 6% premarket, and PDD has climbed 9%.

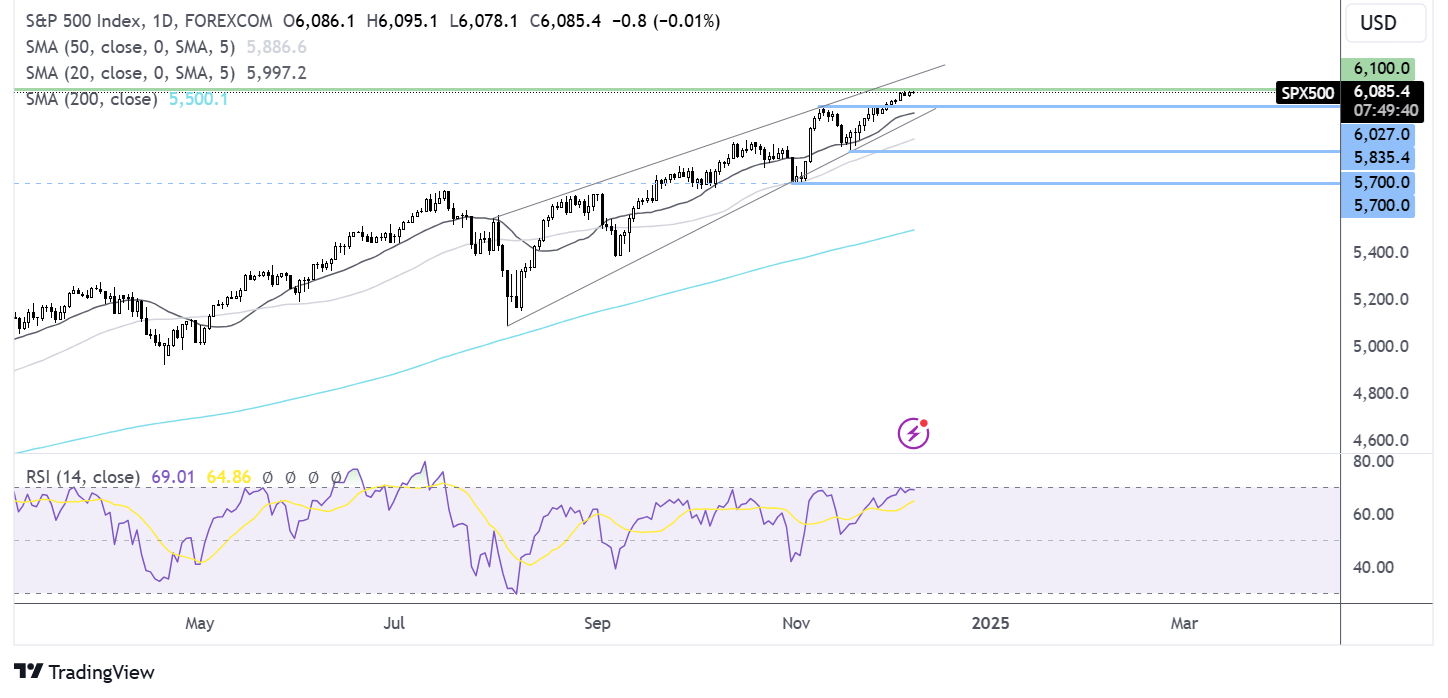

S&P500 forecast – technical analysis.

The S&P 500 has been rising to fresh record highs, reaching 6100, the round number. The move higher appears to be losing steam. Still, buyers will look to expect gains towards 6150, the rising trendline resistance. Meanwhile, support can be seen at 6027, the November high. Below here 6000 and 5970, the rising trendline support come into play.

FX markets – USD is flat, AUD/USD rises

The USD is holding steady after gains last week. Attention is Wednesday’s inflation data for more clues over whether the

EUR/USD is unchanged despite investor confidence tumbling to a 13-month low. The Sentix Investor confidence gauge dropped to -17.5 from -12.8. The fall comes as the economic outlook deteriorates in the region and amid political uncertainty in France and Germany.

AUD/USD has rallied over 1% following China's change of monetary stance to appropriately loose next year. A looser monetary policy could help restore growth and confidence in Australia’s largest trading partner.

Oil rises as China changes its policy stance

Oil prices were rising over 1.4% at the start of the week, boosted by geopolitical developments in the Middle East and a change in China's monetary policy stance.

According to an official report from a meeting of top Communist Party officials, China will adopt a moderately loose monetary policy stance, as it did in 2010 when it sought to recover from the global financial crisis.

This is expected to help the growth outlook and improve the oil demand outlook. Last week, OPEC+ cited the weak demand outlook in China as a reason to leave production cuts in place until Q2 2025.

Separately, rebels overthrew the Syrian President Bashar al-Assad, adding to political uncertainty in the Middle East.