US Dollar Talking Points:

- Inflation is starting to look as though it’s bottomed in the U.S., with yesterday’s headline CPI print gaining for a second month as Core CPI remained at the same 3.3% that’s printed over the prior two months. This morning’s PPI print came out well above the expected 2.6% YoY and .02% MoM, at 3.0% and 0.4%, respectively.

- This morning also brought an ECB rate cut which pushed EUR/USD below the 1.0500 handle for another test below the big figure.

- Markets are still highly expecting another 25 bp rate cut next week and it’s unlikely that the Fed will disappoint there. But – perhaps more market moving than another 25 bp cut will be what the bank says in their updated guidance and projections as part of the SEP. When this was last issued in September, the Fed said that they saw Fed Funds at between 3.1% and 3.6% by the end of 2025. That will likely change in next Wednesday’s release.

The US Dollar is continuing the post-NFP rally, and the currency has set a fresh December high this morning. There’ve been a few different push points along the way, such as yesterday’s CPI release or this mornings PPI data. There’s also been a push from counterparts, as the Bank of Canada cut rates by 50 bps yesterday and then the European Central Bank cut by another 25 basis points this morning. This further highlights the divide in data, where the U.S. economy appears to be on stronger footing than much of the rest of the world; and that’s been combined with the prospect of trade tariffs that have helped to boost the USD even more as economies like Europe or Canada seem more vulnerable to such a scenario than the United States.

This continues what’s been an incredibly strong Q4 for the greenback, which went deep into oversold conditions in Q3 and reversed aggressively around the Q4 open. That strength got a major boost around the US election, which also triggered a run of Euro weakness and that helped to propel DXY up to a test of the 108.00 handle a few weeks ago.

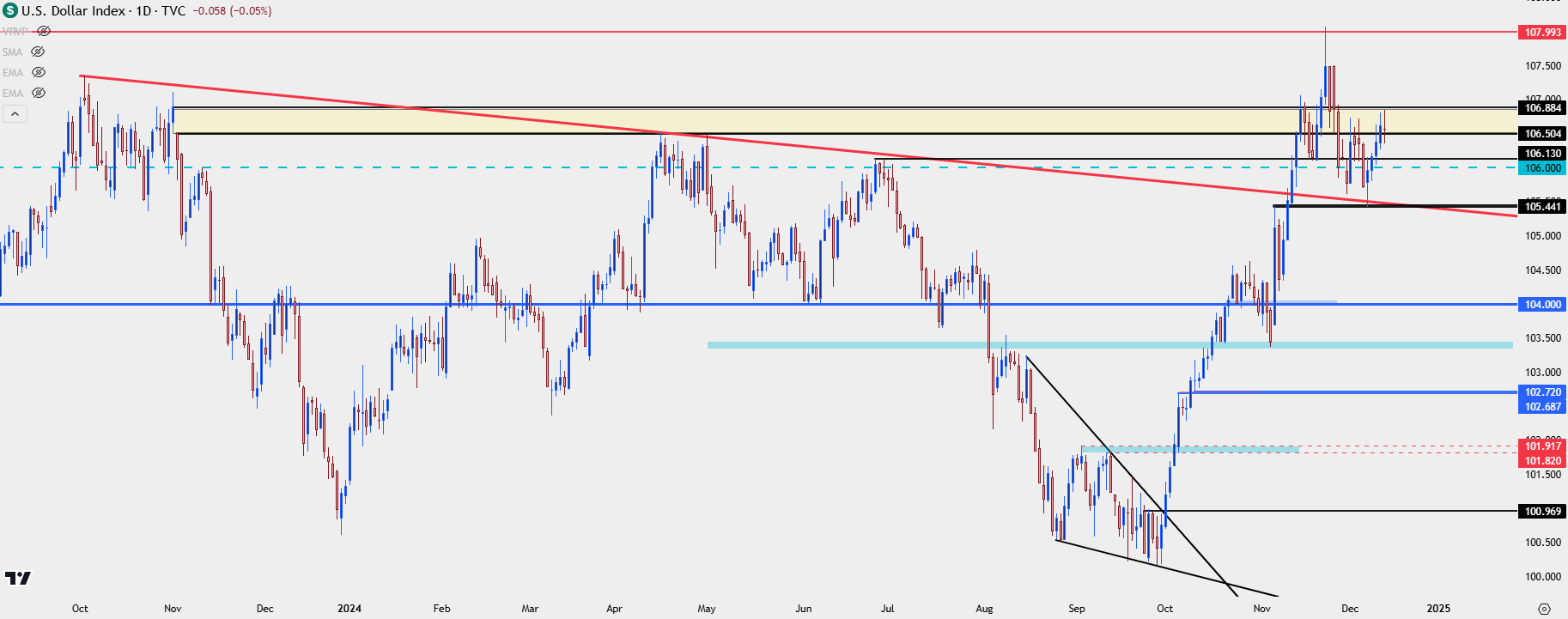

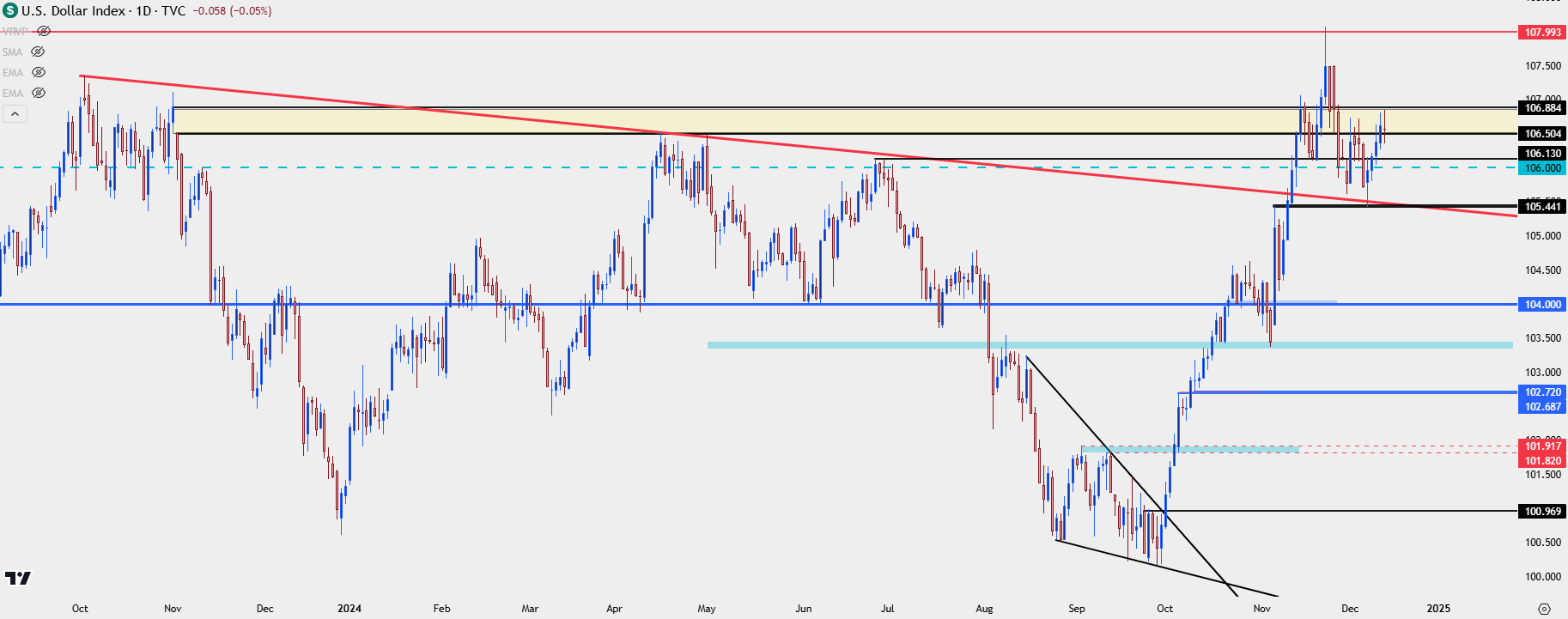

The pullback from that test of fresh two-year highs ran into last Friday, around the release of NFPs at which point a big point of support came into play as taken from prior resistance. This is the 105.44 level that helped to set the high after the election-fueled breakout in DXY and this set the low a week ago before bulls came back-in to re-take control.

US Dollar Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

US Dollar Mean Reversion

When the US Dollar was in a blistering bullish trend in 2022, global equities were in a vulnerable position. It was after the USD pulled back and started to range that global stocks were able to push into the massive rallies that have largely held over the past couple years.

Interestingly, the post-election response in the USD in 2024 is very similar to what showed in 2016. Both stocks and the USD rallied in the aftermath of each. But in 2017 that strength turned around and the US Dollar went into a bearish trend that lasted for much of the year, and that helped to fuel a continued rally in US (and global) equities.

I think that a similar scenario could show here and from the daily chart of the US Dollar below, we can see where price is testing a big area of resistance on the chart. The 106.50-106.88 gap from last November’s FOMC has functioned as resistance at multiple points this year; and the singular instance when price jumped above was short-lived, as the 108.00 test and pullback appeared soon after.

US Dollar Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

US Dollar Big Picture: What Could Induce Mean Reversion

U.S. data remains strong and there’s legitimate question as to whether inflation has bottomed. But I think that question has been there for most of this year as many vantage points around inflation were showing stall or entrenchment at higher levels, and that’s what helped to produce bullish runs in DXY in Q1 and late-Q2 (June), as there was question as to whether the Fed would be able to cut.

They remained persistent and eventually the data opened the door for a move in September. By the point of the rate cut, however, the USD had already largely established the 2024 low and there was only false breakouts below that afterwards. This is what led to the falling wedge and diverging RSI that, eventually, led into the reversal.

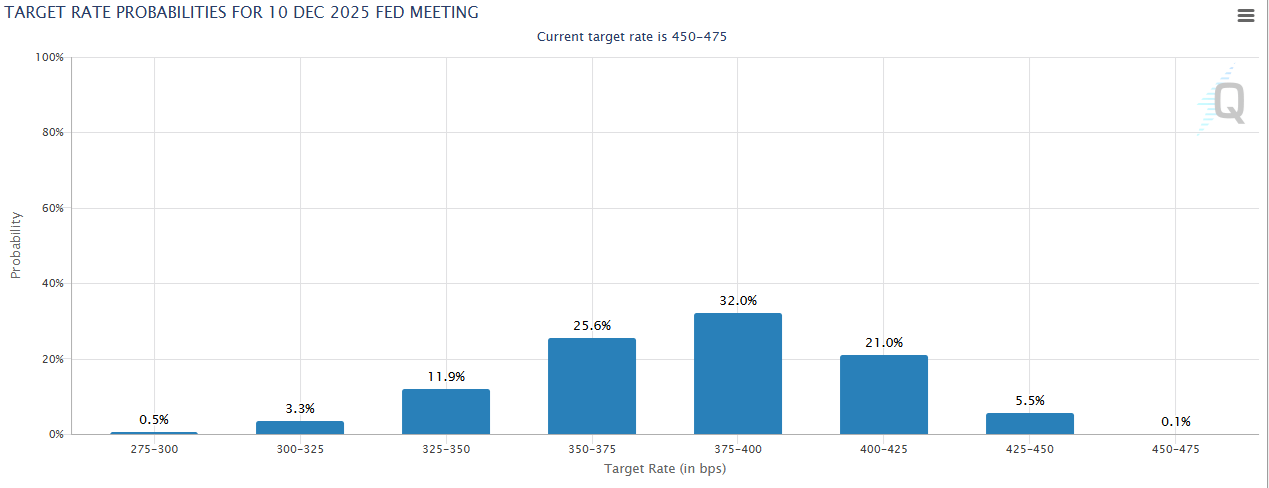

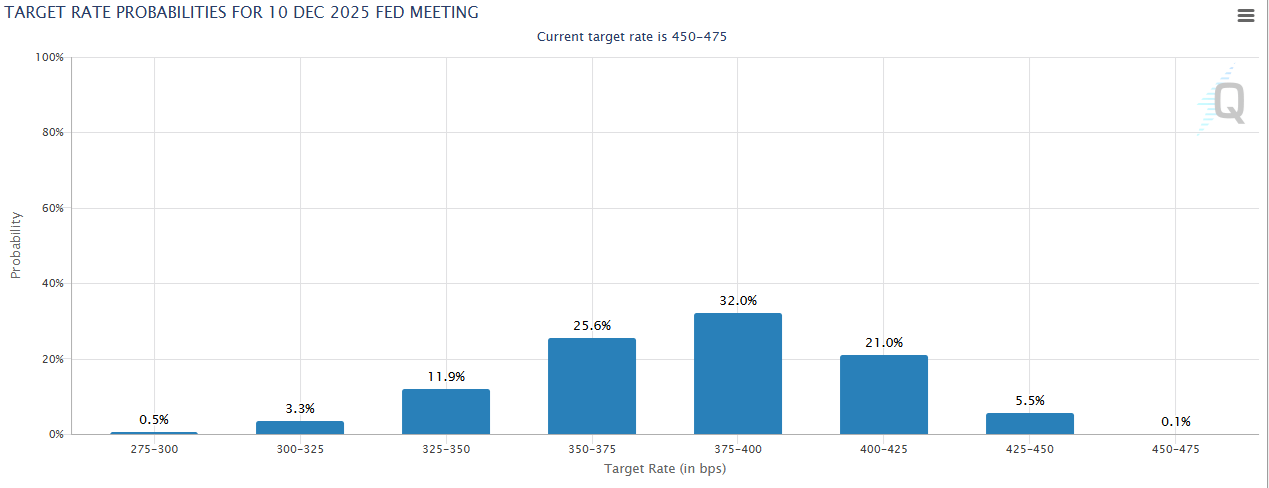

I think at this point it’s well-factored that the Fed will be less-dovish in next week’s projections but the big question is by how much. At their last release of projections in September, they had forecast Fed Funds at 3.1%-3.6% by the end of next year and from 2.6%-3.6% by the end of 2026.

Another cut next week puts the FOMC at 4.25-4.5%; and expectations at this point are circling 3.75-4.00% for the end of next year to a 73.3% probability, and 3.5-3.75% at a 41.3% probability. So, if the Fed forecasts published next week show end of 2025 Fed Funds between 3.5-4.0%, there could be continued case for USD mean reversion and continuation of the bigger picture range. I think this would also likely be the most bullish case for equities as we move into next year; a factor which should not be ignored around the FOMC.

Fed projections to December 2025

Image prepared by James Stanley; data derived from CME Fedwatch

Image prepared by James Stanley; data derived from CME Fedwatch

US Dollar Monthly

Going back to the overlay from the 2016 election, there was a similar bid of strength into US markets on the back of a GOP supermajority and a POTUS win by Donald Trump. I showed that spike in the blue box on the below chart, spanning November and December of 2016. Even larger, however is the red box in 2017 that followed that breakout to fresh decade highs in the USD, and it was that same USD weakness that helped to fuel a massive equity rally. Also during this time the Fed was hawkish, hiking rates multiple times in 2017 despite having only hiked twice since the Financial Collapse, leading into that year.

The purple box in 2022 is something that I think the Fed would want to avoid: This is when the bank hiked aggressively to address inflation that they had previously dismissed as transitory. That purple box also came along with an aggressive sell-off in stocks, that finally started to bottom around the same time that the USD showed signs of topping.

And then in the green box, we have the USD range for the past two years and that’s allowed for a massive equity rally to build, and that’s something that I think the bank would prefer to see continue.

With the US Dollar it’s important to remember that the currency is a composite of underlying currencies. Because we’re talking about currencies here and currencies are the base of the financial system, there’s no other way to value a currency than by using another currency. Or, in the case of the USD, a basket of underlying currencies. So what’s important here is to have some form of similarity in economic policy as an outlier, such as the Fed in 2022, can produce sharp moves that can create reverberations elsewhere.

US Dollar Monthly Chart  Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist

US Dollar Talking Points:

- Inflation is starting to look as though it’s bottomed in the U.S., with yesterday’s headline CPI print gaining for a second month as Core CPI remained at the same 3.3% that’s printed over the prior two months. This morning’s PPI print came out well above the expected 2.6% YoY and .02% MoM, at 3.0% and 0.4%, respectively.

- This morning also brought an ECB rate cut which pushed EUR/USD below the 1.0500 handle for another test below the big figure.

- Markets are still highly expecting another 25 bp rate cut next week and it’s unlikely that the Fed will disappoint there. But – perhaps more market moving than another 25 bp cut will be what the bank says in their updated guidance and projections as part of the SEP. When this was last issued in September, the Fed said that they saw Fed Funds at between 3.1% and 3.6% by the end of 2025. That will likely change in next Wednesday’s release.

Central Banks AD

The US Dollar is continuing the post-NFP rally, and the currency has set a fresh December high this morning. There’ve been a few different push points along the way, such as yesterday’s CPI release or this mornings PPI data. There’s also been a push from counterparts, as the Bank of Canada cut rates by 50 bps yesterday and then the European Central Bank cut by another 25 basis points this morning. This further highlights the divide in data, where the U.S. economy appears to be on stronger footing than much of the rest of the world; and that’s been combined with the prospect of trade tariffs that have helped to boost the USD even more as economies like Europe or Canada seem more vulnerable to such a scenario than the United States.

This continues what’s been an incredibly strong Q4 for the greenback, which went deep into oversold conditions in Q3 and reversed aggressively around the Q4 open. That strength got a major boost around the US election, which also triggered a run of Euro weakness and that helped to propel DXY up to a test of the 108.00 handle a few weeks ago.

The pullback from that test of fresh two-year highs ran into last Friday, around the release of NFPs at which point a big point of support came into play as taken from prior resistance. This is the 105.44 level that helped to set the high after the election-fueled breakout in DXY and this set the low a week ago before bulls came back-in to re-take control.

US Dollar Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

US Dollar Mean Reversion

When the US Dollar was in a blistering bullish trend in 2022, global equities were in a vulnerable position. It was after the USD pulled back and started to range that global stocks were able to push into the massive rallies that have largely held over the past couple years.

Interestingly, the post-election response in the USD in 2024 is very similar to what showed in 2016. Both stocks and the USD rallied in the aftermath of each. But in 2017 that strength turned around and the US Dollar went into a bearish trend that lasted for much of the year, and that helped to fuel a continued rally in US (and global) equities.

I think that a similar scenario could show here and from the daily chart of the US Dollar below, we can see where price is testing a big area of resistance on the chart. The 106.50-106.88 gap from last November’s FOMC has functioned as resistance at multiple points this year; and the singular instance when price jumped above was short-lived, as the 108.00 test and pullback appeared soon after.

US Dollar Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

US Dollar Big Picture: What Could Induce Mean Reversion

U.S. data remains strong and there’s legitimate question as to whether inflation has bottomed. But I think that question has been there for most of this year as many vantage points around inflation were showing stall or entrenchment at higher levels, and that’s what helped to produce bullish runs in DXY in Q1 and late-Q2 (June), as there was question as to whether the Fed would be able to cut.

They remained persistent and eventually the data opened the door for a move in September. By the point of the rate cut, however, the USD had already largely established the 2024 low and there was only false breakouts below that afterwards. This is what led to the falling wedge and diverging RSI that, eventually, led into the reversal.

I think at this point it’s well-factored that the Fed will be less-dovish in next week’s projections but the big question is by how much. At their last release of projections in September, they had forecast Fed Funds at 3.1%-3.6% by the end of next year and from 2.6%-3.6% by the end of 2026.

Another cut next week puts the FOMC at 4.25-4.5%; and expectations at this point are circling 3.75-4.00% for the end of next year to a 73.3% probability, and 3.5-3.75% at a 41.3% probability. So, if the Fed forecasts published next week show end of 2025 Fed Funds between 3.5-4.0%, there could be continued case for USD mean reversion and continuation of the bigger picture range. I think this would also likely be the most bullish case for equities as we move into next year; a factor which should not be ignored around the FOMC.

Fed projections to December 2025

Image prepared by James Stanley; data derived from CME Fedwatch

Image prepared by James Stanley; data derived from CME Fedwatch

US Dollar Monthly

Going back to the overlay from the 2016 election, there was a similar bid of strength into US markets on the back of a GOP supermajority and a POTUS win by Donald Trump. I showed that spike in the blue box on the below chart, spanning November and December of 2016. Even larger, however is the red box in 2017 that followed that breakout to fresh decade highs in the USD, and it was that same USD weakness that helped to fuel a massive equity rally. Also during this time the Fed was hawkish, hiking rates multiple times in 2017 despite having only hiked twice since the Financial Collapse, leading into that year.

The purple box in 2022 is something that I think the Fed would want to avoid: This is when the bank hiked aggressively to address inflation that they had previously dismissed as transitory. That purple box also came along with an aggressive sell-off in stocks, that finally started to bottom around the same time that the USD showed signs of topping.

And then in the green box, we have the USD range for the past two years and that’s allowed for a massive equity rally to build, and that’s something that I think the bank would prefer to see continue.

With the US Dollar it’s important to remember that the currency is a composite of underlying currencies. Because we’re talking about currencies here and currencies are the base of the financial system, there’s no other way to value a currency than by using another currency. Or, in the case of the USD, a basket of underlying currencies. So what’s important here is to have some form of similarity in economic policy as an outlier, such as the Fed in 2022, can produce sharp moves that can create reverberations elsewhere.

US Dollar Monthly Chart  Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist