- AUD/USD, NZD/USD shift focus from China proxies to rate differentials

- Fed meeting looms as a pivotal driver for both pairs next week

- Hawkish rate signals could deepen bearish momentum for Antipodeans

Overview

AUD/USD and NZD/USD are now behaving more like plays on interest rate differentials than outright China proxies, intensifying focus on what Federal Reserve members may signal about the path for the Fed funds rate over the next two years. The price action in the Aussie and Kiwi was ugly on Thursday, and with momentum still with the bears, downside appears far easier than upside near-term.

China proxy out, rate differentials in

AUD/USD was given every excuse to rally on Thursday but couldn’t, with bullish domestic jobs data and more pledges of policy support in China failing to deliver sustained upside. Instead, a big, definitive bearish pin candle on the daily chart emerged.

Source: TradingView

Upon closer inspection, the notion that the Aussie is purely a China proxy doesn’t hold true right now. AUD/USD is exhibiting a far stronger relationship with yield differentials between the United States and China than with USD/CNH or copper futures. The inverse correlation with yield differentials in the belly and back-end of bond curves has been especially strong over the past month, sitting at -0.9. Not quite perfect, but close.

Source: TradingView

The Kiwi is in a similar position to the Aussie, though its relationship with yield differentials and other China-related proxies is not as strong. There’s some correlation, but it’s not overly robust.

FOMC meeting a key risk event

While the Kiwi’s drivers are less obvious than the Aussie’s, the analysis underscores that next week’s Federal Reserve FOMC decision will likely be pivotal for both AUD/USD and NZD/USD. Updated economic and interest rate projections are likely to influence not only the front-end of the US interest rate curve but also the belly and back-end, which have been driving recent FX market movements.

Jerome Powell’s comments last month, noting that downside risks to the labour market had receded and inflationary pressures were more persistent than envisaged in September, have traders on alert for a potential hawkish cut. A 25bps cut next Wednesday is now considered nearly a lock.

Fed set to slash rate cut profile, lift neutral estimate

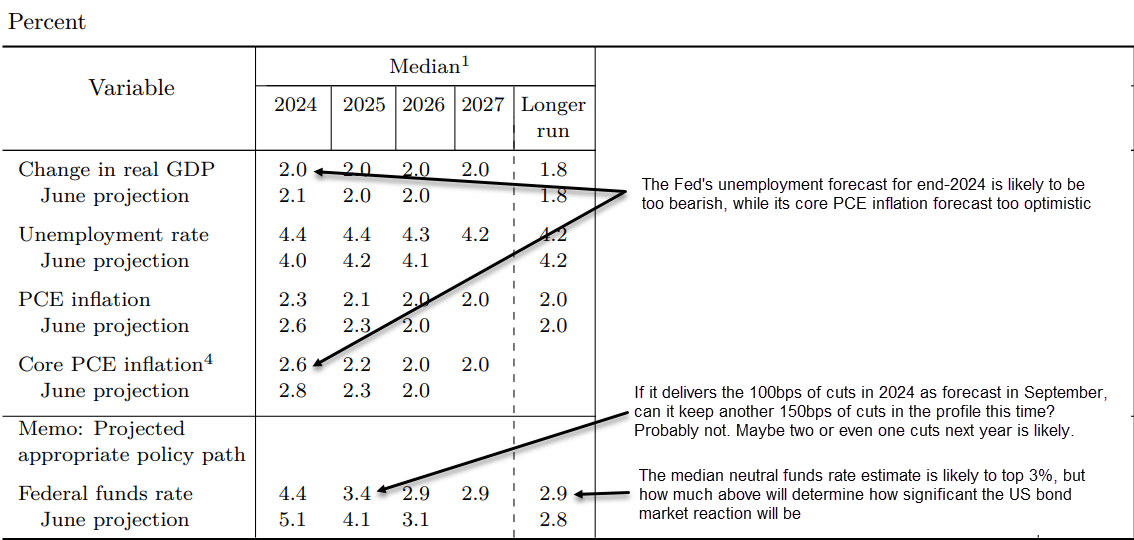

With unemployment likely to undershoot and inflation overshoot the Fed’s September forecasts, and with 100 basis points of rate cuts likely to have been delivered in 2024 as outlined three months ago, the question now becomes what will the Fed signal on the degree of expected easing next year, along with members see the neutral level for the funds rate where inflationary pressures and unemployment remain stable?

Source: Federal Reserve

Three months ago, the answers were 100bps of cuts and a neutral rate of 2.9%. Both now seem too dovish given the recent data flow. This hints that as few as two, or even one, rate cuts may be signalled for 2025 in the updated dot plot. If the Fed sticks with four 25bps cuts, it could amplify concerns about its commitment to finishing the inflation fight.

As for the long-run dot, which signals the median FOMC estimate for the neutral policy rate, there’s evidence suggesting it could be far higher than past estimates. However, FOMC members have been cautious in raising these projections this year. A minor upward adjustment to 3% or slightly higher seems likely. If the estimate were to jump to 3.2% or more, it could spark a sharp adjustment higher in US Treasury yields further out the curve, hitting the Aussie and Kiwi hard.

Traders ready for hawkish cut

Traders are already positioning for a hawkish adjustment to the Fed funds outlook. This is evident in the price action of US interest rate futures, with two and 10-year contracts breaking down over the past week.

Source: TradingView

10-year Treasury note futures have rolled over hard, with the price action accompanied by a noticeable shift in momentum to the downside. With uptrend support obliterated, further price weakness looks likely near-term, pointing to higher US Treasury yields and potential strength in the US dollar against the Aussie and Kiwi.

AUD/USD: bears in control

The bears remain in control of AUD/USD, as reinforced on Thursday as bullish domestic and international fundamental news was unable to prevent another ugly bearish reversal.

Source: TradingView

For the moment, AUD/USD trades in a falling wedge which intersects with key uptrend support dating back to October 2022. The price action has been messy over the past week around, but the overriding trend remains bearish. We’re seeing lower highs and lower lows, momentum indicators are generating bearish signals, and short-covering rips are proving to have a short shelf life.

Selling rallies and downside breaks is therefore preferred until downtrend resistance is broken.

If AUD/USD were to take out Wednesday’s lows beneath .6350, one setup to consider would be to sell with a tight stop above either .6350 or uptrend targeting .6270.

NZD/USD threatening breakdown

Source: TradingView

The technical picture for NZD/USD looks even more dire than AUD/USD with the price threatening to break out of the falling wedge it trades in on the downside. Breaking through the November 2023 lows, if the price gets a wriggle on, there’s not a lot of visible support below until .5600.

If we see the price hold or extend this break, shorts could be considered with a stop either above .5774 or .5800 for protection, depending on your preferred risk profile.

-- Written by David Scutt

Follow David on Twitter @scutty