The Politburo said on Monday that China will switch to an “appropriately loose” monetary policy in 2025, marking the first time it has eased its stance since the GFC. Unconventional counter-cyclical adjustments will be stepped up, to focus on boosting consumption and expanding domestic demand.

China’s indices rallied on the announcement, sending Hang Seng futures over 8% higher from Monday’s low while China A50 futures gained over 6% from the week’s low. The yuan was stable which prevented USD/CNH from breaking above 7.3, in turn allowing AUD/USD to rally from its 2022 trend support level.

AUD/USD and NZD/USD were the strongest FX majors during a risk-on day while the Japanese yen was the weakest. This could see AUD/JPY and USD/JPY gain further traction for bulls over the near term before their anticipated next legs lower begin.

Economic events in focus (AEDT)

It is highly unlikely the RBA will cut rates today, despite growing excitement that they will cut three times next year, beginning in April. They’ll want to see tomorrow’s jobs and quarterly CPI figures in January before entertaining any such thoughts, but something to look out for in their statement is if or how they acknowledge last week’s weak GDP figures. If they do, it could pull forward expectations of a cut to Q1 a tad and unwind some of yesterday’s gains on AUD/USD.

- 10:50 – JP GDP external demand (Q4), money supply (Nov)

- 11:30 – AU business confidence (NAB)

- 14:00 – CN trade balance (Nov)

- 14:30 – RBA interest rate decision (no change expected)

- 14:35 – JP 5-year JGB

- 17:00 – JP machine tool orders (Nov)

- 18:00 – DE CPI

- 22:00 – US small business optimism (Nov)

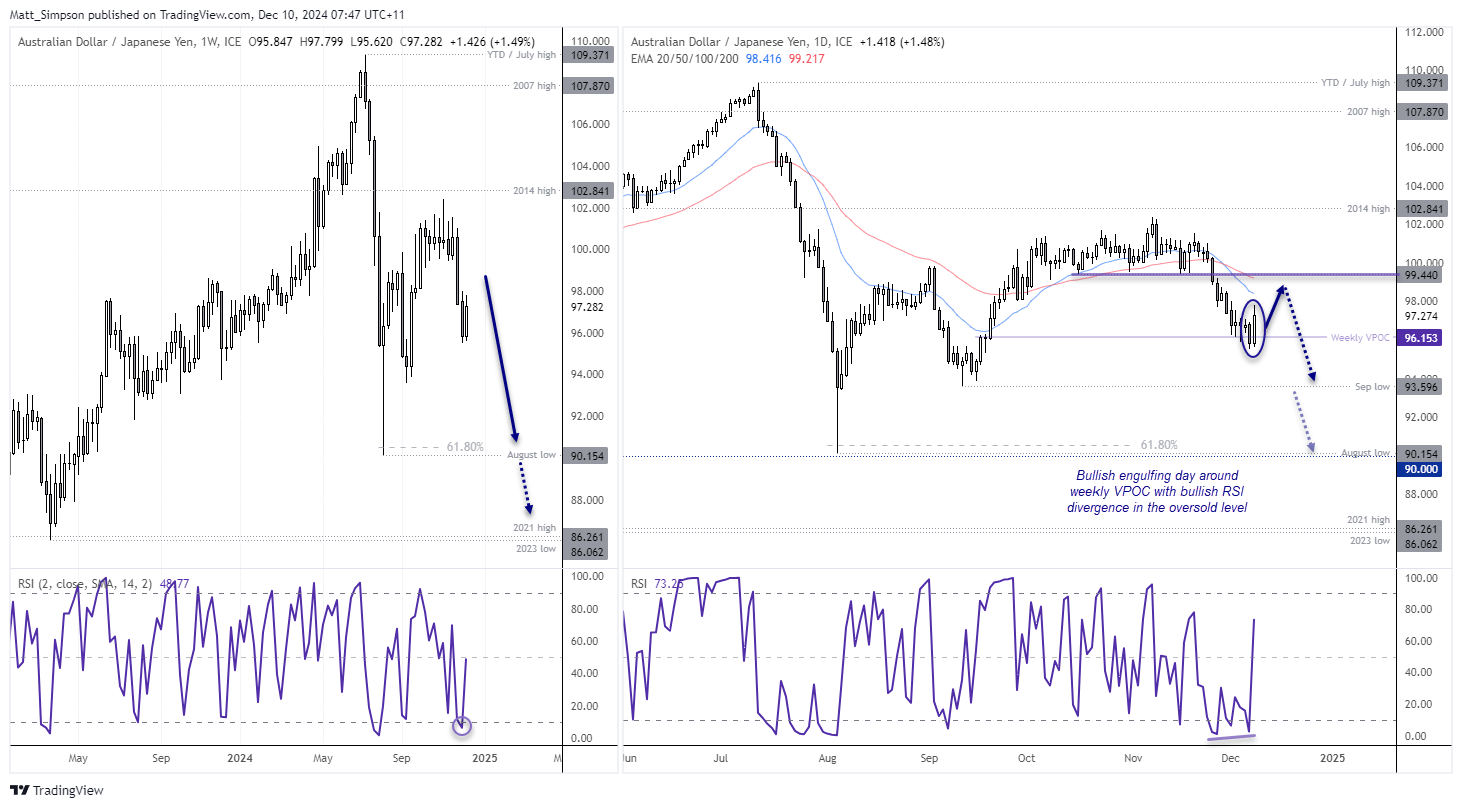

AUD/JPY technical analysis

Two weeks ago, I outlined a bearish scenario for AUD/JPY based on price action clues on the weekly chart. Not that I’m complaining, but the bearish move arrived sooner than I had anticipated (within 24 hours of the video, to be exact). But the market has clearly topped out for now and could be headed for the August low, a break beneath which brings the 86 handle into focus near the 2021 high / 2023 low.

Yet bullish mean reversion is underway, having formed a bullish engulfing day around a weekly VPOC (volume point of control). Bulls could seek dips within Monday’s range to target the 20-day EMA (98.42) or 50-day EMA (99.21) near the original breakout level of 99.44.

Alternatively, bears could wait for evidence of a swing high to form on a lower timeframe around forementioned resistance levels, in anticipation of its next leg lower once momentum realigns with the move on the weekly chart.

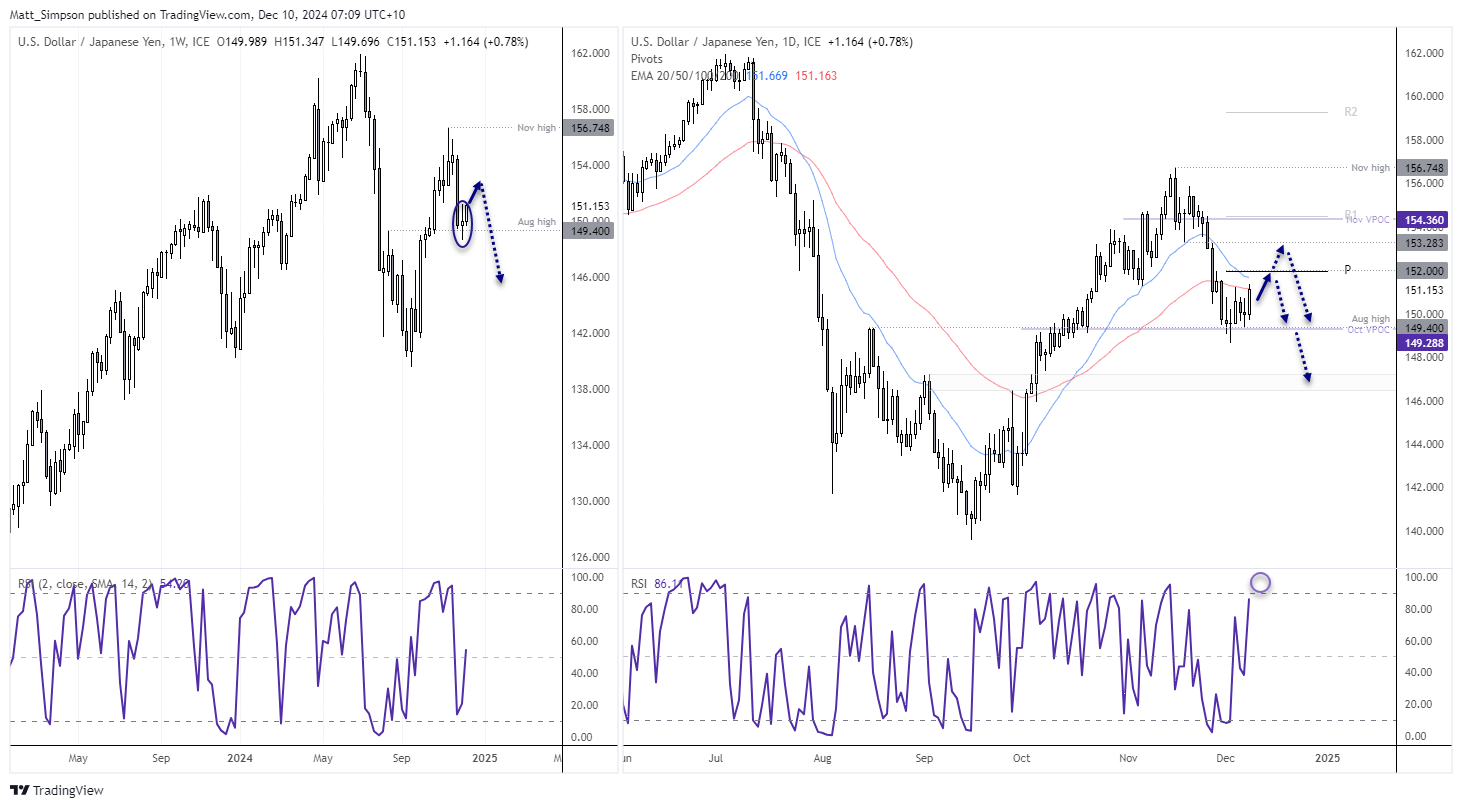

USD/JPY technical analysis:

Last Wednesday I warned of an incoming bounce on USD/JPY. It reached my weekly pivot-point target of 151.3 but 152 is still up for the taking, with prices just 70-ips beneath the level. Yet Monday’s price action now has me wondering whether another bounce could exceed 152 before USD/JPY embarks on its next leg lower.

A higher low formed on Friday in the form of a Rickshaw man doji, perfectly at the August high and October VPOC. Bullish range expansion kicked in on Monday. Also note that prices are now testing the top of last week’s spinning top doji.

- Like AUD/JPY, bulls could seek dips within Monday’s range on USD/JPY in anticipation of another leg higher. A break above 152 brings the 153.28 low into focus.

- Given the daily RSI (2) is approaching overbought, bears could also watch for evidence of a swing high around 152, 153-153.28 in anticipation of its next leg lower.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge