Investor’s risk appetite continues to remain insatiable even as valuations continue to rise, now at around 23 times the S&P’s forward earnings. Index futures were a touch lower on the session, but we have seen this sort of price action before: dips being bought after the cash market opens. Anyway, yesterday was a bit of a mixed session on Wall Street. While the Dow ended lower for a fifth consecutive session on Wednesday, a tech-fuelled rally helped to push the Nasdaq to a fresh record high with a gain of 1.5%, while the S&P 500 also bounced back, erasing losses made in the previous two sessions. Traders were looking forward to Christine Lagarde’s press conference after the European Central Bank decided to cut rates by 25 basis points as expected. This comes ahead of next week’s rate decisions from the US Federal Reserve and Bank of Japan. After a strong performance throughout the year, there are still no major signs of the trend turning bearish for the S&P 500 heading into the final weeks of the 2024. For that reason, we have no reason to adjust our S&P 500 forecast to bearish just yet from a technical point of view, even macro concerns are plentiful.

Anyway, before discussing next week’s central bank rate decisions, let’s have a quick look at the technical aspect of the market first.

Technical S&P 500 forecast: levels to watch and trade ideas

The S&P remains firmly in a bullish trend, showing little sign of weakness despite rising concerns about valuations and the likelihood of elevated interest rates continuing into next year under Trump’s presidency.

Source: TradingView.com

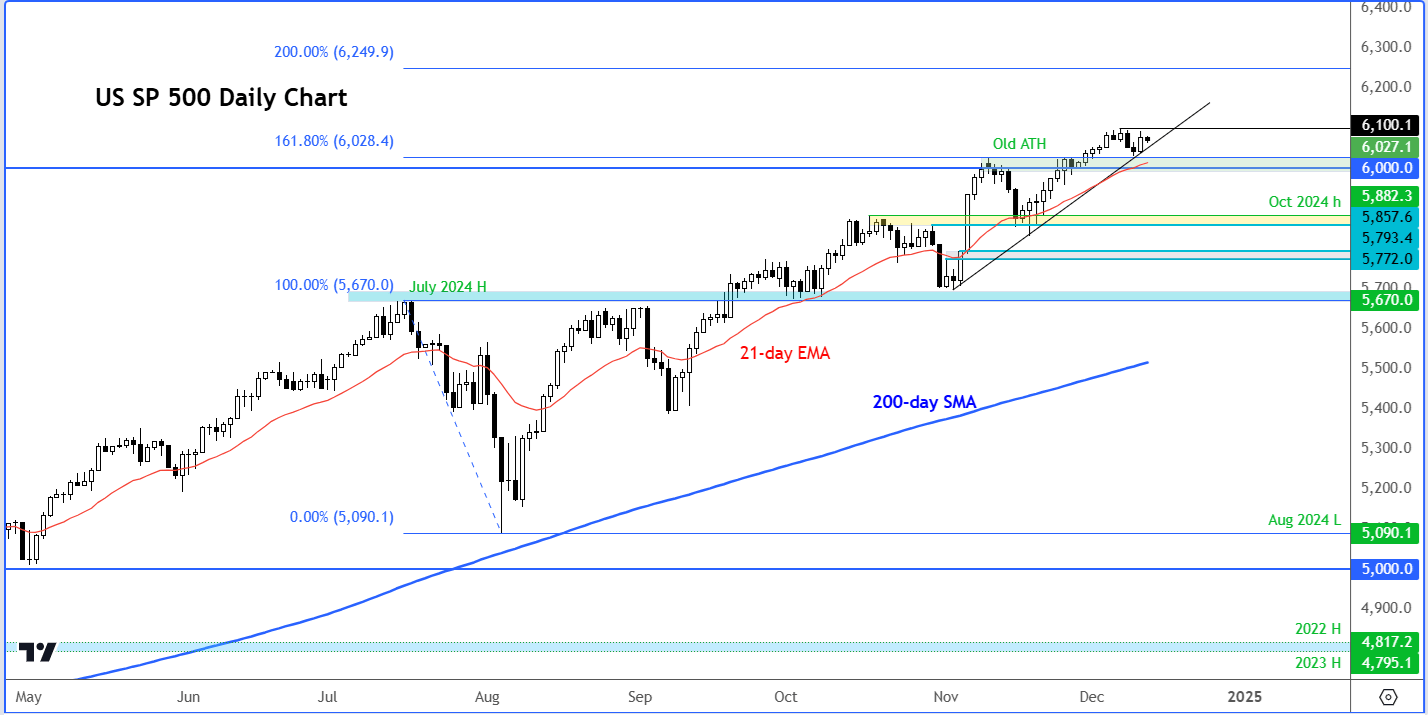

When markets consistently print higher highs and higher lows, it’s usually unwise to bet against the trend; instead, it’s better to follow it until the charts suggest otherwise. While there have been minor corrections along the way, every dip has been met with buying interest, with support emerging at logical technical levels on S&P 500 chart.

Following this week’s earlier decline, attention centred on the 6,000 - 6027 region on the S&P chart, where the upper end of the range aligns with the November high. Previously a resistance area, this zone flipped into support, prompting a strong bounce on Wednesday. To sustain the short-term bullish S&P 500 forecast, this area must hold as support. However, a break below it could trigger a deeper decline, potentially testing the next key support zone, positioned between 5857 and 5882 (highlighted in yellow on the chart).

On the upside, the critical level to monitor is 6100, the most recent all-time high. A move to a fresh all-time high above last week’s peak now seems the most likely scenario given Wednesday’s bullish signal. Whether or not that expected breakout then holds or fails is another question.

ECB cuts rates as expected

So, the European Central Bank has just cut rates by 25 basis points, and we saw an immediate positive response in the DAX. The ECB’s rate decision comes after the Swiss Nation Bank earlier surprised with a 50 basis point rate cut instead of 25 expected, owing to below-forecast inflation in the nation. The ECB could open the door open for further easing in 2025. That is something that President Christine Lagarde could signal at her upcoming press conference and potentially provide the next leg of the selling in the euro or buying in the major indices like the DAX.

Attention turns to Fed, BoJ and BoE

In the week ahead, we will hear from the US Federal Reserve, Bank of England and Bank of Japan among others. Ahead of these central bank meetings, there are not many super important macro releases left until the new year.

Wednesday’s US CPI figures showed no unexpected increases, offering traders the assurance they needed to reinforce expectations of a rate cut at the Federal Reserve’s final meeting of the year next week. The CME’s FedWatch tool now places the likelihood of a 25-basis-point cut at over 96% following the data release. This leaves the Fed with limited flexibility to diverge without causing substantial market disruption. In short, a rate cut now seems all but certain, especially with no further major US data due before next week’s FOMC meeting to influence the decision.

The pressing question is whether the central bank will pause rate cuts in early 2025 or maintain the current pace of 25 basis points per meeting. If the Fed delivers the widely expected 25-basis-point cut next week, lowering the rate range to 4.25–4.50%, markets see just a 22% probability of another cut at the following FOMC meeting on 29 January. Instead, traders are strongly favouring – with a 72% probability – the next reduction to occur at the Fed’s second meeting of 2025, scheduled for 19 March.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R