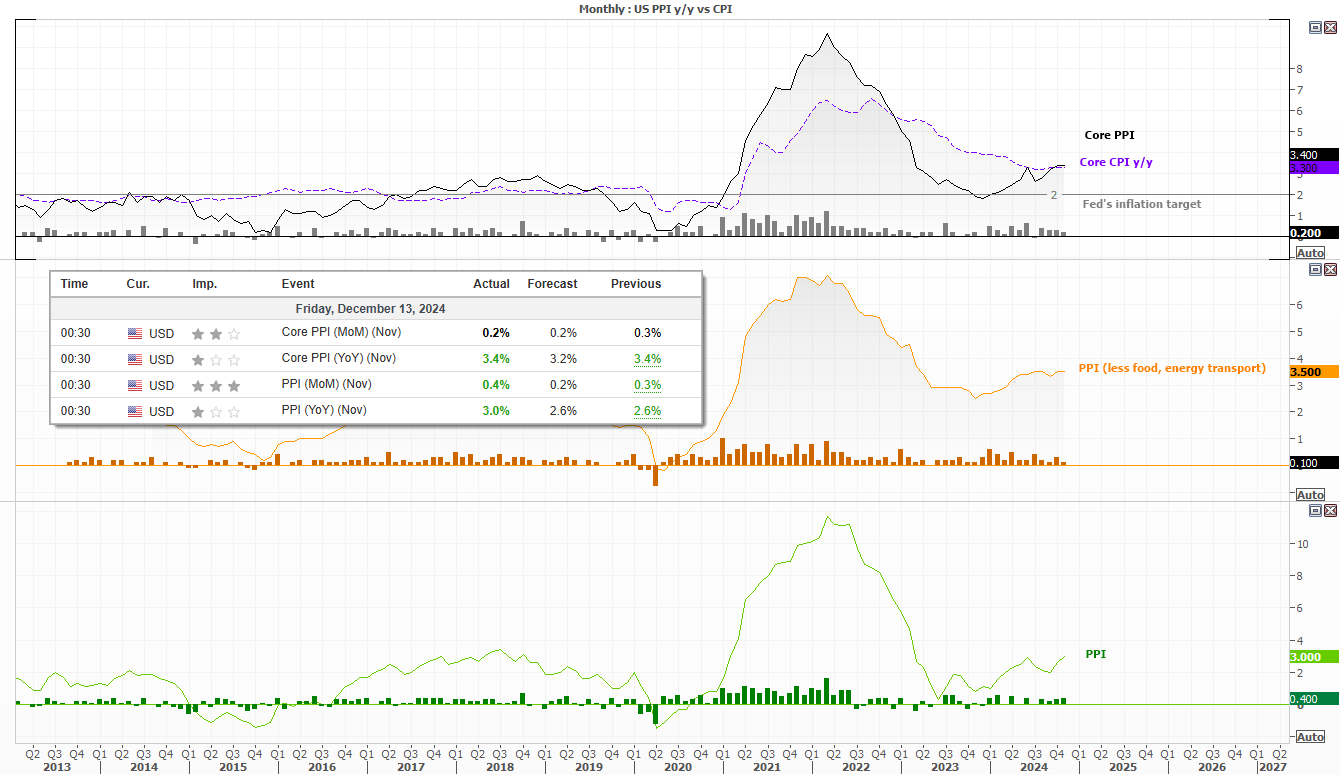

Inflationary pressures are alive and well, with US producer prices surprising to the upside, helping the US dollar climb for a fifth day and win top spot for currency strength on Thursday. Core producer prices remained at a 20-month high of 3.4% y/y in November, as September’s figures was revised up from 3.1% to 3.4%. Regardless, Fed fund futures continue to price in a Fed cut next week with a near 95% probability. Although the next 25bp cut is not expected to arrive until March, with a less convincing 52.1% probability.

- The US yield curve was higher, with the 2-year up 4bp (basis points) and the 10-year rising 6bp

- USD and AUD were the strongest FX majors, CHF and GBP were the weakest

- USD/CHF closed above 0.89 and rallied 1% during its best day in five weeks

- AUD/CAD closed to its highest level since April 2020

- GBP/USD closed to a 6-day low

- AUD/USD closed flat after handing back earlier gains made on a stronger-than-expected employment report

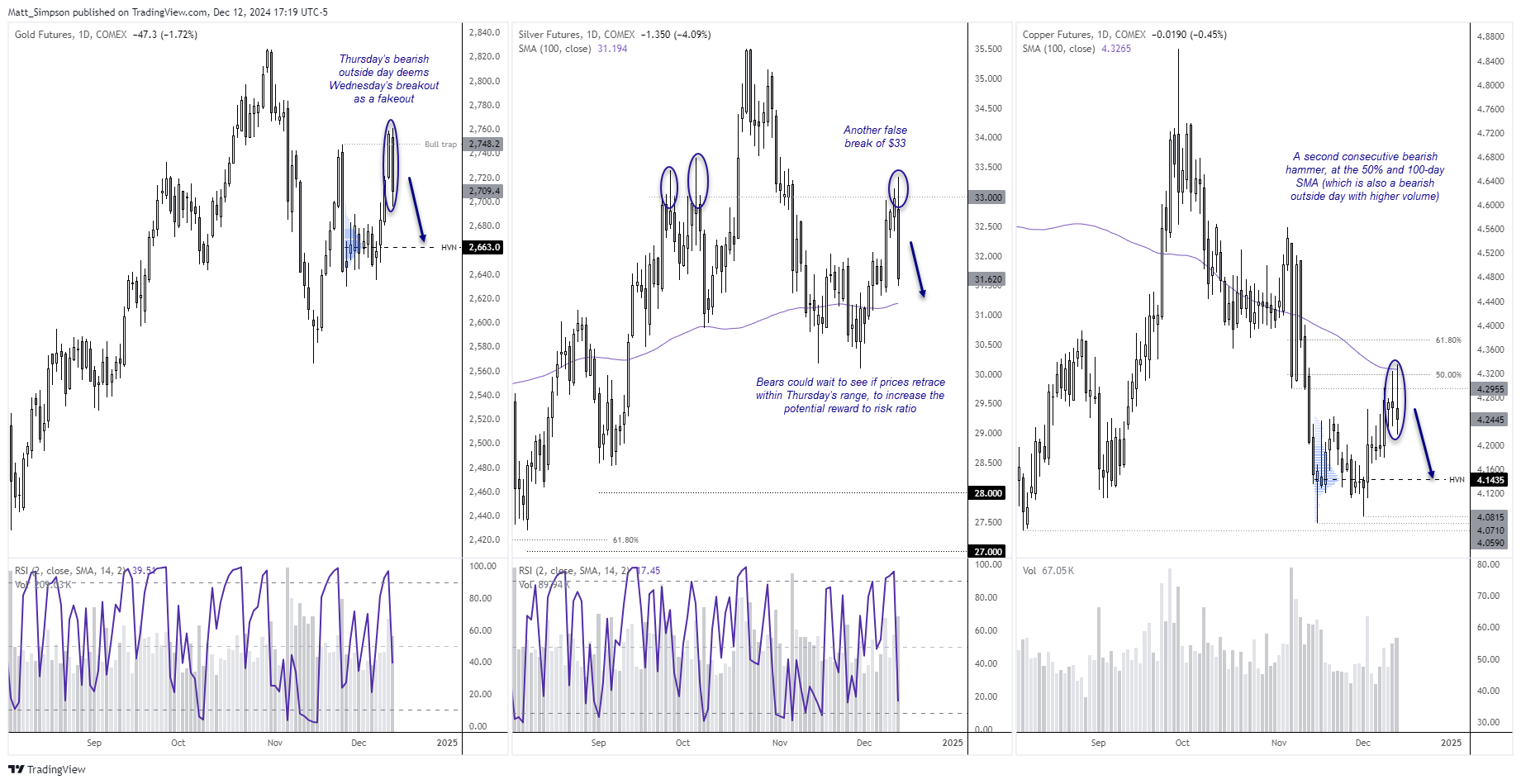

- Gold futures formed a bearish outside day during its worst day in 12

The ECB cut their interest rate by 25bp to 3%, to mark their fourth such move this year. They also kept the door open for further cuts next year, although reiterated that they are not on a preset path for easing. Weak growth and threats of a new US trade war will certainly keep them on guard for further cuts. However, by removing an earlier promise to keep policy sufficiently restrictive, it could mark a return to a more neutral setting.

EUR/CHF rose 0.7% during its best day in four month while EUR/GBP snapped a 4-day losing streak at its 10-month low. Yet the stronger dollar kept EUR/USD in check and closed below 1.05 for a second consecutive day.

Economic events in focus (AEDT)

- 10:50 – JP Tankan survey (Q4)

- 11:01 – UK GfK consumer sentiment survey

- 15:30 – JP capacity utilisation

- 18:00 – UK construction output, industrial production, manufacturing production, trade balance, GDP m/m

- 20:30 – UK inflation expectations

- 21:00 – EU industrial production

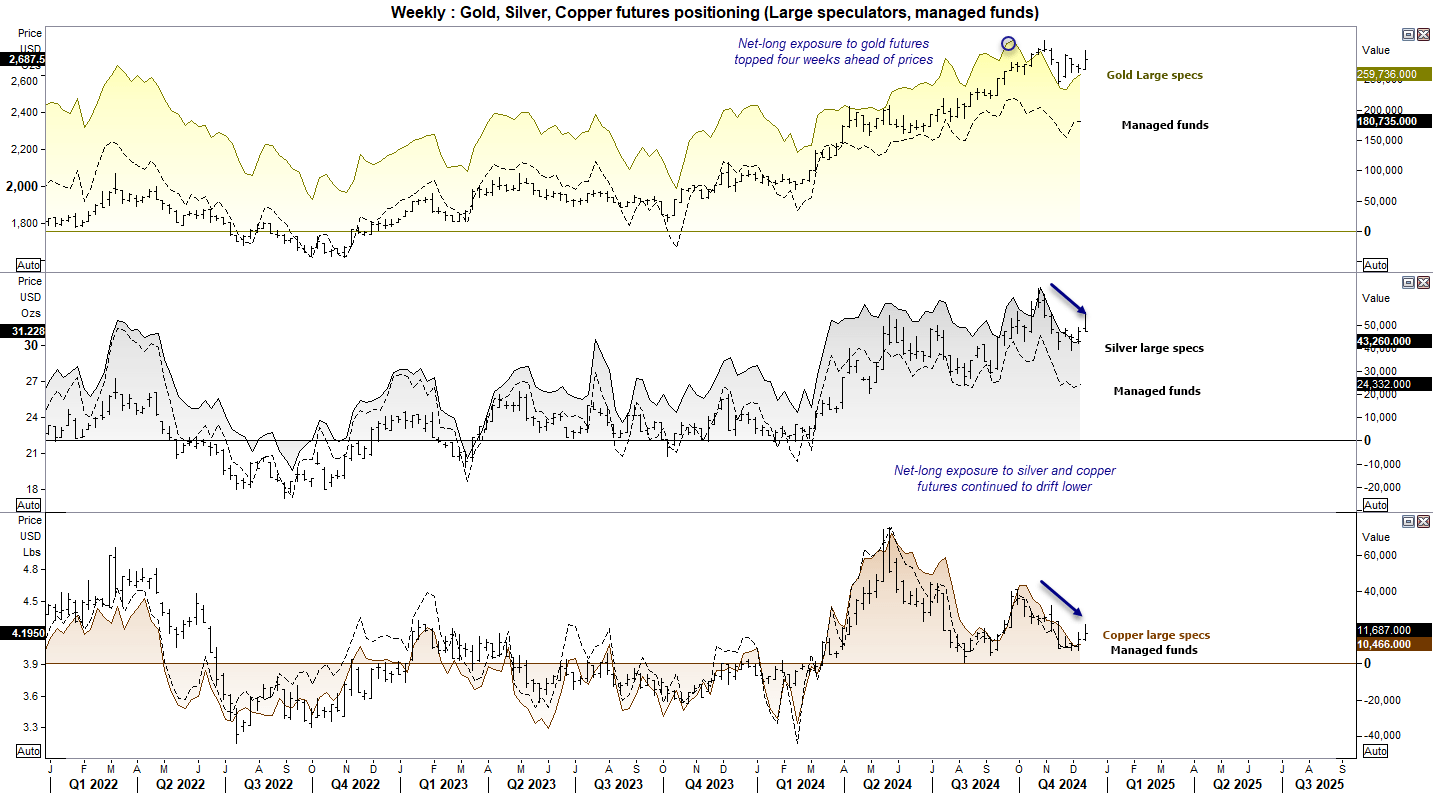

Gold, silver, copper futures positioning – COT report

Net-long exposure to gold futures topped out four weeks ahead of prices. So while we’ve seen a rise of net-long exposure over the past two weeks, I’m not convinced it will power ahead of a new high of its own. And that makes me doubt that prices will simply stampede their way to a new high.

And if gold struggles to it new highs, so will silver. Also note that net-long exposure to silver and copper futures have continues to drift lower, which again points towards capped gains for metals in my view.

Gold, silver, copper technical analysis:

A bearish outside day formed on gold futures which now relegates Wednesday’s break above 2748 as a fakeout. And it’s not the first time we’ve seen a volatile reversal around similar levels in recent history, as a larger bearish engulfing candle formed in late November. Should the US dollar continue to outperform and the Fed’s meeting be more hawkish than expected, then a move down to the 2663 HVN (high-volume node) seems likely. With that said, December does tend to be a bullish month for gold, and with evidence of whipsaws elsewhere then traders may be better looking at markets on a ‘er day’ basis for their direction.

A large bearish outside day formed on silver futures, with its 4% decline marking its worst day in five weeks. The market also struggled around the $33 area back in September, so history does appear to be repeating. However, with so much congestion zones and the 100-day SMA below, bears may want to wait to see if prices retrace within Thursday’s bearish range, as it could potentially increase the reward to risk ratio.

A bearish hammer formed on copper futures for a second consecutive day, although it was also a bearish outside day which met resistance at the 100-day SMA and 50% retracement level. Volumes also increased for a second day, with Thursday’s trading volume being its highest in 7 days to add weight to the bearish candles.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge