EUR/USD looks to the ECB rate decision

- ECB is likely to cut rates by 25 bps

- The focus will be on rhetoric and staff projections

- US PPI & jobless claims are due

- EUR/USD trades between 1.05 – 1.06

EUR/USD steadies above 1.05 after 4-days of losses, amid USD weakness and ahead of the ECB rate decision.

We expect the ECB to cut rates by 25 basis points, bringing them to 3%; however, a 50-basis-point cut cannot entirely be excluded. In fact, the market would likely focus more on communication. The updated staff forecast could see the inflation target being reached sooner next year, which could enable the ECB to cut rates by 25 basis points but with a more dovish tone.

Recent data, including the composite PMI at a 10-month low and political uncertainty in Germany and France affecting economic sentiment, also give the ECB reason to adopt a more dovish stance.

The market is pricing in 150 basis points worth of cuts between now and the end of next year. A dovish-sounding Christine Lagarde could fuel rate-cut bets, pulling EUR lower.

The USD is easing but continues to trade in a narrow range, following US CPI data yesterday, which supports the view the Fed will cut rates next week and ahead of PPI data today.

PPI is expected to rise to 2.6%, YoY up from 2.4%. This comes after CPI rose to 2.7% from 2.6%.

Signs that disinflation is stalling underpin the USD. While a December rate cut looks certain, a more gradual pace of cuts is likely next year.

EUR/USD forecast – technical analyst

EUR/USD fell from 1.12 in late September to a low of 1.0330 on November 2025. The price is currently consolidating between 1.05 to 1.06 and is once again testing the lower band of this holding pattern.

Sellers must take out 1.05 to extend the longer-term bearish trend towards 1.04 and 1.0330.

However, should 1.05 hold, buyers will look to extend the gain to 1.06. Beyond here, 1.07 comes into play.

GBP/USD stays in range ahead of US PPI data & jobless claims

- US CPI rose to 2.7% YoY from 2.6%

- US PPI is expected to rise to 3.2% from 3.1%

- GBP/USD hovers around 1.2750, just below the 200 SMA

GBP/USD continues to trade in a tight range around the 1.2750 level following US CPI data and ahead of more US stats. The UK economic calendar is quiet, leaving the USD in the driving seat.

US CPI rose to 2.2%, up from 2.6%, in line with expectations, while core CPI held steady at 3.3%. Despite the increase in inflation, the data was in line with forecasts, giving the green light to a December rate cut.

According to the CME Fed watch tool, the market is pricing in a 95% chance of a 25 basis point cut at the FOMC meeting next week, up from 85% ahead of the meeting.

Today, attention is on US PPI inflation, which is expected to rise. PPI is forecast to rise to 3.2%, up from the 3.1% previously.

US jobless claims data will also be under the spotlight. It is expected to show the ongoing resilience in the US labour market, with 220K initial claims forecast down from 224 K.

The pound has been supported by expectations that the Bank of England will cut interest rates at a slower pace than its major central bank peers. The BoE is expected to leave rates unchanged in the meeting next week, and the market is only pricing in 60 basis points worth of cuts between now and the end of next year.

The central bank has adopted a more hawkish tone following the New Labour government's budget, which is seen as inflationary.

There is no high impact UK economic data today. Attention will be on GDP figures tomorrow.

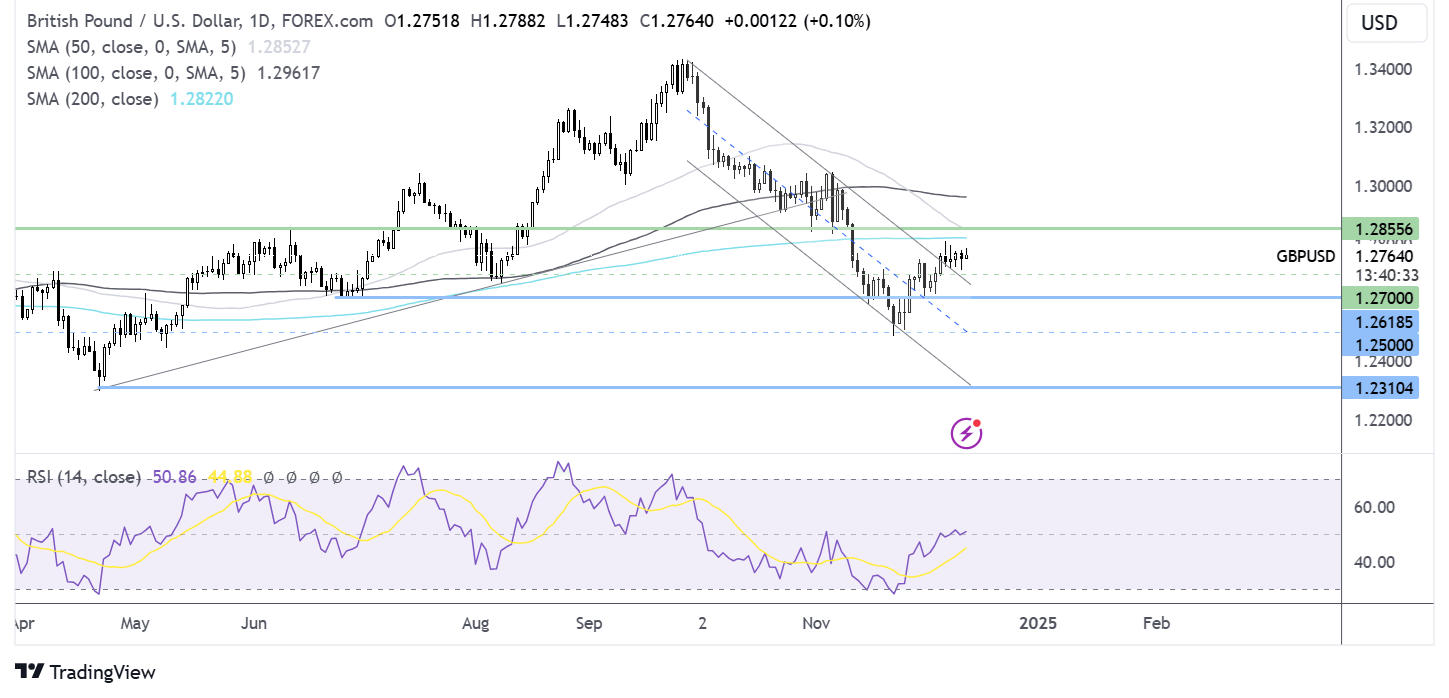

GBP/USD forecast - technical analyst

GBP/USD extended its recovery from 1.25 rising out of the multi-month descending channel, but the recovery has stopped short below the 200 SMA.

Buyers will look to extend the recovery above the 200 SMA1.2825 towards 1.2875 static resistance and 50 SMA. A rise above her brings 1.29 and then the key 1.30 level into play.

Failure to retake the 200 SMA could see sellers retest the 1.27, the weekly low ahead of 1.2630 the December low and 1.26. A breakdown here brings 1.25 into focus.